/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

In the current fervor around artificial intelligence (AI) and data intelligence plays, Palantir Technologies (PLTR) is emerging as a top-conviction name. One Bank of America analyst recently raised the bar, setting a Street-high target of $215 for the stock, the boldest estimate on the books.

This isn’t a speculative moonshot call. The upgrade follows a deep dive into Palantir’s evolving architecture, its so-called forward-deployed engineers now augmented by agentic AI, and a fresh wave of high-impact contract wins that extend beyond its traditional government base. Let’s dive deeper.

About Palantir Stock

Palantir Technologies is a software and data analytics company that develops platforms designed to integrate, manage, and secure complex datasets across government and commercial clients. Headquartered in Denver, Colorado, Palantir has grown from its roots in government intelligence into a broader enterprise-tech play. It specializes in big‑data analytics and AI platforms (including Gotham, Foundry, Apollo, and its newer Artificial Intelligence Platform or AIP) for both government and enterprise clients.

Its market capitalization is around $440 billion, placing it among the largest software and analytics companies globally.

Over the past year, Palantir has delivered a dramatic rally, emerging as one of the standout performers in the broader tech and AI segment. Its total return over the past 52 weeks stands at 325%, driven by accelerating commercial growth, AI tailwinds, and elevated market sentiment.

In 2025 alone, PLTR stock has climbed 145% on a year-to-date (YTD) basis, significantly outpacing major indices like the S&P 500 Index ($SPX), which has delivered around 15% returns over the same period. The stock recently touched a 52-week high of $190 on Aug. 12.

That said, Palantir’s advance has not been without turbulence and has shown susceptibility to sharp pullbacks, with some profit-taking.

Palantir's lofty valuation also indicates that any execution misstep could trigger a sharp revaluation. PLTR stock is currently trading at a substantial premium over peers and its own historical average at 409 times forward earnings.

Palantir's Robust Topline Growth

Palantir released its second-quarter 2025 results on Aug. 4. The quarter marked a key milestone, as it was the first time Palantir’s quarterly revenue exceeded $1 billion, reaching $1.004 billion, up approximately 48% year-over-year (YOY) and 14% sequentially.

On the U.S. front, revenue growth was particularly robust as U.S. revenue rose 68% YOY and 17% quarter-over-quarter, driven by strength in both commercial and government segments. Strategically, U.S. commercial revenue saw an especially sharp jump, with 93% YOY growth and 20% sequential growth.

Adjusted operating income rose to $464 million, reflecting a 46% adjusted operating margin. Adjusted EPS grew to $0.16, surpassing expectations.

As a measure of combined growth and profitability, Palantir’s Rule of 40 score reached 94% in Q2, a strong signal of balance between expansion and operating leverage. On deal metrics, the company closed 157 deals of $1 million or greater during the quarter, including 66 deals of at least $5 million and 42 of at least $10 million. Palantir also reported strong contract momentum with a substantial remaining deal value base.

For fiscal 2025, Palantir now expects total revenue between $4.14 billion and $4.15 billion, a material upward revision from prior estimates. The company also lifted its U.S. commercial revenue target, now expecting it to exceed $1.302 billion, reflecting an expected growth rate of at least 85% in that segment.

Analysts expect the company’s EPS to climb 462% YOY to $0.45 in fiscal 2025, then rise another 33% to $0.60 in fiscal 2026.

What Do Analysts Expect for Palantir Stock?

BofA Securities recently lifted its price target on Palantir to $215 from $180, reaffirming a “Buy” rating on the back of stronger growth projections. The stock got a further boost from a five-year deal with the U.K. Ministry of Defence, Palantir’s first billion-dollar contract outside of the States.

Analyst Mariana Perez Mora highlighted surging adoption of the Maven Smart System, selected by NATO earlier this year, and the company’s deepening use of Agentic AI via its Field Deployment Engineers. BofA now sees government sales surpassing $8 billion by 2030, lifting its long-term growth outlook to a 30% compound annual growth rate (CAGR) through 2030.

On the other hand, HSBC reaffirmed its “Hold” rating on Palantir in August, raising its price target to $181 from $111. This adjustment reflects the company’s strong Q2 2025 performance and revised 2025 guidance. Despite these positive developments, HSBC maintains a cautious stance, citing Palantir’s high valuation and the need for continued execution to justify the elevated price target.

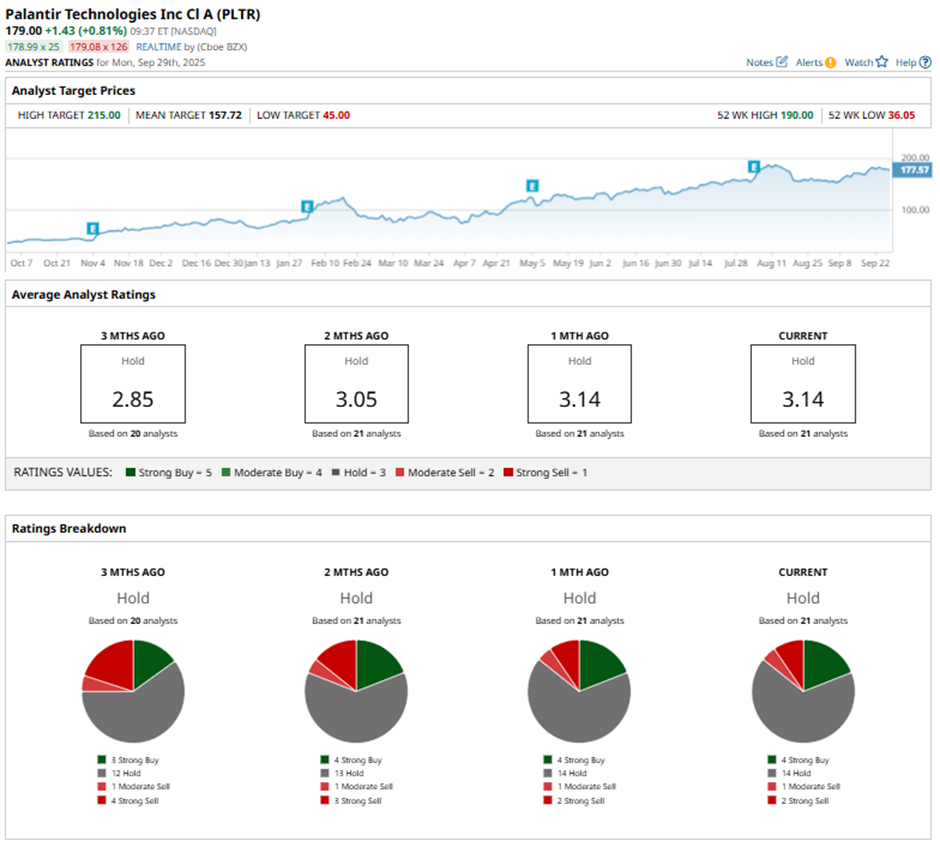

PLTR stock has a consensus rating of a “Hold" overall. Of the 21 analysts covering the stock, four advise a “Strong Buy,” 14 suggest a “Hold,” one analyst gives it a “Moderate Sell” rating, and two rate it as a “Strong Sell.”

While PLTR stock is trading at a premium to its average analyst price target of $157.72, the Street-high target of $215 signals that shares can still rise as much as 16% from current levels.