Iron Horse Acquisitions Corp. (NASDAQ:IROH) shares rose 83.37% to $7.50 in after-hours trading.

Check out the current price of IROH stock here.

The surge followed the company’s announcement that it had finalized its business merger with Rosey Sea Holdings Limited and China Food Investment (CFI).

China Food Investment, the parent company of Zhong Guo Liang Tou Group Limited, and Rosey Sea Holdings Limited are both based in the British Virgin Islands.

New Trading Symbol Debuts October 1

The merged company will be known as CN Healthy Food Tech Group Corp. and will start trading under the ticker symbols “UCFI” and “UCFIW” on October 1, 2025.

See Also: Ryvyl (RVYL) Stock Is Ripping Higher After Hours: Here's Why

Major Milestone

“We are pleased to announce the successful completion of our merger, marking a significant step forward in bringing value for our shareholders,” stated CFI representatives.

Stock Performance

2025 loss stands at 60.25%, with the stock dropping 67.28% from its peak of $12.50 on August 27 to yesterday’s close of $4.09.

The Delaware-based special purpose acquisition company (SPAC) has a market capitalization of $8.86 million and an average trading volume of 21,140 shares. It’s 52-week range has been between $3.41 and $14.13, showing notable price fluctuations. The company currently has a price to earnings ratio of 82.98.

Price Action: According to Benzinga Pro data, IROH dropped 60.48% to $4.09 on Tuesday in the regular session.

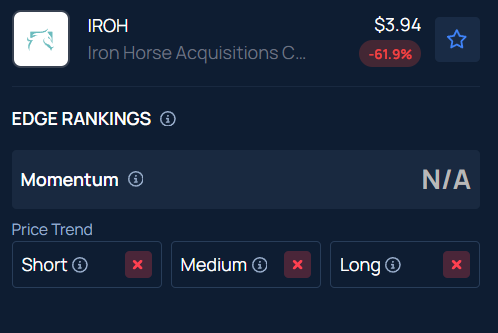

Benzinga Edge Stock Rankings indicate that IROH has a negative price trend across all time frames. Track the performance of other players in this segment.

Read Next:

Photo Courtesy: Garun .Prdt on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.