Noodles & Co. (NASDAQ:NDLS) stock surged 8% in after-hours trading on Thursday, as investors seized on optimistic commentary on comparable restaurant sales and a new value strategy from the company’s CEO. The rebound followed a brutal regular session where the stock plummeted over 29% on disappointing quarterly results.

Check NDLS’s stock price here.

What Fueled Optimism Despite A Sharp Fall?

The after-hours rally was primarily fueled by CEO Drew Madsen‘s remarks on the company’s “Delicious Duos” value platform, which was launched at the beginning of August. He revealed that the initiative is already yielding impressive results.

“Comparable restaurant sales have increased to an average of positive 5% over the past two weeks, demonstrating that our value-focused initiatives are resonating with guests,” Madsen said in a statement. This positive, forward-looking data point appeared to give investors a reason to buy back into the heavily sold-off stock, suggesting the company has a viable plan to combat weak consumer spending.

Noodles & Co. Q2 Misses Expectations

This glimmer of hope came after a dismal second-quarter report that drove the daytime sell-off. The company missed revenue expectations, posting $126.4 million against a forecast of $131.62 million, according to Benzinga Pro.

Its net loss also widened to $17.6 million from $13.6 million in the same period last year. Additionally, Noodles & Co. lowered its full-year revenue guidance and announced plans to close up to 32 company-owned restaurants.

Madsen acknowledged the “challenging consumer environment” and a “strong value-conscious climate” for the poor quarterly performance, problems the new successful value platform is designed to address.

See Also: Mortgage Rates Hit 10-Month Low, Giving Trump More Ammo To Push Fed For Aggressive Cuts

Price Action

The stock was up 22.39% year-to-date and down by 57.52% over the year.

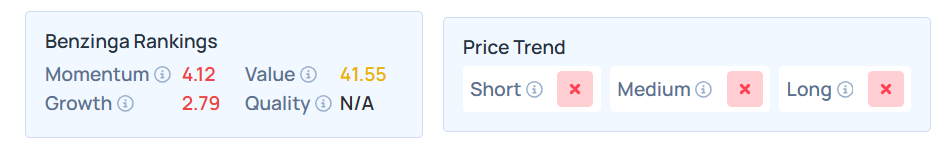

Benzinga's Edge Stock Rankings indicate that NDLS maintains a weaker price trend over the short, medium, and long terms. However, the stock scores moderately on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended mixed on Thursday. The SPY was up 0.0093% at $644.95, while the QQQ declined 0.078% to $579.89, according to Benzinga Pro data.

On Friday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.