/Pfizer%20Inc_%20logo%20on%20iPad-by%20Koshiro%20K%20via%20Shutterstock.jpg)

Pfizer (PFE), a pharmaceutical and biotechnology company, rose to great heights during the pandemic with its COVID-19 vaccine. However, it has spent the last few years attempting to reposition itself following the post-pandemic decline in COVID-related revenues. Many investors have written off the stock due to deteriorating sales of Comirnaty and Paxlovid, as well as concerns that its recovery strategies will fail to produce long-term growth. Pfizer stock has dipped 19.3% over the past 52 weeks and 9.7% year-to-date.

However, recent developments indicate that Pfizer may end up being far stronger than the market currently appreciates.

Momentum Beyond COVID-19

One of the clearest signals of progress lies in Pfizer’s oncology portfolio. Pfizer's top priority for 2025 is to increase research and development productivity. During the second quarter earnings call, the business highlighted significant breakthroughs in oncology, hematology, and vaccines, which collectively address multibillion-dollar markets. The company recently noted strong momentum with Braftovi and Mektovi, which achieved 23% year-over-year operating growth in the second quarter. These cancer-targeted treatments are becoming increasingly key growth drivers, and their growing market penetration indicates Pfizer’s capacity to perform well outside of its COVID-19 business.

Additionally, ELREXFIO, a treatment for multiple myeloma, continues to outperform in clinical trials. Meanwhile, Pfizer’s investigational antibody-drug conjugate Sigvotatug vedotin (SV) is advancing in Phase 3 trials for non-small cell lung cancer (NSCLC). With NSCLC expected to approach $60 billion in market size by 2030, management believes SV might become a cornerstone therapy if approved. In addition, Pfizer's cancer pipeline is being strengthened through strategic collaborations. Its in-licensing agreement with 3SBio offers it access to SSGJ-707, a bispecific antibody targeting PD-1 and VEGF, in the enormous $55 billion immunotherapy space.

In hematology, HYMPAVZI achieved promising Phase 3b findings. Management thinks that, if approved, it will be well-positioned to increase market share in the hemophilia industry, which is expected to reach $10 billion by 2030. Pfizer is also pushing ahead in vaccines, where there are large unmet needs. It is reaching the end of its Phase 3 trial for a Lyme disease vaccine and expects to file for approval next year.

Pfizer Has Solid Financial Execution

While the pipeline is crucial for Pfizer’s future, the company’s current portfolio continues to deliver. The Vyndaqel family experienced 21% year-over-year growth, while Eliquis revenue increased 6% as it remained the top anticoagulant. Global sales of Paxlovid, an antiviral medication, increased by 71%, while global sales of Comirnaty, a COVID-19 vaccine, increased by 95%. Other drugs, such as Cibinqo, which treats atopic dermatitis, showed a 46% rise, while LORBRENA increased 48% year over year and is now the standard of therapy for first-line ALK-positive NSCLC.

In the second quarter, Pfizer’s total revenue increased 10% year-over-year to $14.7 billion. Adjusted EPS came in at $0.78, ahead of guidance and up 30% year-over-year. Importantly, recently launched and acquired products generated $4.7 billion year-to-date, growing 15% operationally. This performance gives Pfizer confidence that it can balance potential loss of exclusivity (LOEs) while accelerating future growth. Gross margins remained strong at 76%. Pfizer expects an additional $1.5 billion in savings from manufacturing optimization by 2027. Net savings of $4.5 billion are on track by the end of 2025, with $7.7 billion predicted by 2027. These steps will improve Pfizer’s capacity to withstand LOE headwinds in the coming years.

Despite continued investments in business development, Pfizer maintains its status as a reliable dividend stock. The company returned $4.9 billion to shareholders through dividends while investing $4.7 billion into internal R&D. Its dividend yield of 7.2%, much higher than the healthcare sector average of 1.6%, is attractive for income-seeking investors. The company has also shown reliability by paying and increasing dividends for the past 16 years.

With the confidence that non-COVID revenues are outperforming and operational efficiency is improving, Pfizer raised its 2025 adjusted EPS guidance to a range of $2.90 to $3.10.

What Does Wall Street Say About Pfizer Stock?

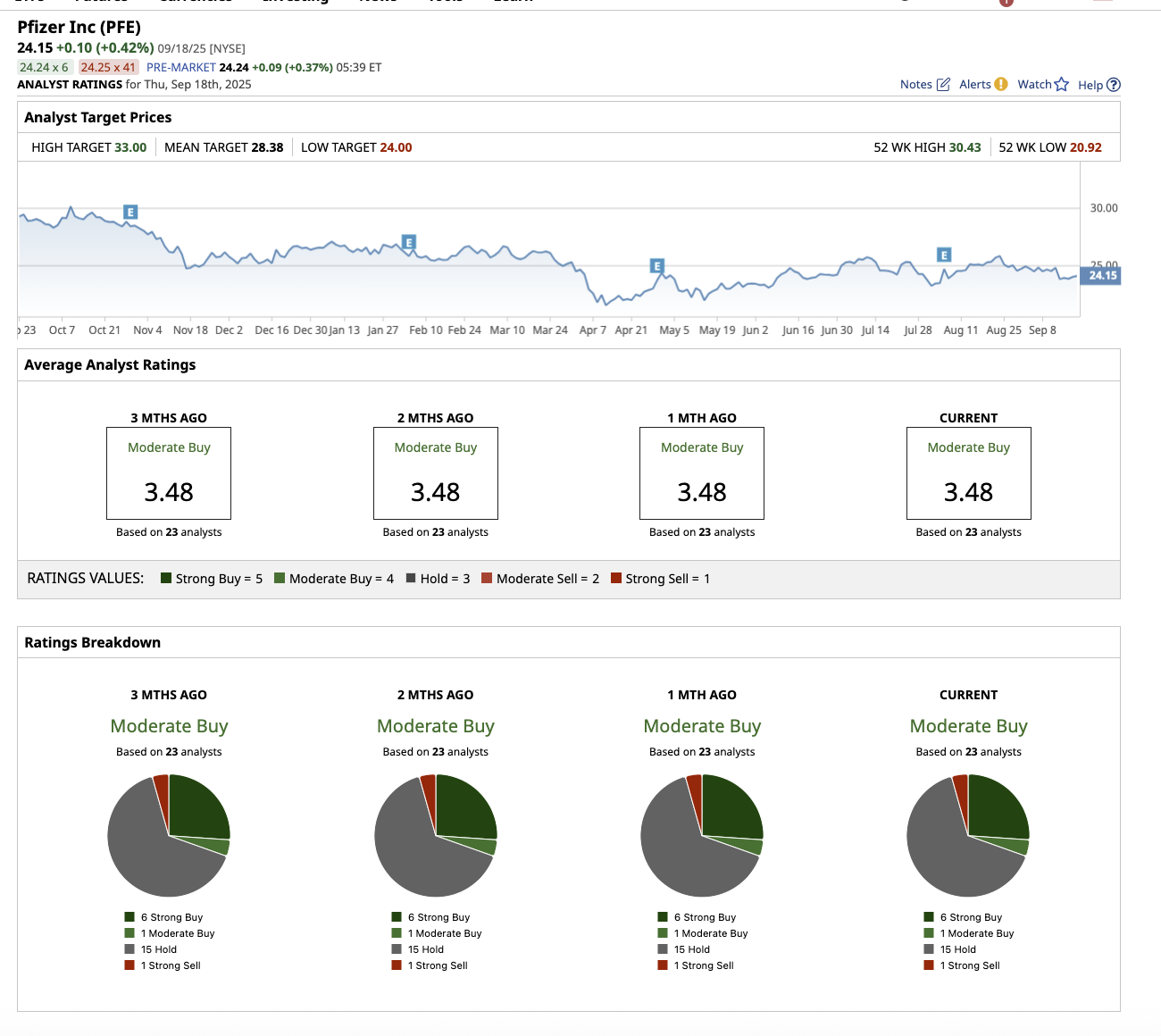

Pfizer’s recovery story appears to be strengthening, thanks to a growing base of long-term non-COVID revenue and strong late-stage trial results. For now, Wall Street remains cautiously optimistic about Pfizer stock, rating it a “Moderate Buy.”

Out of the 23 analysts who cover PFE stock, six rate it a “Strong Buy,” one rates it a “Moderate Buy,” 15 rate it a “Hold,” and one suggests a “Strong Sell.” Its average price target of $28.38 suggests that the stock can increase by 17.5% over current levels. However, its high target price of $33 implies upside potential of 37% over the next 12 months.

The Recovery Could Surprise Investors

Pfizer’s post-pandemic story has been one of a company transforming into a diverse growth powerhouse. Its strong oncology pipeline, distinct hematology medicines, intriguing vaccine candidates, and long-term commercial portfolio provide multiple engines of growth. If the business executes effectively, Pfizer’s rebound might be even larger.

However, to see Pfizer come to its full potential, investors will require patience and a long-term investment horizon.