It seems Watson, my name for the algorithm-driven investment side of markets, was once again triggered by something the US president said Wednesday.

-

The soybean market rallied 26.25 cents off its session low Wednesday to close 11.25 cents higher for the day.

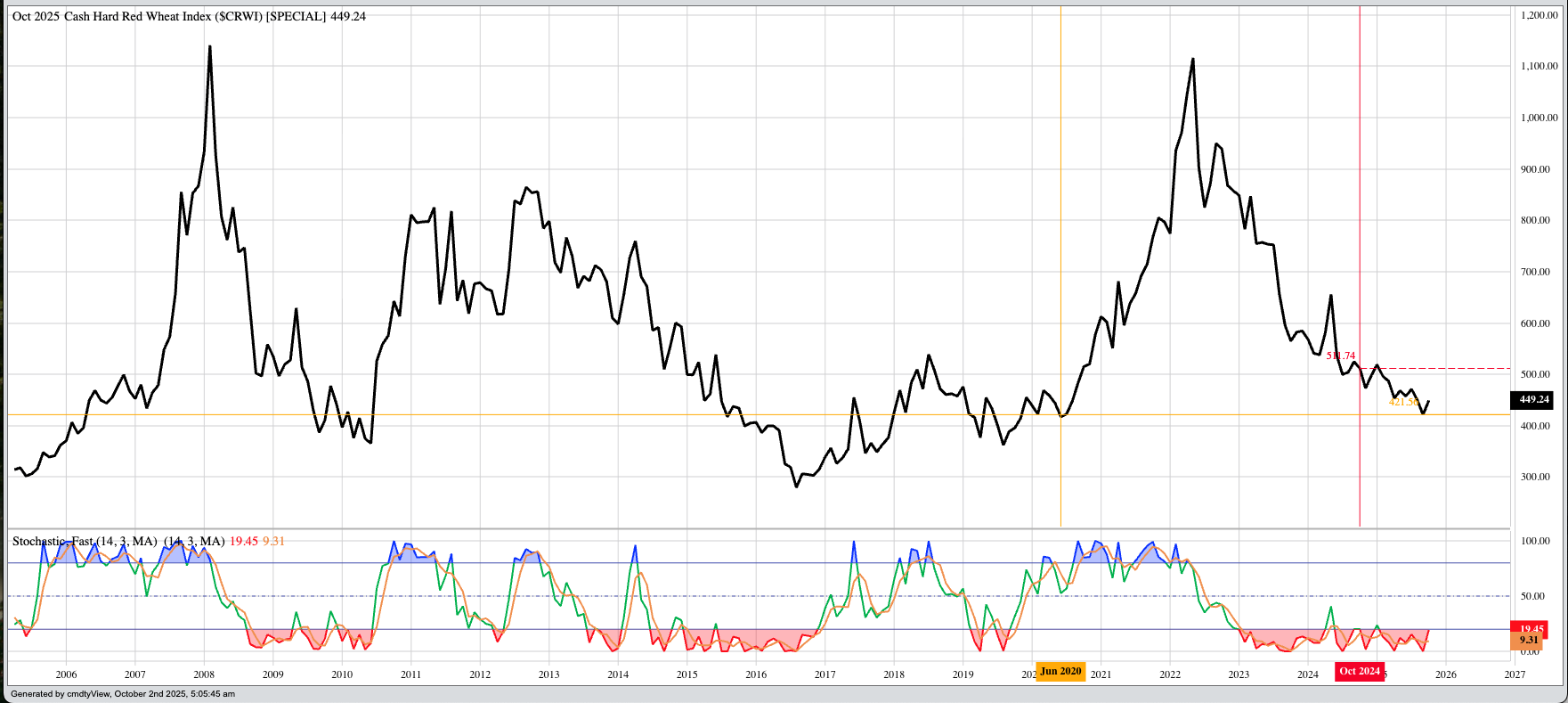

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. In other news, it seems National Cash Indexes, particularly in the wheat sub-sector, have lost some of their reliability as a read on real market fundamentals.

I owe my son an apology. Going back to Wednesday’s rally in the soybean market, the first thing he told me, his Blink reaction to the move, was it had to do with the US president again saying he was talking to Chna’s President Xi in four weeks. I tried to squash that bug, refusing to believe Watson was so artificially unintelligent that it would fall for the same old schtick from the US president. It was only after that I decided to write about potential frost in the US Northern Plains this coming weekend. Down deep, I knew though. My friend from central Nebraska knew I knew too. Shortly after I posted yesterday’s Afternoon Commentary, my phone rang. My friend was on the other end, laughing at how I had tried to connect the dots in all but the most logical way. I had to laugh with him, realizing I had done what I so often write about: Talked myself out of my son’s Blink reaction that once again had been correct. Do I think the supposed meeting in four weeks will change anything? No. As I’ve said countless times, the US is losing the trade war the president started on social media nearly a decade ago.

The corn market was quietly higher pre-dawn Thursday morning. The fact I chose to ignore the obvious Wednesday afternoon doesn’t change the reality the corn market uncovered new buying interest as the December issue (ZCZ25) tested $4.10 yesterday. After posting a low of $4.1050, Dec25 extended this little pop to a high of $4.1925 overnight, though trade volume was only 10,500 contracts. But the market is actually more interesting than that. Recall Wednesday finished with the December issue up 1.0 cent. Last night, the National Corn Index ($CNCI) came in at $3.7450, up 1.25 cents from Tuesday meaning merchandisers were pushing cash bids ever so slightly. While basis firmed by 0.25 cent, coming in at 42.0 cents under December futures, the market is still sitting below its previous 5-year low weekly close for this week of 32.75 cents under December. Additionally, Dec25 priced at $4.1650 (Wednesday’s close) put it in the lower 23% of its 5-year price distribution range based on weekly closes only. Recall in yesterday’s Afternoon Commentary I mentioned how trade volume in Dec25 had jumped to 261,500 contracts. The CME is showing open interest in corn increased by 22,000 contracts during the rally. This indicates the move was more than short-covering by Watson.

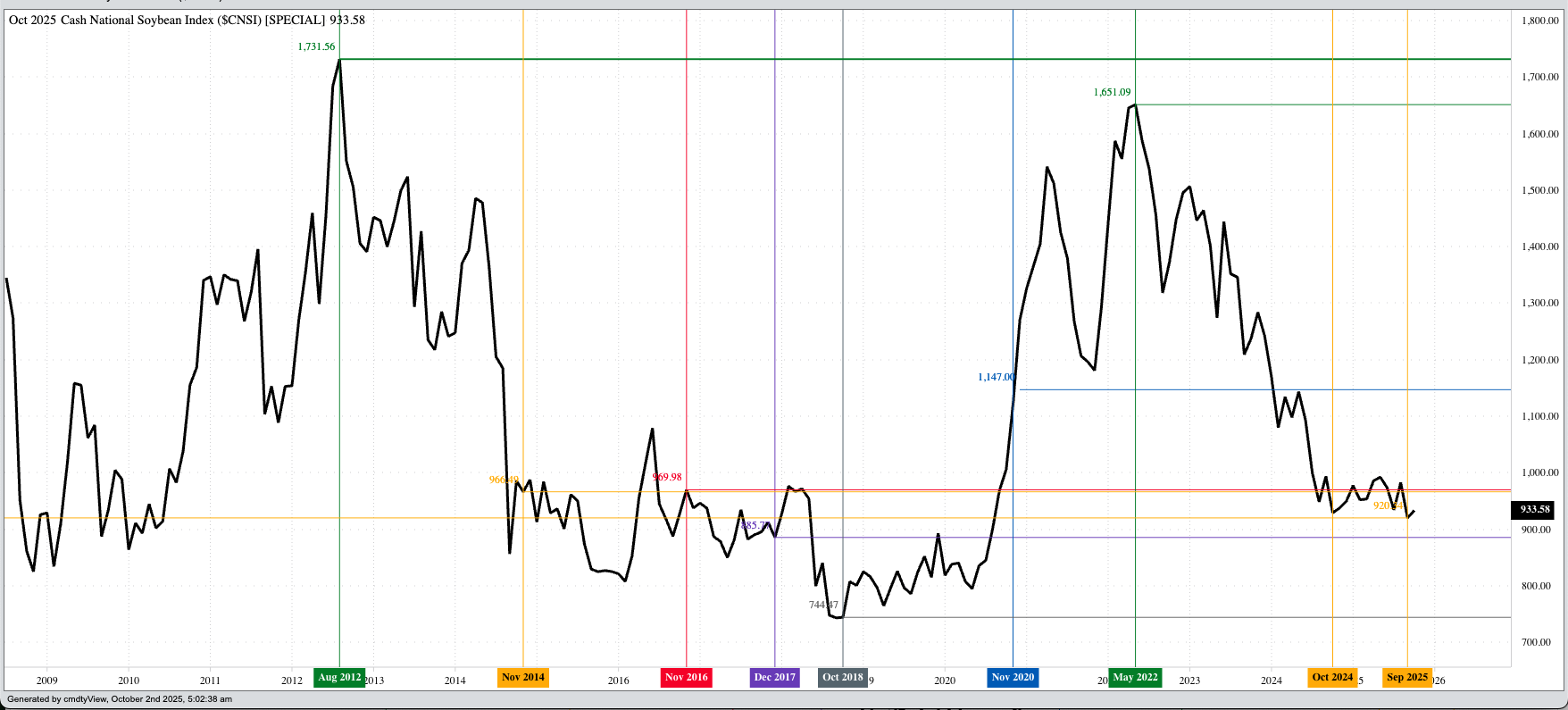

The soybean market was sitting near unchanged at this writing. November (ZSX25) posted an overnight trading range of 6.0 cents, from up 1.5 cents to down 4.5 cents on trade volume of 15,300 contracts. My friend who called Wednesday afternoon also told me he used yesterday’s rally to sell some of his soybeans, knowing that a move created by Watson being triggered by something the US president said would not hold. He later updated me with a message stating merchandisers were weakening basis in his area due to the rally in the futures market. Recall the Nov25 issue closed Wednesday 11.25 cents higher, followed by the National Soybean Index ($CNSI) coming in at $9.3350, up 13.25 cents for the day. I will tell you here and now, this shakes my faith in the Index a bit. We’ve seen this before, though, so I’m willing to give it a couple days to see if this bump in basis holds. Theoretically, it could be argued the world’s largest buyer could see recent developments in the US as an opportunity to get some secondary supplies on the books. First, the Index posted its lowest monthly close since August 2020 and second, with the US government closed there will be no announcements of sales made.

The wheat sub-sector was also sitting near unchanged pre-dawn Thursday. The December SRW issue posted a 2.75-cent trading range, from down 1.0 cent to up 1.75 cents on trade volume of 5,350 contracts. I again have questions as the National SRW Index showed a daily gain of 3.0 cents following Wednesday’s 1.25-cent higher close by the December futures contract. As I’ve said before, markets don’t have to make sense, and Thursday morning finds me with more questions than answers. Do I think US wheat fundamentals suddenly changed directions with the turning of the calendar page from September to October? No. But let’s see how the rest of the week plays out. Over in HRW we see what confirms my idea something is amiss with last night National Indexes. Recall the December futures contract closed yesterday 2.25 cents lower. However, the National Index ($CRWI) is showing a price of $4.4950, up 27.75 cents for the day telling us national average basis did a 30.0-cent U-turn. I don’t think so. What concerns me most is if the National Indexes I have used for decades have been corrupted, I’ve lost two of the three key reads on real market fundamentals: Cash price and basis.