Azitra Inc. (NYSEAMERICAN: AZTR) shares skyrocketed 58.71% in after-hours trading to $1.51 on Thursday, following the implementation of a 1-for-6.66 reverse stock split and significant SEC filing activity that revealed new institutional ownership.

Check out the current price of AZTR stock here.

According to the Benzinga Pro data, the Connecticut-based biotechnology company closed regular trading at $0.95, up 5.82% for the session, before surging in extended hours. The dramatic after-hours movement came as the reverse stock split became effective at 12:01 a.m. Eastern Time on August 21.

Reverse Stock Split Details and Market Impact

According to SEC Form 8-K filed on August 20, stockholders previously approved the reverse split at a February 20 special meeting, granting the board discretion to determine timing and exact ratio. Every 6.66 shares of outstanding common stock will combine into one share, with no fractional shares issued.

See Also: Lucid Announces 1-For-10 Reverse Stock Split: How’s The EV Stock Reacting?

The company’s post-split CUSIP number changed to 05479L 302, while par value and other stock terms remain unchanged. Stockholders entitled to fractional shares will receive cash payments based on the average closing price for the five trading days preceding August 20.

Alumni Capital Reveals Strategic Investment Position

Concurrent with the reverse split, Schedule 13G filings disclosed that Alumni Capital LP and affiliated entities hold beneficial ownership of 2,605,586 shares, representing 9.99% of the outstanding stock. The Miami-based investment firm, managed by Ashkan Mapar, acquired the position through warrant agreements and a purchase agreement dated April 25, 2025.

The filing indicates Alumni Capital currently owns 849,700 shares through commitment warrants, with rights to acquire additional shares at the issuer’s discretion, subject to ownership limitations of 4.99% under the purchase agreement and 9.99% under warrant terms.

Market Performance and Trading Metrics

AZTR has experienced significant volatility over the past year, trading in a range of $0.13 to $0.96 before the after-hours surge. The company maintains a market capitalization of approximately $21.54 million with average daily volume of 145,550 shares. The stock has declined 78.76% over the trailing 12-month period prior to Wednesday’s gains.

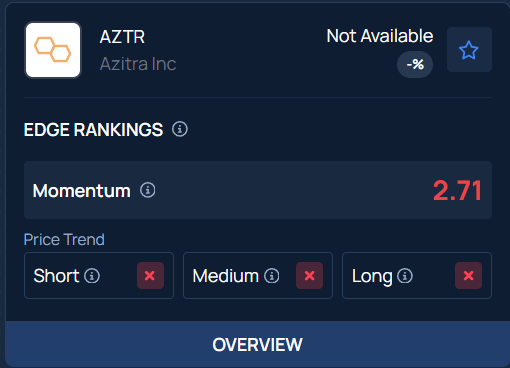

Benzinga Edge Stock Rankings indicate that AZTR stock has a negative price trend across all time frames. Find out the stock value of other biotech companies.

Read Next:

Photo Courtesy: Golden Dayz on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.