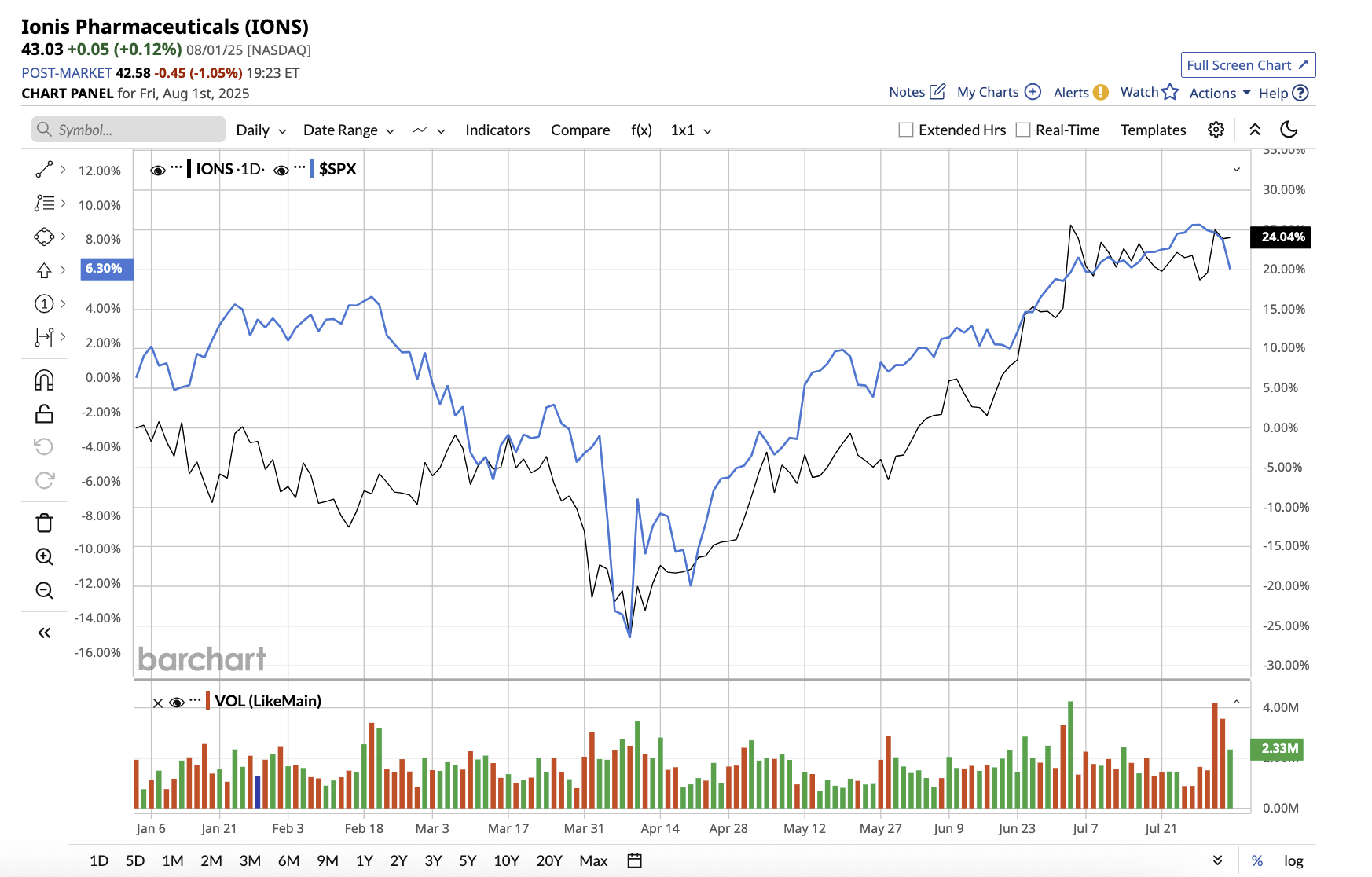

Sitting at a market cap of $6.8 billion, Ionis Pharmaceuticals (IONS) is a U.S.-based biotech company that develops RNA-targeted therapeutics to treat diseases caused by genetic or biochemical dysregulation. Ionis has many approved products in the market, most in collaboration with large pharmaceutical companies. However, it independently launched its sole product, Tryngolza, in December of last year. The drug had a blockbuster performance following its commercial launch. IONS stock has surged 21.5% year-to-date, outperforming the market.

Based on the biotech's strong second-quarter results, Morgan Stanley analyst Michael Ulz upgraded the stock to a "Buy" with about 45% upside potential, based on the target price of $62.

Ulz cited a combination of strong operational performance and promising future catalysts as reasons for his bullish stance on Ionis. Let’s take a look at what those drivers are, and whether Ionis stock is truly a “Buy” now.

Why Did Morgan Stanley Upgrade IONS Stock?

According to Michael Ulz, the launch of Tryngolza was the standout factor in Ionis' second quarter earnings, exceeding not only Wall Street's expectations but also initial internal sales forecasts. Its robust commercial debut shows Ionis' management's strong execution capabilities and solidifies investor confidence in the company's strategic direction.

Tryngolza (olezarsen) is used to treat familial chylomicronemia syndrome (FCS), a rare and life-threatening genetic lipid disorder in adults, in combination with diet. It was the drug's second full quarter on the market, with net product sales of $19 million in Q2. Management emphasized in the Q2 earnings call that physicians are prescribing it to a large number of patients, indicating increased confidence in the drug. Furthermore, approximately 60% of patients are covered by commercial insurance and 40% by government programs, with more than 90% paying no out-of-pocket costs, contributing to the drug's success.

Crucially, with a positive opinion from the European CHMP (Committee for Medicinal Products for Human Use), Ionis is planning to expand Tryngolza's reach throughout Europe. This will lay the groundwork for significant international expansion. The company also earned a royalty revenue of $70 million from the following products, among others:

- Spinraza (nusinersen) — for spinal muscular atrophy in partnership with Biogen (BIIB)

- Wainua (eplontersen) — for ATTRv PN, co-commercialized with AstraZeneca (AZN)

Total revenue in the second quarter increased by an impressive 100.8% year-on-year to $452 million. The company also reported a profit of $0.70 per share, up from a loss of $0.45 per share in the year-ago quarter.

Morgan Stanley's Ulz also mentioned many upcoming events that could boost the stock, including the anticipated Phase 3 readouts for severe hypertriglyceridemia (SHTG) and other pipeline updates scheduled for 2026. Furthermore, early feedback from key opinion leaders on the upcoming Phase 3 CORE/CORE2 data for Olezarsen to treat patients with sHTG has been overwhelmingly positive, adding to the sense of optimism. The company expects topline data from the trial in September of this year.

Notably, Ionis has an extensive late-stage pipeline, with many in Phase 2-3 clinical development. Donidalorsen is expected to be approved in August for hereditary angioedema (HAE), a rare but well-known genetic condition that causes painful swelling episodes. Management believes Donidalorsen has the potential to significantly broaden the company's footprint, as up to 20% of HAE patients switch prophylactic therapies each year, indicating dissatisfaction with current options. Furthermore, ION582 is beginning a Phase 3 trial to determine its efficacy for Angelman syndrome (AS), a serious and rare neurodevelopmental disorder.

With a successful drug launch under its belt and multiple potential catalysts on the horizon, Morgan Stanley believes Ionis is well-positioned for continued growth.

Management is also confident that the company's current momentum will lead to long-term revenue growth and positive cash flow. For the full year, Ionis expects revenue to increase by 17% to 20%, to $825 million to $850 million, while analysts predict $869.6 million in revenue.

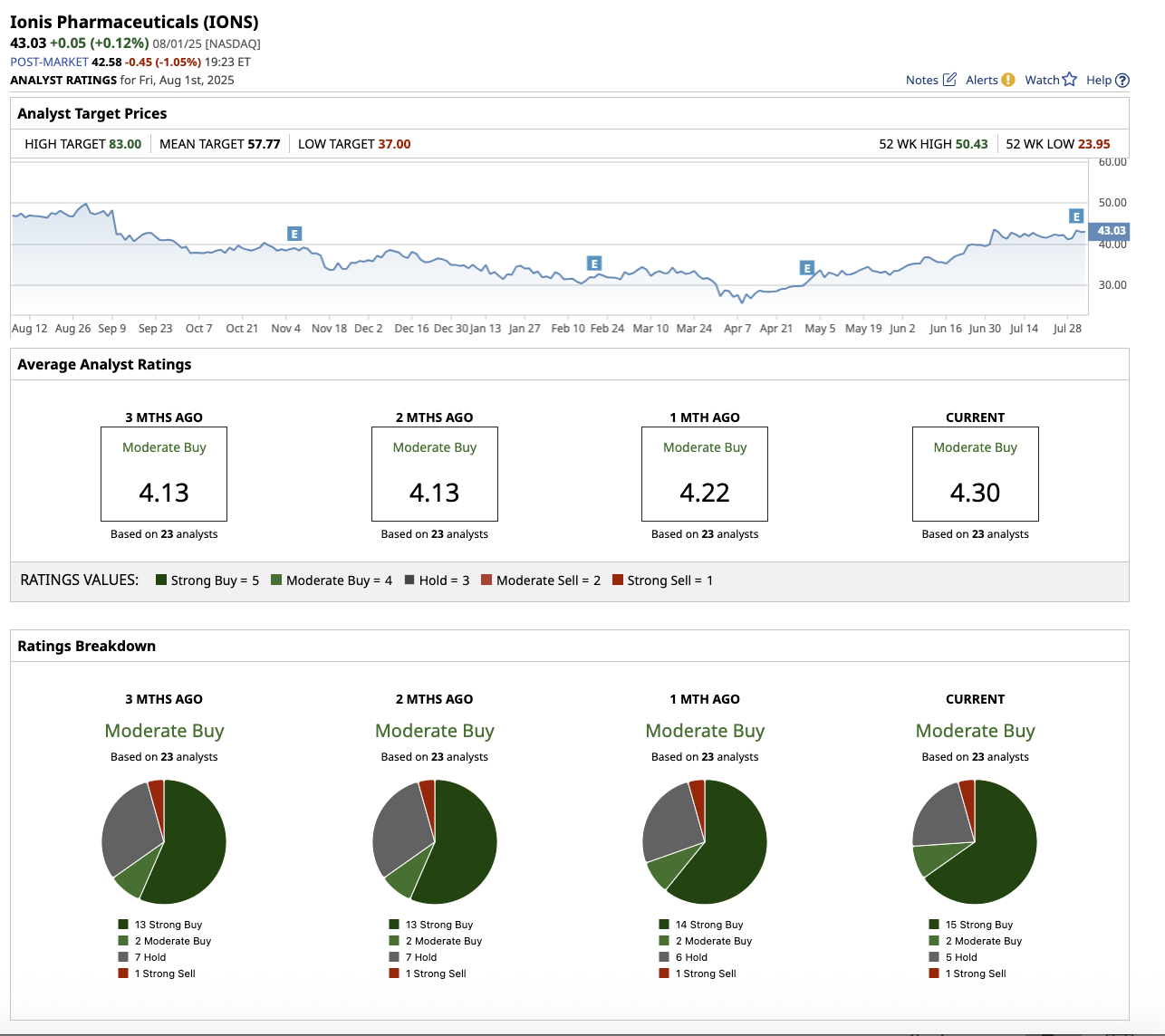

What Are Other Analysts Saying About IONS Stock?

Aside from Morgan Stanley, Oppenheimer, Needham, Raymond James, and H.C. Wainwright analysts also maintain a “Buy” rating for IONS stock. Furthermore, H.C. Wainwright has raised the target price to $65 from $50.

Separately, Wells Fargo analyst Yanan Zhu maintained a “Buy” rating and a target price of $77 for IONS after the company's strong second-quarter performance, which the firm says reflected both top-line momentum and operational discipline. Zhu also highlighted the company's strategic execution, specifically the successful launch of Tryngolza.

Looking ahead, Zhu expects additional upside from several key catalysts, including upcoming pivotal trial readouts and potential regulatory milestones. These developments could further strengthen the company's pipeline and unlock long-term value for shareholders.

Overall, on Wall Street, IONS remains a “Moderate Buy.” Of the 23 analysts covering the stock, 15 rate it a “Strong Buy,” two say it is a “Moderate Buy,” five rate it a “Hold,” and one suggests a “Strong Sell.” The average target price of $57.77 suggests an upside potential of 35% from current levels. Additionally, the Street-high estimate of $83 suggests the stock has an upside potential of 93% over the next 12 months.

With successful products and a robust pipeline approaching key milestones, Ionis appears to be on track to become a multi-product, multibillion-dollar biotech leader, which explains analysts' optimism for the stock. Ionis is developing a long-term, growth-oriented business model capable of delivering transformational therapies to patients while providing strong returns to investors, making it a compelling biotech stock for the long haul.