After a rough 2022, the tech sector rebounded throughout 2023, spurred on by investor excitement over the advent of generative artificial intelligence. The tech-heavy Nasdaq finished the year up 43%, its strongest performance since 2020. The index closed the previous year down 33%.

The S&P 500, meanwhile, surged around 24%, a gain that was led by that top-tier group of tech stocks known as the "Magnificent Seven."

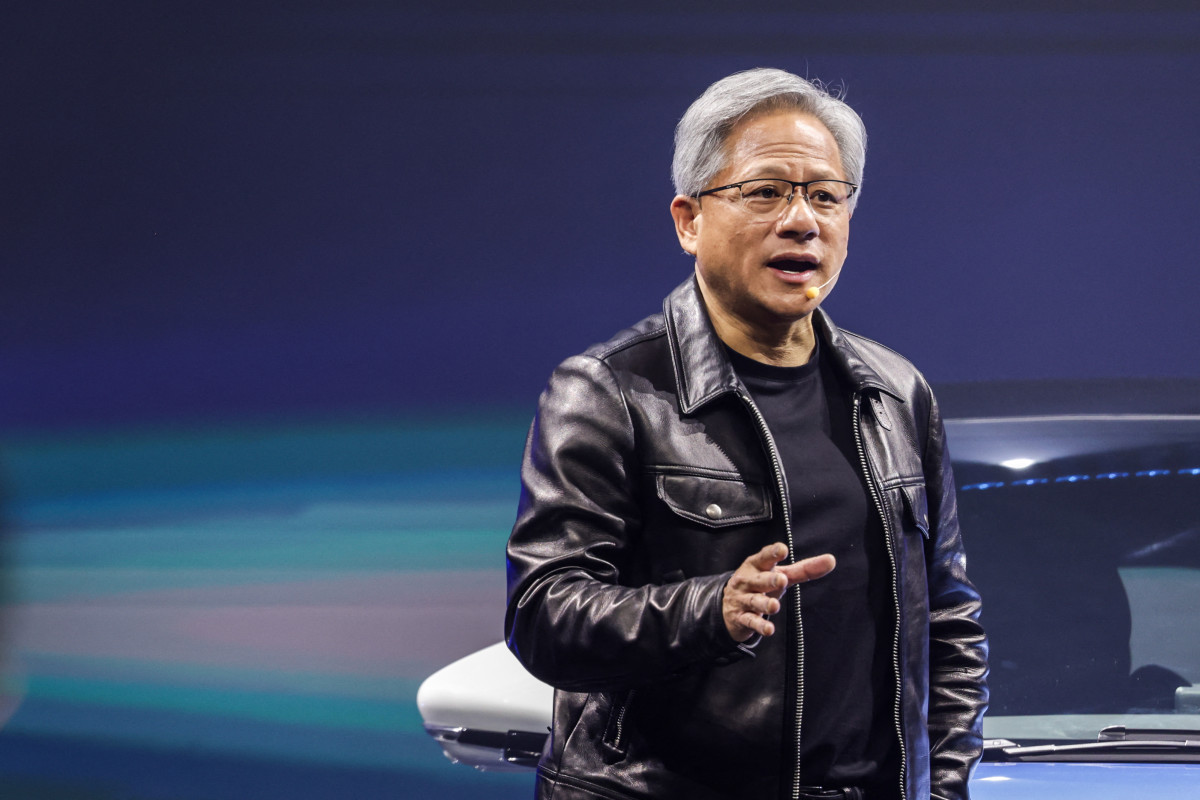

Within that group, certain names emerged as clear leaders: Meta (META) -) was up just shy of 200% for the year, and Nvidia (NVDA) -) was up 239%. Shares of Tesla (TSLA) -) just about doubled for the year and shares of Microsoft (MSFT) -) rose more than 50%.

Related: Prominent investor foresees a lot of Big Tech acquisitions in 2024

Certain swaths of Wall Street expect that tech-fueled performance to continue into 2024 and beyond.

Wedbush Securities analyst Dan Ives claimed in a Monday note that the tech bull market has officially begun. He thinks that tech stocks will continue rising in 2024, led, at least in part, by the continuing growth of the AI sector and the semiconductor chips that power the software.

Within that, Ives said that the key to the business of AI is the monetization of use cases; Microsoft, he said, is the clear leader in the field owing to the company's "significant AI monetization opportunity."

Ives believes tech stocks will be up 25% in 2024, and that the Nasdaq will hit 20,000, well above its all-time closing high of 16,057.44, which was achieved in 2021.

"The Street is still significantly underestimating how quickly this AI monetization cycle is playing out among enterprises in the field," he said.

Related: AI trends: What experts, execs think artificial intelligence will look like in 2024

Analyst: A five-year bull market

Deepwater Management's Gene Munster, concurring with Ives' impression of the importance of AI in the strength of the tech market, said Tuesday that "we're entering a three-to-five-year tech bull market."

"This is powered by AI," he said. "This is not about interest rates. It's about a fundamental shift in productivity."

Munster told CNBC that the market is facing the first of a three-to-five-year-long tech bubble, something he called the "only logical outcome" of such a powerful technological shift.

Given the strength of the Magnificent Seven's performance in 2023, Munster said that he doesn't expect the group to continue leading the market in 2024. The bullish tech performance will, instead, come from smaller companies with a sub-$20 billion market cap.

Still, he said that some exposure to the mega-cap tech stocks is a good idea through 2024. The strongest pathways to that exposure, he said, revolve around Google (GOOGL) -) and Apple (AAPL) -).

The former, according to Munster, might see better AI performance due to the recent release of its Gemini product. Munster expects the latter to release a foundation AI model next year.

Contact Ian with tips via email, ian.krietzberg@thearenagroup.net, or Signal 732-804-1223.

Related: Human creativity persists in the era of generative AI

Get exclusive access to portfolio managers’ stock picks and proven investing strategies with Real Money Pro. Get started now.