/Willis%20Towers%20Watson%20Public%20Limited%20Co%20office%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $32.8 billion, London, the United Kingdom-based Willis Towers Watson Public Limited Company (WTW) is a leading global advisory, broking, and solutions company. The firm operates through two segments: Health, Wealth & Career, and Risk & Broking, providing integrated services that help clients manage risk, optimize benefits, and enhance organizational performance worldwide.

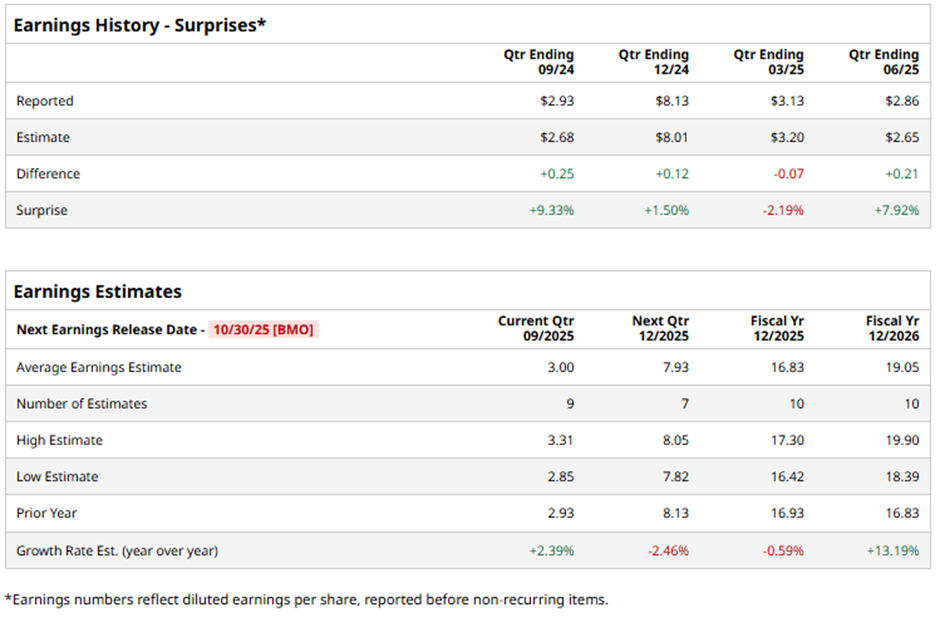

Willis Towers Watson is expected to release its fiscal Q3 2025 earnings results before the market opens on Thursday, Oct. 30. Ahead of this event, analysts expect WTW to report an adjusted EPS of $3, up 2.4% from $2.93 in the prior year's quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the insurance broker to post adjusted EPS of $16.83, a marginal decline from $16.93 in fiscal 2024. However, adjusted EPS is projected to grow 13.2% year-over-year to $19.05 in fiscal 2026.

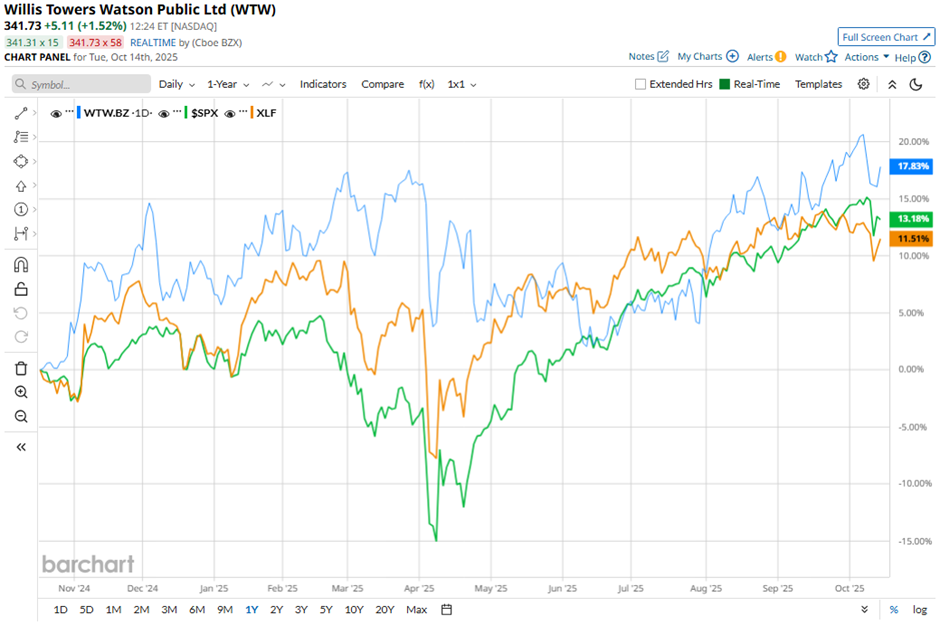

Shares of Willis Towers Watson have risen 16.4% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 13.1% gain and the Financial Select Sector SPDR Fund's (XLF) 13.2% return over the period.

Shares of Willis Towers Watson rose 4.6% on Jul. 31 after the company reported stronger-than-expected Q2 2025 results. Adjusted EPS of $2.86 and revenue reached $2.26 billion, topping forecasts. The gain was driven by a 7% increase in revenue from the Risk & Broking unit to $1.05 billion, reflecting higher demand for insurance and risk advisory services amid rising premium costs and extreme weather risks.

Analysts' consensus view on WTW stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 23 analysts covering the stock, 12 recommend "Strong Buy," one suggests "Moderate Buy," nine indicate “Hold,” and one has a "Strong Sell." The average analyst price target for Willis Towers Watson is $373.84, indicating a potential upside of 9.4% from the current levels.

.jpg?w=600)