Robinhood Markets Inc (NASDAQ:HOOD) surged to a new all-time high on Tuesday, fueled by a combination of robust growth and strategic initiatives. The rally follows a strong August report revealing a 112% year-over-year increase in total platform assets to $304 billion, with $4.8 billion in net deposits for the month. Here’s what investors need to know.

What To Know: CEO Vlad Tenev on Monday highlighted the early success of event contracts, with over four billion traded since inception. The Robinhood CEO noted that trading volumes crossed two billion contracts in the third quarter alone.

The company’s recently launched prediction-market business is gaining traction, now pacing at an annualized revenue rate exceeding $200 million. Further fueling investor optimism, Bloomberg reported on Tuesday that Robinhood is exploring the launch of its prediction markets outside the US.

Bullish sentiment from Wall Street continues to grow. On Tuesday, Needham analyst John Todaro reiterated a Buy rating on the stock and increased the price target from $120 to $145. This follows recent positive ratings from Piper Sandler and Goldman Sachs, as Robinhood expands its offerings to include features for more sophisticated investors and access to pre-IPO companies.

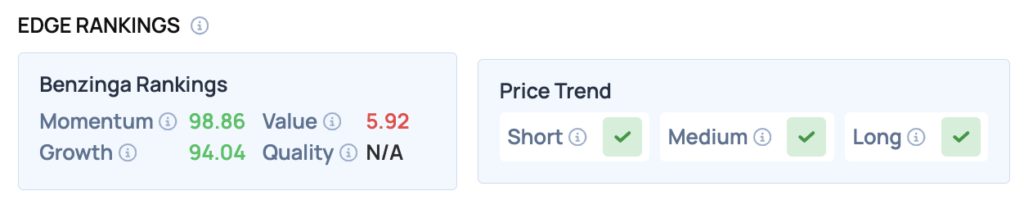

Benzinga Edge Rankings: Underscoring the stock’s powerful performance, Benzinga Edge rankings give Robinhood a near-perfect Momentum score of 98.86.

HOOD Price Action: Robinhood shares were up 1.92% at $139.35 at the time of publication Tuesday, according to Benzinga Pro. Over the past month, Robinhood stock has gained about 35.2% versus a 3.9% rise in the S&P 500 and is up roughly 252% year-to-date compared to the index’s 12.3% gain. The stock is trading at new 52-week highs on Tuesday.

Robinhood stock is significantly above its 50-day moving average of $111.14, indicating strong bullish momentum. Key resistance is observed near the recent high of $142.47, while support can be identified around the 50-day moving average.

Read Also: What’s Going On With Nike Stock Ahead Of Q1 Earnings?

How To Buy HOOD Stock

By now you're likely curious about how to participate in the market for Robinhood Markets – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock