Shares of post-quantum semiconductor company SEALSQ Corp (NASDAQ:LAES) are trading sharply higher on Tuesday, fueled by a series of strategic partnerships. Here’s what investors need to know.

- LAES shares are climbing with conviction. Check the full analysis here.

What To Know: The latest catalyst for SEALSQ shares is a collaboration announced Tuesday with Swiss compliance provider Wecan Group to develop a post-quantum Know Your Customer (KYC) solution for the financial industry, protecting sensitive client data from future quantum computing threats.

The collaboration follows a Monday announcement of an expanded partnership with energy management firm Landis+Gyr to deploy SEALSQ's cybersecurity technology to protect North America’s smart energy grid.

The recently-announced deals cap a busy week for the company, which also announced a partnership on Oct. 9 with Trusted Semiconductor Solutions to co-develop “Made in USA” secure semiconductors for U.S. defense and government agencies.

Together, the agreements could signal SEALSQ’s growing role in embedding quantum-resistant security across the finance, energy and defense sectors.

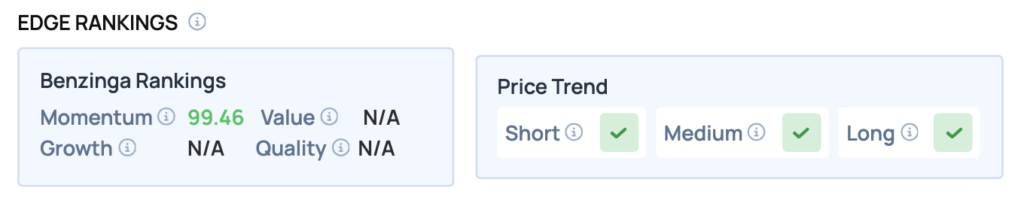

Benzinga Edge Rankings: The stock’s powerful upward trend is reflected in its Benzinga Edge Momentum score, which stands at an exceptionally high 99.46.

LAES Price Action: SEALSQ shares were up 9.38% at $6.70 at the time of publication Tuesday, according to Benzinga Pro. The stock is trading within its 52-week range of $0.30 to $11.00.

SEALSQ stock is well above the 50-day, 100-day and 200-day moving averages, which are all below $3.52, suggesting a strong upward trend. Key support levels may be established around the recent low of $6.07, while resistance could be seen near the high of $7.57.

Read Also: Bitcoin, Ethereum ETFs Bleed $755 Million, But Technical Analysis Gives Bulls Hope

How To Buy LAES Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in SEALSQ’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock