Shares of Ethzilla Corp (NASDAQ:ETHZ) are volatile Thursday morning, pulling back sharply after an early rally. The initial surge appears to have been triggered by a Wednesday tweet from influential trader Capybara Stocks, who is widely credited with sparking the recent Beyond Meat short-squeeze.

- ETHZ shares are trending. See the full breakdown here.

What To Know: The trader revealed they had acquired 2.2% of Ethzilla, purchasing 360,000 shares at an average price of $16. Capybara Stocks suggested that ETHZ is "undervalued even more severely than BYND was," based on a similar mix of technical and fundamental factors.

Capybara Stocks first stepped into the spotlight after he made a post on Reddit explaining why he purchased 4% of the company. The Capybara Stocks account on X was created shortly after the trader’s Beyond Meat post on Reddit was removed.

The trader’s new investment in Ethzilla drew immediate parallels to the Beyond Meat frenzy, which saw the stock soar over 400% amid massive short interest and meme-stock momentum. While Capybara's involvement initially sent ETHZ shares flying early Thursday, the rally has since faded.

The volatility on Thursday comes as Ethzilla announced a strategic partnership with Liquidity.io, a regulated digital asset platform. The deal will see Ethzilla take a 15% equity stake in Satschel, Inc., a subsidiary of Liquidity.io, through a $15 million investment.

This partnership is expected to accelerate Ethzilla’s ability to securitize real-world assets on-chain, expanding its capabilities to offer compliant digital securities.

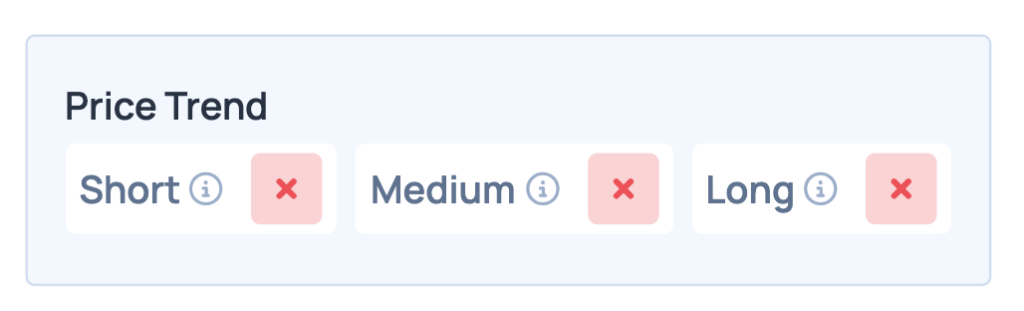

Benzinga Edge Rankings: Highlighting the stock’s technical weakness, Benzinga Edge data indicates a bearish price trend for ETHZ across short, medium and long-term timeframes.

ETHZ Price Action: ETHZilla shares were down 0.26% at $15.60 at the time of publication on Thursday, according to Benzinga Pro data.

Read Also: What’s Driving Beyond Meat’s 19% Pre-Market Drop?

How To Buy ETHZ Stock

By now you're likely curious about how to participate in the market for ETHZilla – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock