Shares of Hims & Hers Health Inc (NYSE:HIMS) are trading lower Friday morning after comments from President Donald Trump indicated that he expects the prices of popular weight-loss drugs to decrease. Here’s what investors need to know.

- HIMS stock is trending lower. See the trading setup here.

What To Know: While Hims & Hers doesn’t manufacture the GLP-1 drugs, a class of medications that help manage Type 2 diabetes and obesity, like Eli Lilly’s Zepbound and Novo Nordisk’s Ozempic, it sells cheaper, compounded versions of them.

The company’s business model relies on offering more affordable alternatives to these high-demand drugs, and the prospect of the brand-name versions becoming significantly cheaper could negatively impact the company’s market share and profitability.

Regulators currently allow for compounded versions of drugs to be sold when there is a shortage of the original, but a price drop in the originals could lead to a decrease in demand for Hims’ compounded alternatives. Hims & Hers generated over $225 million in revenue in 2024 from its GLP-1 offering.

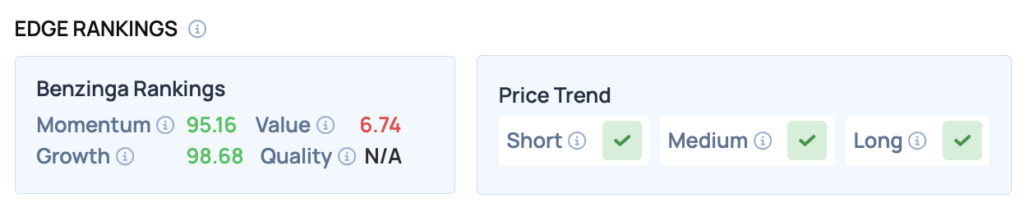

Benzinga Edge Rankings: Despite Friday’s downturn, Benzinga Edge stock rankings show Hims with a very strong Growth score of 98.68.

HIMS Price Action: Hims & Hers Health shares were down 9.45% at $53.57 at the time of publication on Friday, according to Benzinga Pro data.

Read Also: Gold And Tech Are Rising Together—But History Says One Will Soon Break

How To Buy HIMS Stock

By now you're likely curious about how to participate in the market for Hims & Hers Health – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock