Shares of WhiteFiber Inc (NASDAQ:WYFI) are trading higher Friday morning, propelled by a second-quarter earnings report that showcased top-line growth and subsequent bullish sentiment from Wall Street analysts. Here’s what investors need to know.

What To Know: In its first financial release since its August initial public offering, the AI infrastructure and cloud services provider announced a 48% year-over-year surge in total revenue to $18.7 million.

The growth was primarily fueled by its cloud services division, which saw a 33% revenue increase to $16.6 million. Despite the strong revenue performance, the company reported a net loss of $8.83 million for the quarter.

Following the Wednesday announcement, analysts reacted positively. Needham reiterated its Buy rating and maintained a $34 price target. Similarly, Roth Capital maintained its Buy rating and raised its price target on WhiteFiber to $28.

CEO Sam Tabar highlighted the “exceptionally strong” demand for AI infrastructure, stating that WhiteFiber is well-positioned as a “pure-play provider” that integrates both GPU cloud services and the underlying data center capacity.

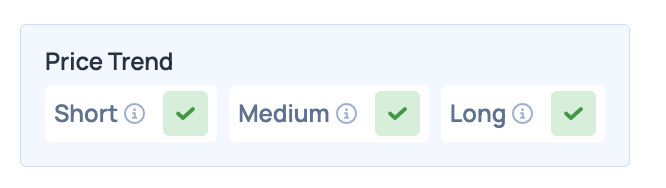

Benzinga Edge Rankings: According to Benzinga Edge data, the stock’s price trend is positive across short, medium and long-term timeframes.

Price Action: According to data from Benzinga Pro, WYFI shares are trading higher by 12.82% to $26.41 Friday morning. The stock has a 52-week high of $27.12 and a 52-week low of $14.01.

How To Buy WYFI Stock

By now you're likely curious about how to participate in the market for WhiteFiber – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Whitefiber, which is trading at $23.41 as of publishing time, $100 would buy you 4.27 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock