Shares of QMMM Holdings Ltd (NASDAQ:QMMM) are trading sharply lower Thursday, continuing a reversal from a marked rally earlier in the week.

What To Know: The sell-off follows a volatile surge on Tuesday, when the stock soared over 1,700%, briefly hitting a 52-week high of $303. The massive spike was triggered by the Hong Kong-based company’s announcement of a major strategic pivot into the cryptocurrency and artificial intelligence sectors.

QMMM on Tuesday revealed plans to establish a $100 million cryptocurrency treasury, initially targeting Bitcoin (CRYPTO: BTC), Ethereum (CRYPTO: ETH) and Solana (CRYPTO: SOL). The company aims to create a “crypto-autonomous ecosystem” that leverages AI-driven analytics to assist traders. Although the news intially sparked a buying frenzy, the momentum faded in after-hours trading Tuesday, and the stock continued its pullback late Thursday.

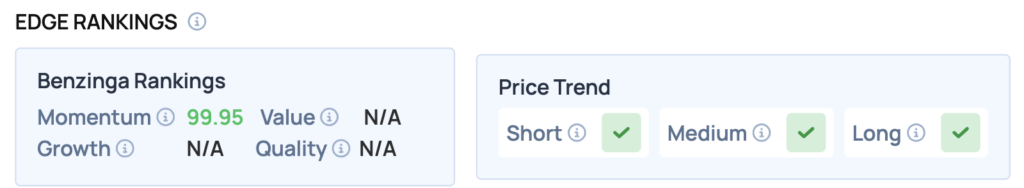

Benzinga Edge Rankings: Reflecting its extreme price volatility, Benzinga Edge gives the stock a nearly perfect Momentum ranking of 99.95.

QMMM Price Action: According to data from Benzinga Pro, the stock was down about 38.91% to $66.90 in Thursday afternoon trading. The stock has a 52-week high of $303.00 and a 52-week low of $0.54.

How To Buy QMMM Stock

By now you're likely curious about how to participate in the market for QMMM Holdings – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock