The number of baby boomers filing for bankruptcy is rising, and it’s not just about medical bills anymore. Many people assume that health care costs are the main reason older Americans struggle with debt, but the real story is more complicated. Boomers are facing a mix of financial pressures that didn’t exist for previous generations. These challenges are changing how people think about retirement, debt, and financial security. If you’re a boomer—or you care about one—understanding these trends can help you avoid the same pitfalls. Here’s what’s really driving this wave of bankruptcies, and what you can do about it.

1. The Disappearance of Pensions

Pensions used to be a safety net for retirees. Many boomers expected to rely on a steady pension check after decades of work. But over the past 30 years, most private companies have replaced pensions with 401(k) plans or nothing at all. This shift means more people are responsible for their own retirement savings. If you didn’t save enough, or if your investments lost value, you might not have enough to cover basic expenses. Without a pension, some boomers are forced to use credit cards or loans to fill the gap, leading to mounting debt and, eventually, bankruptcy.

2. Supporting Adult Children

Many boomers are helping their adult children financially. Some are paying for college, helping with rent, or even letting grown kids move back home. This support can drain retirement savings fast. It’s hard to say no to family, but these choices can leave boomers with little left for themselves. When emergencies hit, there’s no cushion. The result? More debt, more stress, and a higher risk of bankruptcy. If you’re in this situation, set clear boundaries and make sure your own needs come first.

3. Rising Housing Costs

Housing is more expensive than ever. Some boomers still have mortgages, while others have taken out home equity loans to pay for renovations, medical bills, or to help family. Property taxes and maintenance costs keep going up, too. If your income drops in retirement, these bills can become overwhelming. Selling the house isn’t always easy, especially if you owe more than it’s worth. For many, housing costs are the biggest monthly expense, and they can push people into bankruptcy when money gets tight.

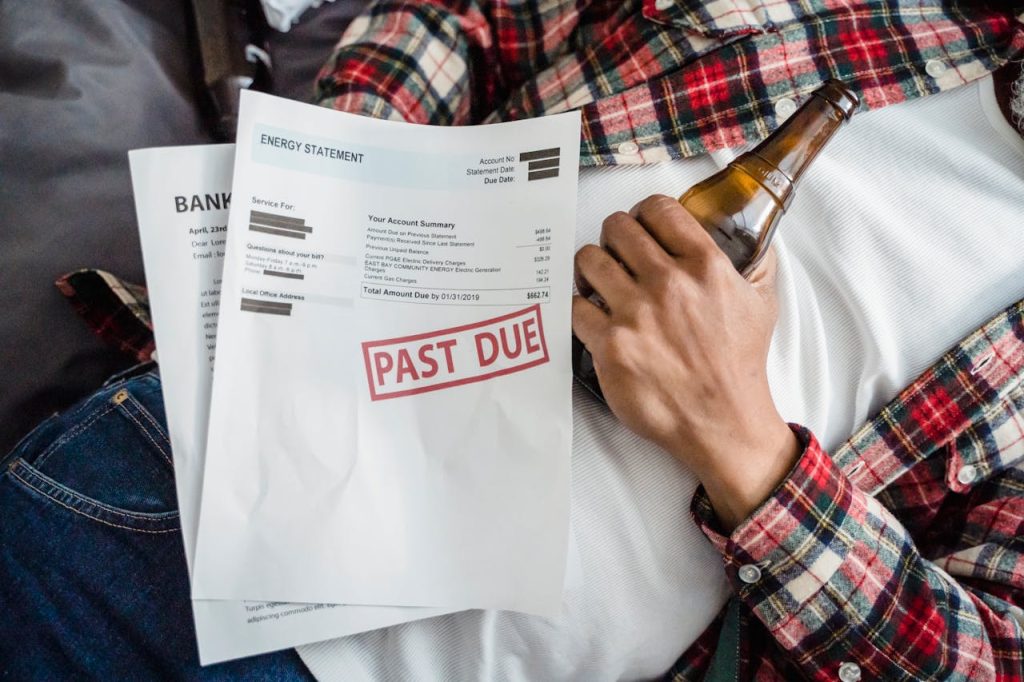

4. Credit Card and Consumer Debt

Credit card debt is a growing problem for older Americans. Many boomers use credit cards to cover everyday expenses, especially if they’re on a fixed income. Interest rates are high, and balances can grow quickly. Some people also have car loans, personal loans, or payday loans. When you’re juggling multiple payments, it’s easy to fall behind. Missed payments lead to fees, higher interest, and damaged credit. Over time, the debt snowballs, and bankruptcy can start to look like the only way out.

5. Divorce Later in Life

Divorce rates among people over 50 have doubled in the past 25 years. Splitting up late in life can devastate your finances. You might lose half your savings, your home, or your retirement accounts. Legal fees add up fast. Living alone is more expensive than sharing costs with a partner. After a divorce, many boomers find themselves starting over with less money and more debt. If you’re facing a “gray divorce,” get professional advice and protect your assets as much as possible.

6. Job Loss and Age Discrimination

Losing a job in your 50s or 60s is tough. It’s harder to find new work, and age discrimination is real. Some boomers end up taking lower-paying jobs or part-time work just to get by. Others can’t find work at all. Without a steady income, it’s easy to fall behind on bills. Unemployment benefits don’t last forever, and savings can disappear quickly. If you’re worried about job security, keep your skills up to date and build an emergency fund if you can.

7. Underestimating Retirement Expenses

Many people underestimate how much money they’ll need in retirement. Health care, housing, food, and transportation all add up. Inflation makes everything more expensive over time. Some boomers retire early, only to realize their savings won’t last. Others are forced to retire because of health issues or layoffs. When expenses outpace income, debt fills the gap. Planning ahead and being realistic about costs can help you avoid this trap.

8. Student Loan Debt

It’s not just young people who have student loans. Many boomers took out loans for their own education or co-signed for their children or grandchildren. These loans don’t go away in retirement. In fact, the number of older Americans with student loan debt has quadrupled in the past two decades. Monthly payments can eat up a big chunk of a fixed income. If you’re struggling with student loans, look into income-driven repayment plans or loan forgiveness options.

9. Lack of Financial Literacy

Some boomers never learned the basics of budgeting, investing, or managing debt. Financial products have become more complex, and scams are everywhere. Without the right knowledge, it’s easy to make costly mistakes. Taking the time to learn about personal finance can help you make better decisions and avoid bankruptcy. Free resources are available online, at libraries, and through community organizations.

Facing Bankruptcy: What You Can Do Next

Bankruptcy isn’t the end of the road. It’s a tool to help people get a fresh start. If you’re a boomer facing bankruptcy, you’re not alone. Many people are in the same boat, dealing with the same pressures. The most important thing is to take action early. Talk to a credit counselor or bankruptcy attorney. Make a list of your debts and assets. Look for ways to cut expenses and boost your income. And remember, it’s never too late to learn new skills or change your financial habits. The sooner you face the problem, the more options you’ll have.

Have you or someone you know faced financial struggles in retirement? Share your story or advice in the comments below.

Read More

Seniors Are Being Denied Credit Over This One Forgotten Factor

6 Times Credit Cards Can Save You From An Embarrassing Situation

The post Why More Boomers Are Declaring Bankruptcy—And It’s Not Medical Bills appeared first on The Free Financial Advisor.