According to Benzinga Pro data, Star Equity Holdings Inc. (NASDAQ:STRR) shares surged 27.7% during after-hour trading session to $2.72 on Thursday, up from a $2.13 closing price, following stockholder approval of its merger with Hudson Global Inc. (NASDAQ:HSON).

Check out the current price of STRR stock here.

Stockholders Approve Merger Deal

Star stockholders approved the merger proposal on August 21, during a special meeting. Of the 3.2 million shares outstanding, the proposal received overwhelming support with 1,788,515 votes in favor, 90,748 against, and 988 abstentions, according to SEC filings.

The merger, originally announced on May 21, will see Connecticut-based diversified holding company become a wholly owned subsidiary of Hudson Global under the new name “Star Operating Companies, Inc.” The transaction is set to close at 12:01 a.m. EST on August 22.

Key Executive Connection

Jeffrey Eberwein, Hudson’s CEO and holder of approximately 10% of Hudson’s common stock, also serves as Star’s Executive Chairman and substantial stockholder. This cross-ownership structure was disclosed in the joint proxy statement filed on July 23.

Recent Insider Activity

SEC Form 4 filings show recent restricted stock unit (RSU) awards to key executives on August 18. Eberwein received 860 RSUs, while directors Parks Louis and Todd Michael each received 485 and 535 RSUs, respectively. Jennifer Palmer also received 460 RSUs. The grants vest after one year and were valued using the $10.00 liquidation preference price of Star’s Series A preferred stock.

Star’s market capitalization stands at $6.89 million with an average daily trading volume of 26,200 shares. The stock has traded between $1.72 and $4.55 over the past year, up 48.67% year-to-date before today’s merger-driven surge.

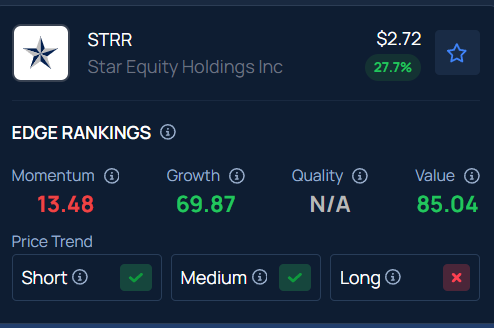

Benzinga’s Edge Stock Rankings indicate that STRR is experiencing long-term consolidation along with medium and short-term upward movement. Know how its momentum lines up with other well-known names.

Read Next:

Photo Courtesy: Golden Dayz on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.