Poor Elon Musk. While all the cool kids were jamming at 1600 Pennsylvania Avenue on Thursday night to talk tech with President Donald Trump, he was, well, somewhere else. Although the Tesla (TSLA) CEO says he was invited, his lack of attendance caught Wall Street’s attention.

This feels like a metaphor for the real elephant in the room.

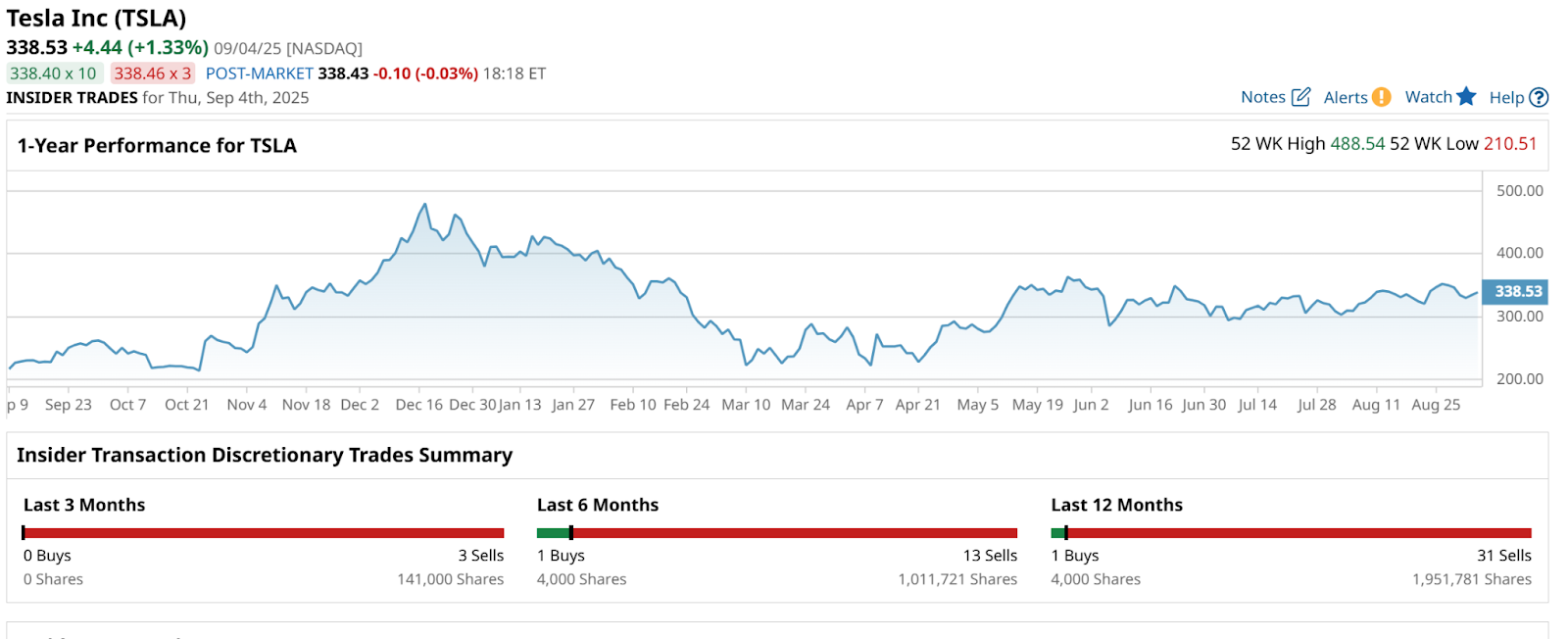

Tesla’s stock price has, in 2025, stagnated. Although shares are up 60% from their year-to-date low, they have not flown higher like a rocket ship. Instead, now down “just” 14.5% in the YTD, Tesla has become a rather boring company to watch.

Musk’s 2025 has been chaotic to say the least. His much-heralded role as the head of the Department of Government Efficiency (DOGE) turned out to be more of a downward-facing dog. His political involvements have weakened sales in Europe and the U.S., and created consumer backlash to the Tesla brand.

These are not investment developments. But if there were ever a market environment in which pop culture, entertainment, political drama, and the stock market have correlated highly, this is the year. So TSLA has had a lot of news pushing its price around. Is there anything to break the logjam? Let’s go hunting for some reasons to buy it now.

I’ll start with the daily chart. I’ve drawn in some horizontal lines to mark 2025’s top, bottom, and its most recent short-term peak around $367. It is 8% below that as of Thursday’s close, which is more like half that for a typical stock. Because TSLA’s beta is more than 2x the market.

There’s absolutely nothing for me to go on here, in terms of a strong, price-driven signal.

So let’s look at the weekly. It is not much different. TSLA has actually been a quite reliable trading stock on charts just like these. But that was the past few years. Not the current one.

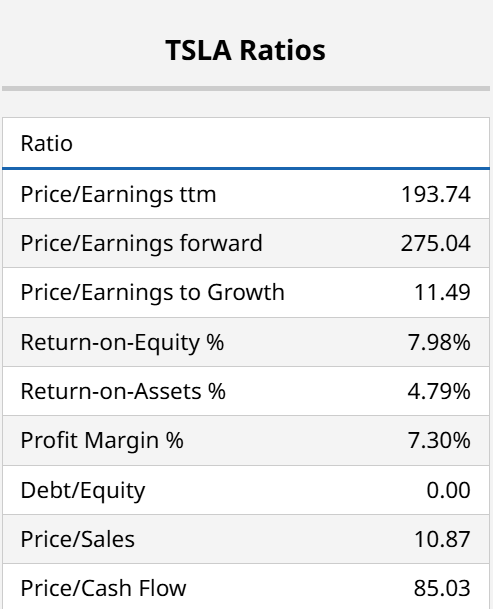

I’m at a disadvantage with no technical catalyst to speak of, but there are other ways to at least try to get a strong sense of where the stock’s future path is tilting. So here’s a table of fundamental ratios.

Unless you are a connoisseur of 85x cash flow stocks, especially those with low profit margins and forward earnings that look more like passing yard statistics for an NFL quarterback, this too is no help. At least not for bulls.

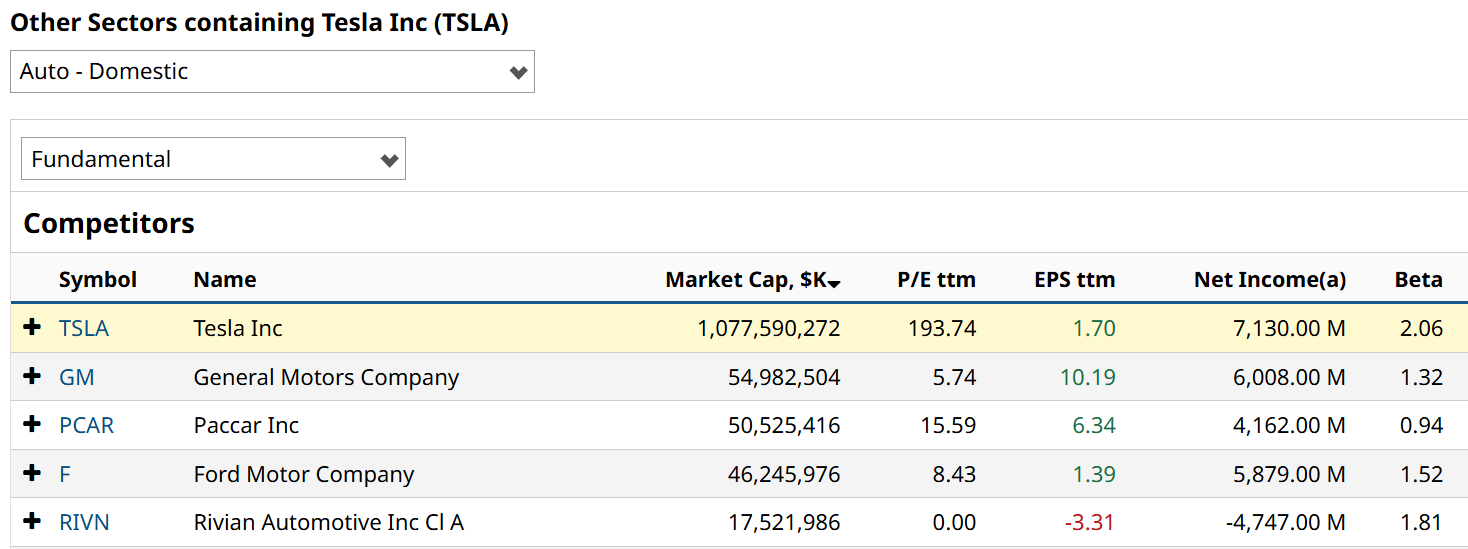

Now, let’s look at some of its auto peers, to see if TSLA stands out there. It does. Its beta is higher, as is its valuation and market cap. Translation: There’s still no incentive to buy the stock here.

The counter to this: TSLA is a technology innovator, and we should stop thinking of it as a car company. And it is going to do many great things outside the U.S., in due time. Those are not my words. But that’s part of the long-term bullish case offered by others. I’m not on board with that.

But I’m not yet throwing in the towel on looking for a catalyst. Even if a lot of TSLA shareholders apparently have! See the last 12 months below. These are insider sales, and they are 31 to 1.

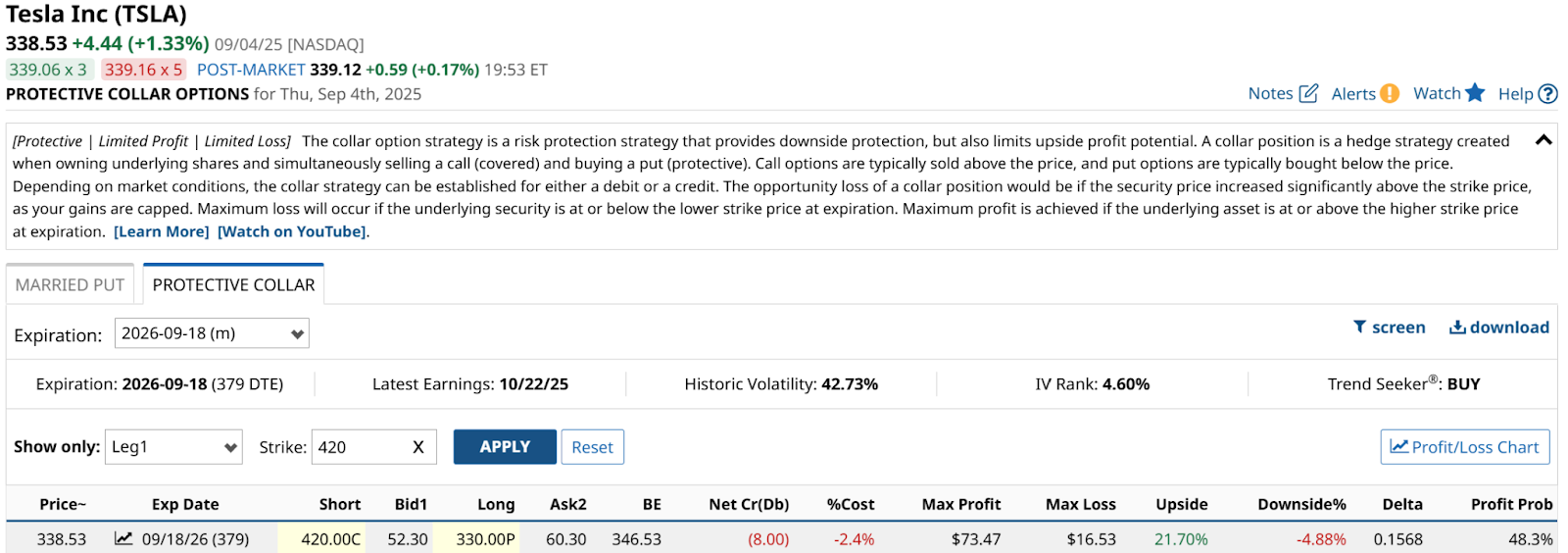

When All Else Is Lost, You Can Still Collar It. Even TSLA.

I’ve collared TSLA a few times in recent years, and so I can state from experience that with stocks like this, even in the worst price quagmire, an option collar at least offers a chance. Without risking too much capital. Let’s explore that, since nothing else above produced a happy outcome.

I swear I actually did a collar screener with one of Barchart’s slick option-finder tools, and it really did find a smokin’ combination with a call strike of… $420. If you’re not familiar with why Musk and 420 go together, ask AI.

TSLA has been a very collarable stock for some time, and with the shares at $338 as of Sept. 4, a $420 call and $330 put out just over 12 months produces a haughty 21% upside potential, but only 5% downside. For a stock that can drop 5% at market open at any time, that’s a bargain to me. What more, the cost to put this one is only 2.4%.

Collaring: A Third Way to Play Tesla Stock Here

Elon Musk floated the idea of creating a third political party in the United States this past summer.

Fortunately for investors, there’s no need to wait for Musk to decide on his proposed party, because a third choice exists between buying and selling TSLA stock. It is an option strategy, and specifically the collar. And when it comes to meandering, directionless stocks with a history of popping with little warning, it is good to know we vote for this other approach to seeking profits.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.