Carvana Co (NYSE:CVNA) shares are trading higher Tuesday after the e-commerce platform for buying and selling used cars expanded its same-day vehicle delivery service to the San Diego area. The launch allows local customers to receive their purchased vehicle on the same day they place an order.

- CVNA is among today’s top performers. Check the analyst take here.

What To Know: The positive momentum also builds on recent analysis of the company’s asset-backed securities (ABS) data. A BTIG note from October 17, which maintained a Buy rating and a $450 price target, highlighted stabilizing credit performance.

September data for the company’s 2025-N1 subprime ABS showed a moderation in cumulative net loss growth and a decline in short-term delinquencies.

Analysts noted that overall delinquency trends improved, with 30-day delinquencies dropping 44 basis points to 6.64%. The firm sees Carvana's vertically integrated model as a key advantage, projecting revenue to grow to $24.03 billion in fiscal 2026 and Adjusted EBITDA to expand from $1.38 billion in fiscal 2024 to $2.19 billion.

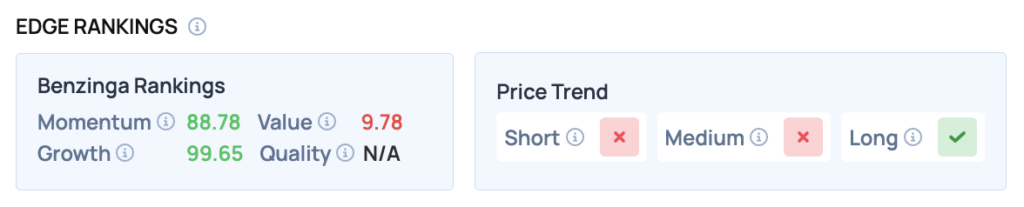

Benzinga Edge Rankings: Further supporting the positive sentiment, Benzinga Edge stock rankings award Carvana an exceptional Growth score of 99.65 and a strong Momentum score of 88.78.

CVNA Price Action: Carvana shares were up 5.43% at $355.94 at the time of publication on Tuesday, according to Benzinga Pro data.

Read Also: Gold Sinks 5% On Worst Day In 5 Years, Dow Jones Hits Record Highs: What’s Moving Markets Tuesday?

How To Buy CVNA Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Carvana’s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock