/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Amazon (AMZN) stands at the cusp of a strategic inflection point, and investors are taking notice. In a bold move, Wells Fargo just upgraded Amazon stock's rating from “Equal Weight” to “Overweight”, citing renewed confidence that Project Rainier could meaningfully accelerate Amazon Web Services (AWS) growth.

At its core, Rainier represents Amazon’s bet on building proprietary AI and cloud infrastructure — a bet that, if executed well, could reshape its earnings trajectory for years to come. Rainier could be a genuine gamechanger for AMZN stock. Let’s dig deeper.

About Amazon Stock

Amazon is a global technology and e-commerce behemoth headquartered in Seattle, Washington. Today, the company operates across a dazzling range of businesses, cloud services via AWS, digital streaming, subscription services, advertising, physical retail, consumer electronics, and more. Its diversified growth model has placed it among the world’s most valuable public companies, with a market capitalization of $2.3 trillion, and it has a secure position in the Magnificent Seven group.

Over the past year, AMZN stock has delivered a muted performance relative to its Big Tech peers, down less than 1% year-to-date (YTD), making it among the weakest performers in the “Magnificent Seven.” The stock has delivered 17% returns over the past 52 weeks.

While that underperformance has raised questions among investors, sentiment could be shifting amid fresh optimism about AWS’s artificial intelligence (AI) investments and the infrastructure initiative “Project Rainier,” and broad bullishness among analysts.

AMZN stock currently trades at a premium compared to the sector median, but below its own historical average at 32.92 times forward earnings.

Amazon’s Project Rainier Could Be a Strategic Leap Into AI Infrastructure

Amazon’s Project Rainier marks a pivotal shift in its cloud computing strategy, positioning AWS at the forefront of AI infrastructure. This ambitious initiative involves constructing a vast AI supercomputer, powered by hundreds of thousands of AWS’s custom-designed Trainium2 chips. The scale of this project is unprecedented, with the system delivering up to five times the computing power of Anthropic’s current largest training cluster.

The strategic partnership with Anthropic, an AI startup backed by Amazon, is central to Rainier’s design. Anthropic’s next-generation AI models, including the Claude series, will leverage this infrastructure, significantly enhancing their capabilities. This collaboration not only strengthens AWS’s position in the AI market but also demonstrates Amazon’s commitment to reducing reliance on third-party hardware providers by developing proprietary solutions.

Financially, the impact of Project Rainier is substantial. Wells Fargo analyst Ken Gawrelski projects that the facility will generate approximately $14 billion in annual AWS revenue at full capacity. The anticipated acceleration in AWS revenue growth, driven by Rainier, is expected to outpace previous forecasts, with growth rates reaching 22.1% in 2026 and 23.5% in 2027.

While the project may exert some pressure on profit margins in the short term, the long-term benefits — including enhanced AI capabilities, reduced infrastructure costs, and a strengthened competitive position — present a compelling case for Amazon.

Amazon’s Q2 Results Surpassed Projections

Amazon reported its second-quarter 2025 earnings on July 31, posting net sales of $167.7 billion, up 13% year-over-year (YOY) and exceeding analyst expectations. Operating income jumped to $19.2 billion, while net income rose to $18.2 billion, or $1.68 per share, comfortably surpassing forecasts. That's compared with $13.5 billion, or $1.26 per share, in the year-ago quarter.

The strong performance was fueled by growth across key segments, including 11% sales expansion in North America, 16% expansion in International markets, and a 17.5% increase in AWS revenue.

Furthermore, Amazon guided for Q3 2025 net sales between $174 billion and $179.5 billion, reflecting 10% to 13% growth versus Q3 2024. For the period, Amazon expects operating income of $15.5 billion to $20.5 billion, compared with $17.4 billion in the prior-year period.

Analysts remain upbeat, projecting EPS of $6.76 for fiscal 2025, up 22% YOY, and anticipating a further 12% annual increase to $7.60 in fiscal 2026.

What Do Analysts Expect for Amazon Stock?

Recently, Wells Fargo upgraded Amazon to “Overweight” from “Equal Weight,” raising its price target to $280 from $245. The firm cited confidence in AWS revenue acceleration driven by Project Rainier as the main driver to reverse AMZN stock’s YTD underperformance.

Late last month, TD Cowen also reiterated a “Buy” rating and set a $255 price target on Amazon following its Accelerate third-party seller conference. The event highlighted new AI-powered Seller Assistant tools and an AI Creative Studio to boost ad creation, alongside expanded global logistics and fulfillment efficiency.

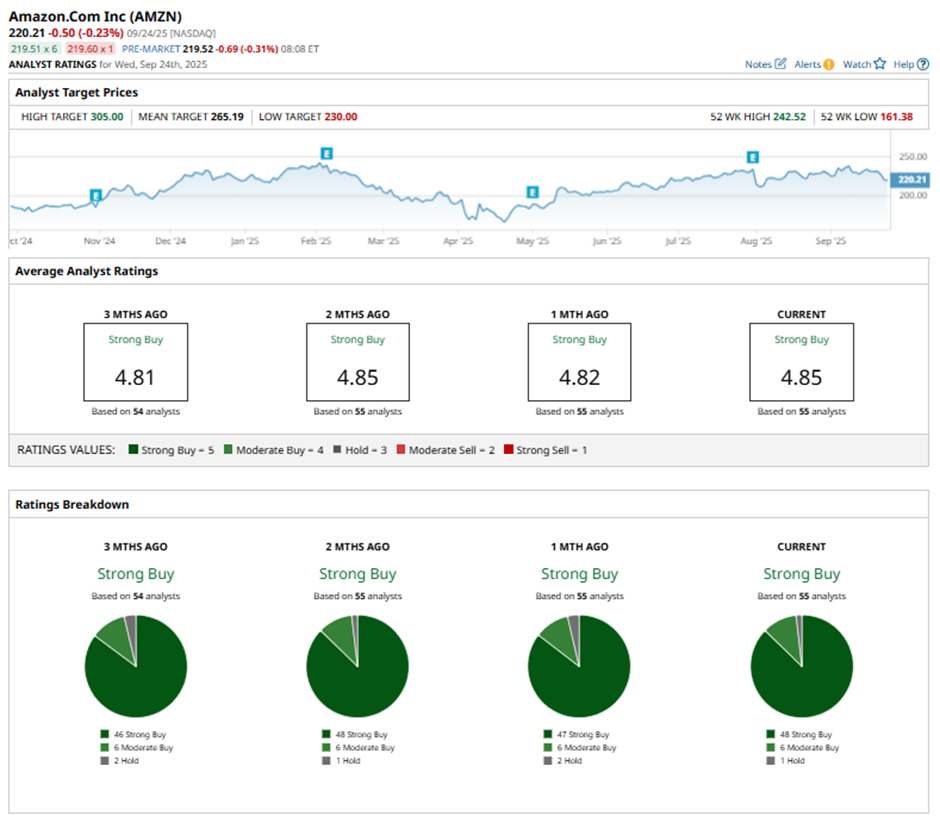

Wall Street is majorly bullish on AMZN stock. Overall, AMZN has a consensus “Strong Buy” rating. Of the 56 analysts covering the stock, 49 advise a “Strong Buy,” six suggest a “Moderate Buy,” and one analyst is on the sidelines with a “Hold” rating.

The average analyst price target for AMZN is $266.65, indicating potential upside of 22%. The Street-high target price of $305 suggests that the stock could rally as much as 39% from here.