/Code%20on%20computer%20screen%20java%20html%20by%20Pexels%20via%20Pixabay.jpg)

On paper, Monday.com (MNDY) should be a strong candidate for upside. Billed as an open platform which democratizes the power of software, Monday leverages artificial intelligence to bolster collaborative endeavors and help generate efficiencies in customer management. Sales growth has been strong as well, with the company generating $972 million in 2024, up 33.21% over the prior year.

Unfortunately, investors haven’t been pleased with the performance in the charts. Since the beginning of the year, MNDY stock fell almost 22%, a sharp contrast to the Nasdaq’s gain of nearly 18% during the same period. Against its public market debut, MNDY is down about 3%. To add insult to injury, the Barchart Technical Opinion indicator rates the equity as a 96% Strong Sell.

What’s interesting, though, is that MNDY stock has its fair share of believers. Among 25 experts, Monday commands a Strong Buy consensus view, with 20 analysts rating it with the highest level of conviction. Further, the mean price target stands at $281.17, implying long-term upside of roughly 53%.

Peculiarly, the least bullish target comes in at $205, which would still translate to a solid 11.2% lift. With an options spread, speculators can easily expand their potential payout. Of course, that’s easier said than done.

Following a decent showing in the second quarter, Monday still saw its equity plummet, with investors worried about slowing sequential growth. Looking back in hindsight, the gushing of red ink represented a discounted opportunity. Even so, the ride hasn’t been a smooth one. For instance, MNDY stock was above $219 a pop on Sept. 19 before nosediving.

Nevertheless, for those willing to take a risk, there could be an opportunity here.

Using Statistics to Plot a Course Forward for MNDY Stock

With baseball switching fully into playoff mode, the use of statistics has escalated dramatically. Much like our national pastime, analytics alone won’t guarantee victories. However, they help filter out irrational emotions, putting the focus instead on empirically backed decision-making processes. Combined with the appropriate tactical moves and a little bit of luck, the data-based approach should theoretically be the most effective.

In my opinion, a similar philosophy can be applied to the financial markets. Essentially, market reality could be defined simply as the current valuation, the immediate negotiation point between bulls and bears. However, by the inverse logic, reality could also be defined as a spectrum of possibilities that have collapsed so that there is only one remaining outcome — the ticker price that you currently observe.

My hypothesis is that with a first-order Markov chain defined on higher-order states, it’s possible to narrow down the effective or realistic range of possibilities. Under this model, the next state depends only on the current state. Subsequently, the distinctive profile of the last 10 weeks should be instructive in how the next 10 weeks may pan out.

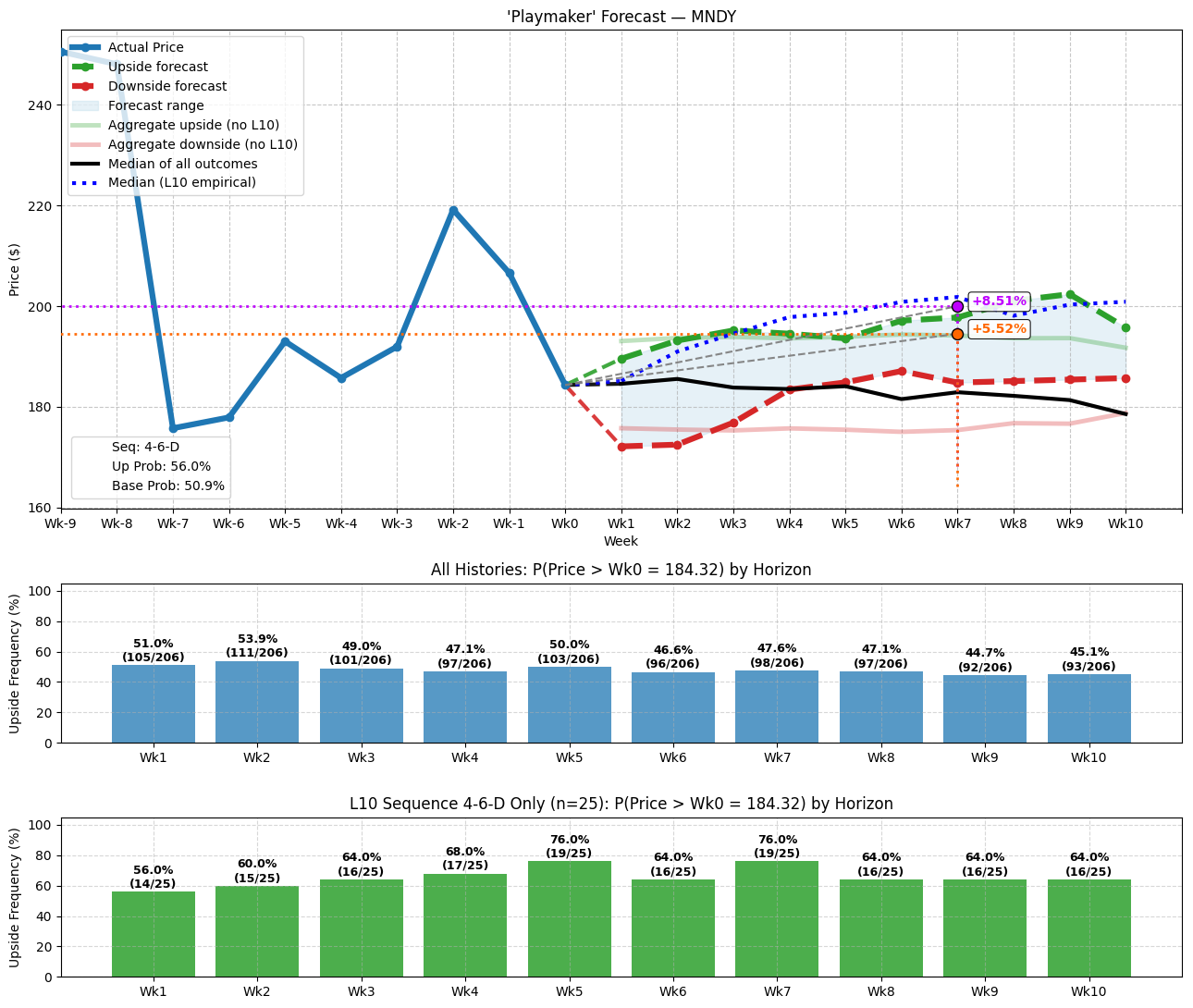

Using this logic, in the trailing 10 weeks, MNDY stock has printed a 4-6-D sequence: four up weeks, six down weeks, with an overall downward trajectory. Since its market debut, this sequence has materialized 25 times on a rolling basis. Over the next several weeks, the chance of upside relative to the starting point is quite high, roughly 66%.

More importantly, the median price of outcomes associated with the 4-6-D is projected to just pop above the $200 level. If the observed sentiment regime holds true, then half of outcomes would be expected to land above $200 and half below. In contrast, the median price of all aggregated outcomes in the dataset would be expected to fall below the anchor price.

In other words, under “normal” circumstances, MNDY stock wouldn’t qualify as a strong bullish bet. However, when the aforementioned behavioral state is distribution-heavy, speculators tend to buy the dip.

Targeting an Ambitious but Rational November Bull Spread

With the above market intelligence, the trade that’s arguably the most tempting is the 190/200 bull call spread expiring Nov. 21. This transaction involves buying the $190 call and simultaneously selling the $200 call, for a net debit paid of $450 (the most that can be lost in the trade).

Should MNDY stock rise through the second-leg strike price ($200) at expiration, the maximum profit would be $550, a payout of over 122%. Breakeven comes in at $194.50, representing a 5.52% gap from Wednesday’s closing price.

Those who really want to get aggressive could raise the second leg to $210, where there are spreads with payouts close to 180%. Still, traders who want to play it safe can still get a very good reward with the 190/200 spread.