FTX founder Sam Bankman-Fried has been convicted of defrauding customers of his popular cryptocurrency exchange out of billions of dollars.

The 31-year-old, who was once worth $26bn, was found guilty of two counts of fraud and five counts of conspiracy in a Manhattan courtroom on Thursday 2 November.

During his high-profile trial, jurors heard how he had taken FTX customers’ money and used it to pay off the debts of Alameda Research – a related cryptocurrency hedge fund he founded in 2017 – as well as to fund luxury real estate purchases and hefty political donations.

The crypto billionaire now faces a maximum sentence of 110 years in prison on the charges.

So when will he be sentenced?

Bankman-Fried’s sentencing is scheduled for 28 March 2024, when the judge will determine how long he will spend behind bars for his crimes.

He is expected to remain in a Brooklyn jail while he awaits sentencing.

He has been held there since August when his bail was revoked after a judge ruled that he had harassed his former girlfriend and fellow FTX executive Caroline Ellison, tried to interfere with witnesses, and given documents to reporters.

He had initially been arrested in January 2023 at a $40m luxury apartment complex in the Bahamas that served as company offices.

The FTX founder was then extradited to the US and held under house arrest on $250m bail at the Palo Alto home of his parents, both prominent faculty members at Stanford University’s prestigious law school.

The trial saw key members of the crypto billionaire’s inner circle testify against him, including Ellison, Bankman-Fried’s ex-girlfriend and the former head of Alameda, and FTX co-founder Gary Wang, who was Bankman-Fried’s childhood friend from math camp.

Ellison testified that Bankman-Fried directed her to illegally use FTX customer funds to prop up Alameda, which had lost millions of dollars, owing to its trading system, Modelbot, created by Bankman-Fried, which was programmed to trade roughly 500 different crypto coins on 30 or so different unregulated crypto exchanges, mostly in Asia.

The system left the company unable to repay its lenders when they recalled their loans, Ellison said.

Ms Ellison told the court that “Alameda took several billion dollars of money from FTX customers and used it for our own investments and to repay debts that we had”.

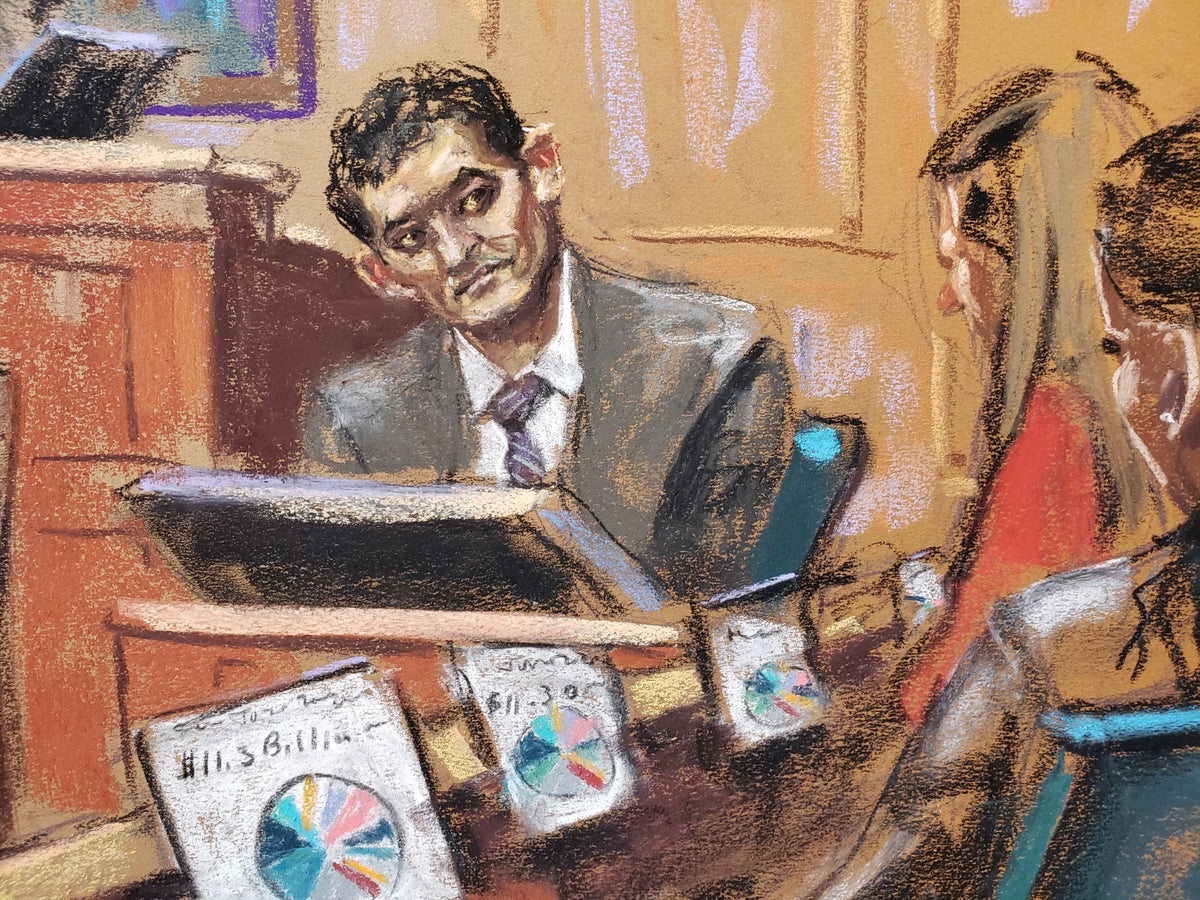

Sam Bankman-Fried— (Copyright 2023 The Associated Press. All rights reserved.)

She told the court she faced a “constant state of dread” knowing that billions of dollars in loans were being recalled that could only be paid back using FTX customer money.

Ellison, who pleaded guilty to seven counts of fraud and conspiracy, also said Bankman-Fried’s utilitarian philosophy on rules meant that he thought even actions like lying and stealing could be justified in pursuit of the greater good.

She said this philosophy made her “more willing to do things like lie and steal over time”.

Both FTX and Alameda went bankrupt in late 2022 amid a run on customer deposits, and their assets are currently being sold off and reapportioned.

Despite the testimony from those previously closest to him, Bankman-Fried maintained his innocence as he took the stand in his defence.

He argued that he did not intend to steal from his customers, and that Ellison was responsible for the financial woes of Alameda after she failed to hedge its financial positions early in 2022 to insulate the fund from the market.

His defence also focused on the on-and-off relationship between the pair, which reportedly began in 2018 and ended in 2022.

Bankman-Fried’s defence attorney Mark Cohen suggested Ellison let the heartbreak over their breakup impede business communications in a damaging way.

Bankman-Fried did admit that he made mistakes that harmed customers and employees – but continued to claim that he never defrauded anyone or stole money.

Caroline Ellison, former CEO of Alameda Research founded by Sam Bankman-Fried, exits Manhattan federal court after testifying— (Copyright 2023 The Associated Press. All rights reserved.)

“Poor risk management is not a crime,” Mr Cohen said on Wednesday. “The question of whether Sam’s business judgment was reasonable, even if it later turned out to be mistaken, is not a criminal one.”

The jury disagreed.

As the guilty verdict against Bankman-Fried was read out in court on Thursday, he reportedly sat motionless, looking down at his hands in his lap.

In a statement following the verdict, Mr Cohen said in a statement: “We respect the jury’s decision. But we are very disappointed with the result. Mr Bankman-Fried maintains his innocence and will continue to vigiorously fight the charges against him.”

Prosecutor Damian Williams told reporters outside court: “Sam Bankman-Fried perpetrated one of the biggest financial frauds in American history.

“The cryptocurrency industry might be new. The players, like Sam Bankman-Fried, might be new. But this kind of corruption is as old as time.”

Bankman-Fried is set to face a second trial in March 2024 on five additional charges, including bribery.