Advanced Micro Devices, Inc. (NASDAQ:AMD) Tuesday reported downbeat third-quarter revenues and earnings.

Despite the chipmaker warning of a slowdown in PC sales, investors grew optimistic on its share gains from rival Intel Corporation (NASDAQ:INTC) in the data center market.

BofA Securities On Advanced Micro Devices

Analyst Vivek Arya maintained a Buy rating while reducing the price target from $90 to $82.

Advanced Micro Devices reported in-line third-quarter results, but its fourth-quarter outlook was disappointing, Arya said in a note. “We tone down CY23E pf-EPS by 4% to $3.73,” he added.

“AMD faces a tougher mix next year on less enterprise, lower PC volumes & higher start-up costs on new 5nm server/PC portfolio, but it is partially offset by stronger Embedded (Xilinx) and continued shift to data centric products,” the analyst wrote.

Mizuho Securities On Advanced Micro Devices

Analyst Vijay Rakesh reiterated a Buy rating while lowering the price target from $102 to $95.

Although management’s guidance fell short of consensus estimates for the December quarter, the developments were broadly as expected, Rakesh said: “DC Strong, and PC/Client Weak into Early C23E.

“SepQ PC/Client and Gaming softness to continue into the DecQ as we expect consumer weakness and inventory correction to persist,” he added.

Check out other analyst stock ratings.

KeyBanc Capital Markets On Advanced Micro Devices

Analyst John Vinh reaffirmed an Overweight rating while reducing the price target from $100 to $85.

“While 3Q cloud revs more than doubled y/y, enterprise and DC GPU declined; AMD indicated it was seeing certain cloud customers moderate in reaction to the macro,” Vinh wrote in a note. “While these results are disappointing, we see favorable risk/reward following the reset and see Genoa sustaining share gains in data center,” he added.

Raymond James On Advanced Micro Devices

Analyst Melissa Fairbanks maintained a Strong Buy rating while reducing the price target from $100 to $80.

“While results were consistent with previewed results, the outlook was somewhat better than feared, particularly against a significantly weakened PC macro – compounded by aggressive pricing actions taken by the competition,” Fairbanks said.

“Importantly, both Data center and Embedded sales are expected to grow on a y/y and q/q basis in December, supported by improved supply and strong new product introductions, highlighted by the Genoa launch next week,” she added.

Rosenblatt Securities On Advanced Micro Devices

Analyst Hans Mosesmann reiterated a Buy rating with a price target of $200.

“AMD delivered to pre-announced guide for 3Q22 and gave a flattish outlook for 4Q22 that was better than feared as the consumer PC inventory drain is farther along than expected and with DC (share gains), and embedded (mostly Xilinx), seeing solid strength in a constrained environment,” Mosesmann wrote in a note.

“We see 1H23 as a recovery PC CPU period and emerging volume ramps of existing EPYC 3 and Xilinx on supply issues no longer issues, and the ramp of EPYC 4 Genoa 5nm-based server CPU,” the analyst further stated.

AMD Price Action: Shares of Advanced Micro Devices were trading 4.16% higher at $62.14 Wednesday morning.

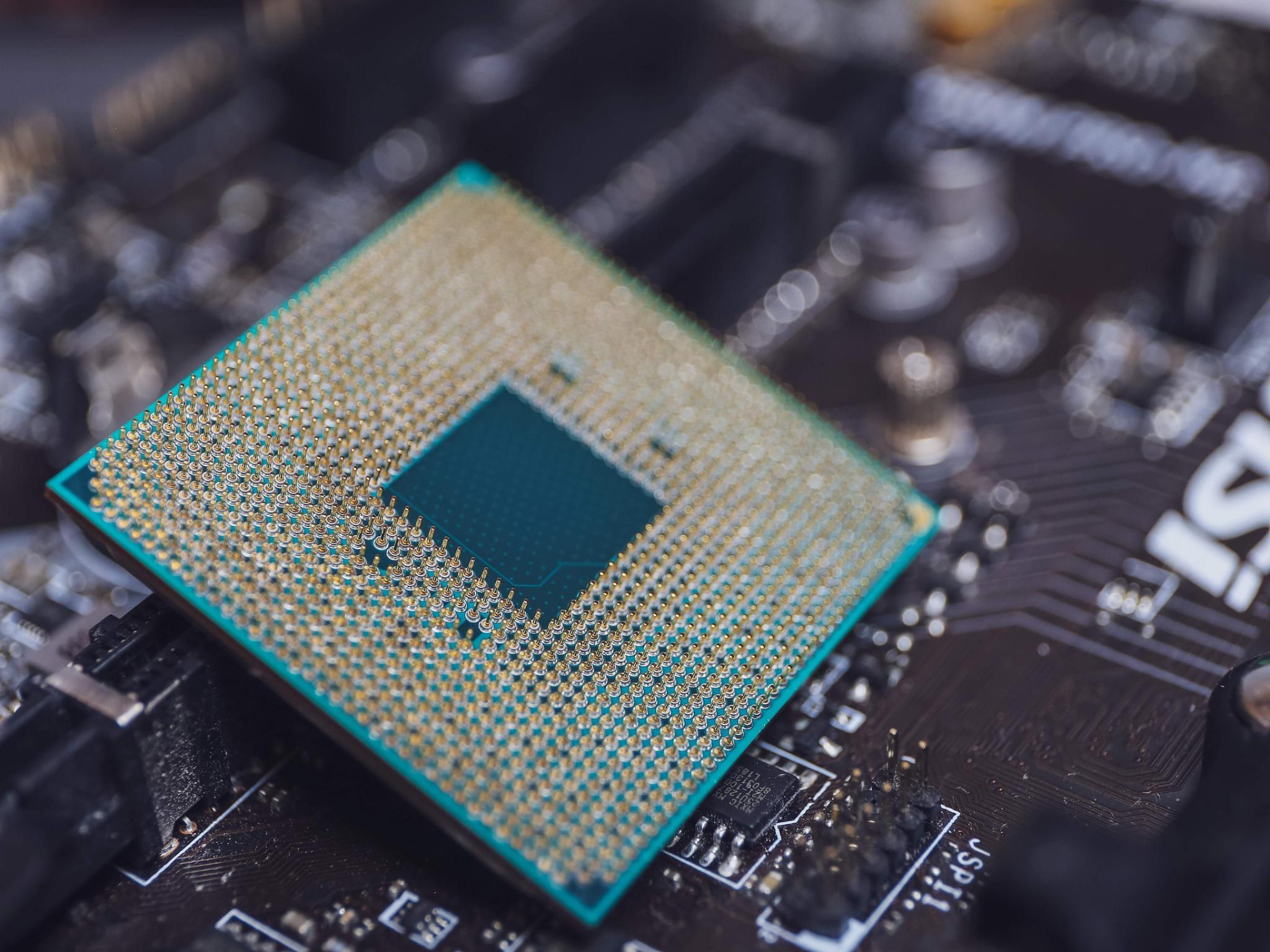

Photo courtesy of AMD.