/Western%20Digital%20Corp_%20logo%20on%20sign-by%20360b%20via%20Shutterstock.jpg)

Valued at a market cap of $43.7 billion, Western Digital Corporation (WDC) develops, manufactures, and sells data storage devices and solutions built on hard disk drive (HDD) technology. The San Jose, California-based company’s product portfolio includes internal and external HDDs, data center drives and platforms, portable drives, network-attached storage (NAS) systems for home and office use, and related accessories. It is scheduled to announce its fiscal Q1 earnings for 2026 in the near future.

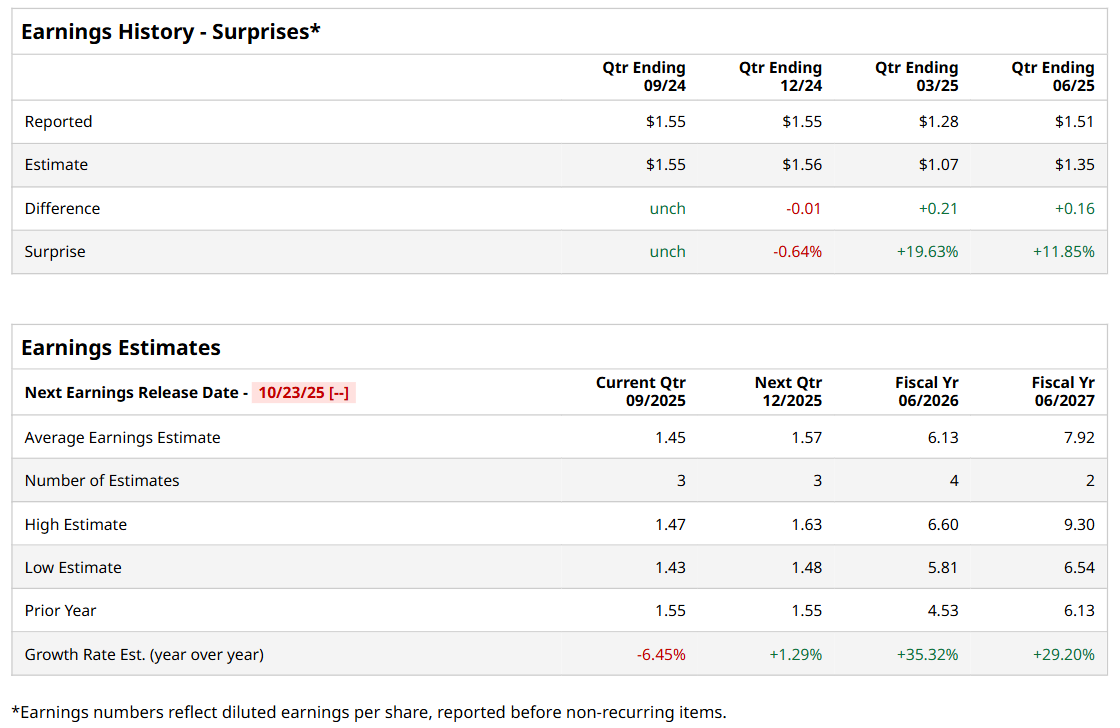

Ahead of this event, analysts expect this data storage company to report a profit of $1.45 per share, down 6.5% from $1.55 per share in the year-ago quarter. The company has met or surpassed Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion. In Q4 2025, WDC’s EPS of $1.51 exceeded the forecasted figure by a notable margin of 11.9%.

For fiscal 2026, analysts expect WDC to report a profit of $6.13 per share, representing a 35.3% increase from $4.53 per share in fiscal 2025. Furthermore, its EPS is expected to grow 29.2% year-over-year to $7.92 in fiscal 2027.

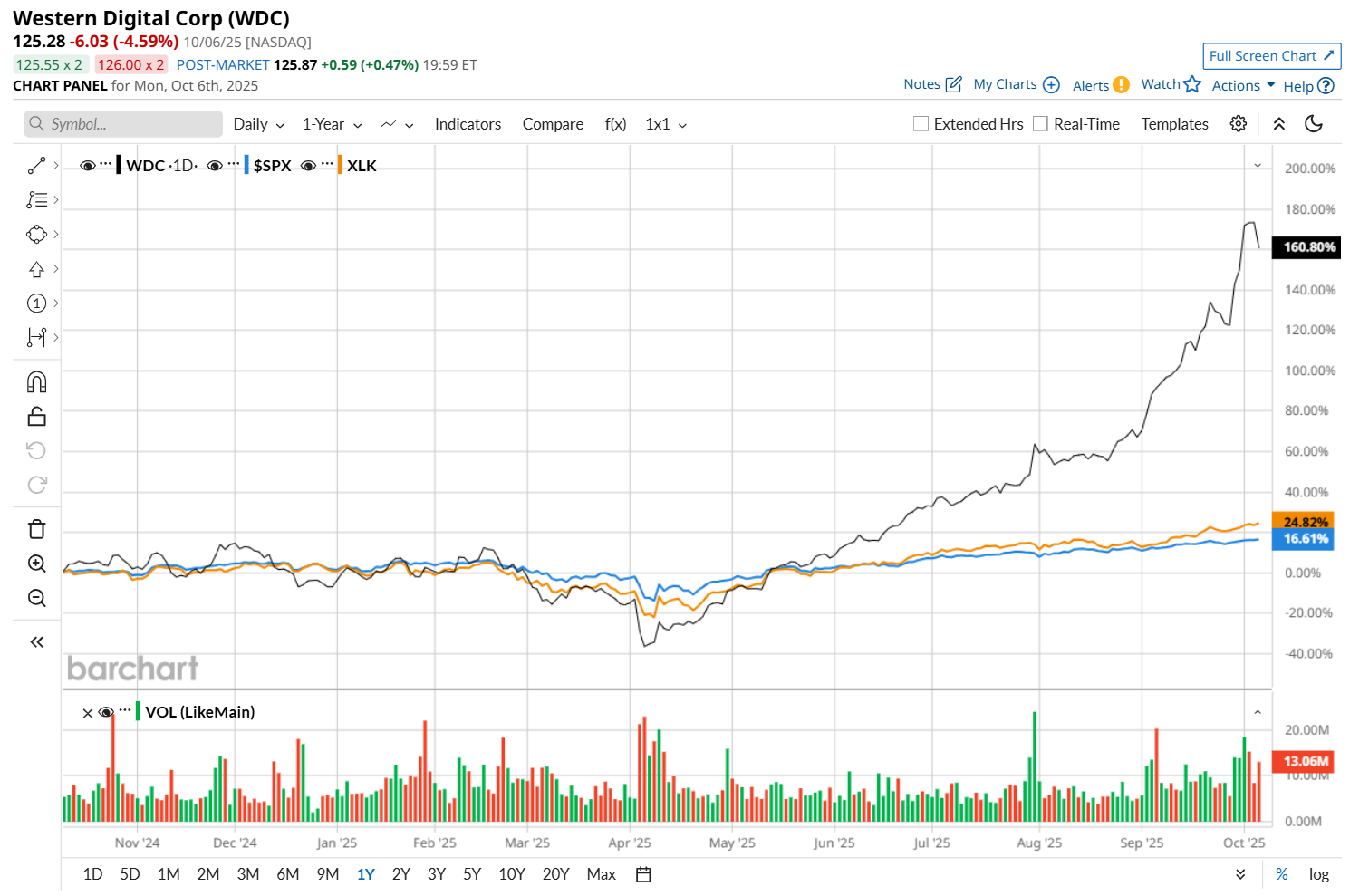

Shares of WDC have rallied 151.8% over the past 52 weeks, significantly outperforming both the S&P 500 Index's ($SPX) 17.2% uptick and the Technology Select Sector SPDR Fund’s (XLK) 27.7% return over the same time frame.

On Sep. 29, shares of Western Digital surged 9.2% and maintained this upward momentum over the next four trading sessions, after several investment banks, including Morgan Stanley (MS) and Rosenblatt Securities, sharply raised their price targets on the stock. The upgrades reflected a strengthening market for hard disk drives (HDDs) amidst rising data storage demand, fueled by expanding cloud infrastructure spending and accelerating AI-related investments.

Wall Street analysts are highly optimistic about WDC’s stock, with a "Strong Buy" rating overall. Among 24 analysts covering the stock, 18 recommend "Strong Buy," one indicates a "Moderate Buy," and five suggest "Hold.” While the company is trading above its mean price target of $99.95, its Street-high price target of $160 implies a 27.7% potential upside from the current levels.