/Wells%20Fargo%20%26%20Co_%20location-by%20jetcityimage%20via%20iStock.jpg)

San Francisco, California-based Wells Fargo & Company (WFC) provides various banking, investment, mortgage, and consumer and commercial finance products and services in the U.S. and internationally. With a market cap of $269.4 billion, the company operates through Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management segments.

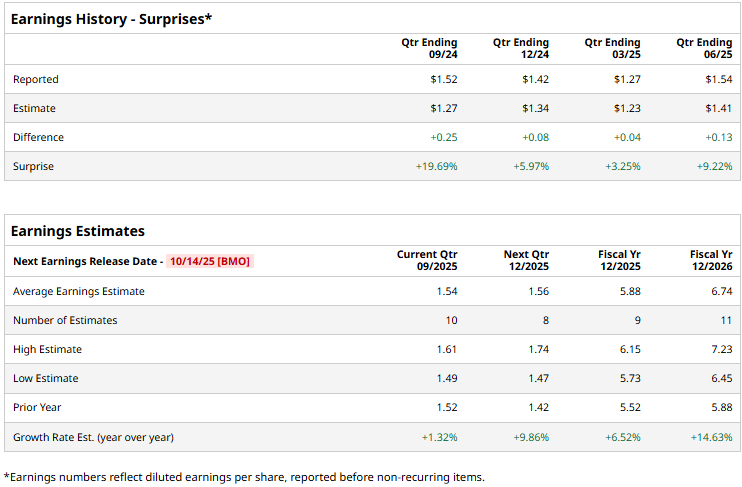

The financial sector giant is expected to release its third-quarter results before the market opens on Tuesday, Oct. 14. Ahead of the event, analysts expect WFC to deliver a profit of $1.54 per share, up a modest 1.3% from $1.52 per share reported in the year-ago quarter. Meanwhile, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, its EPS is expected to come in at $5.88, up 6.5% year-over-year from $5.52 reported in fiscal 2024. In fiscal 2026, its earnings are expected to surge 14.6% year-over-year to $6.74 per share.

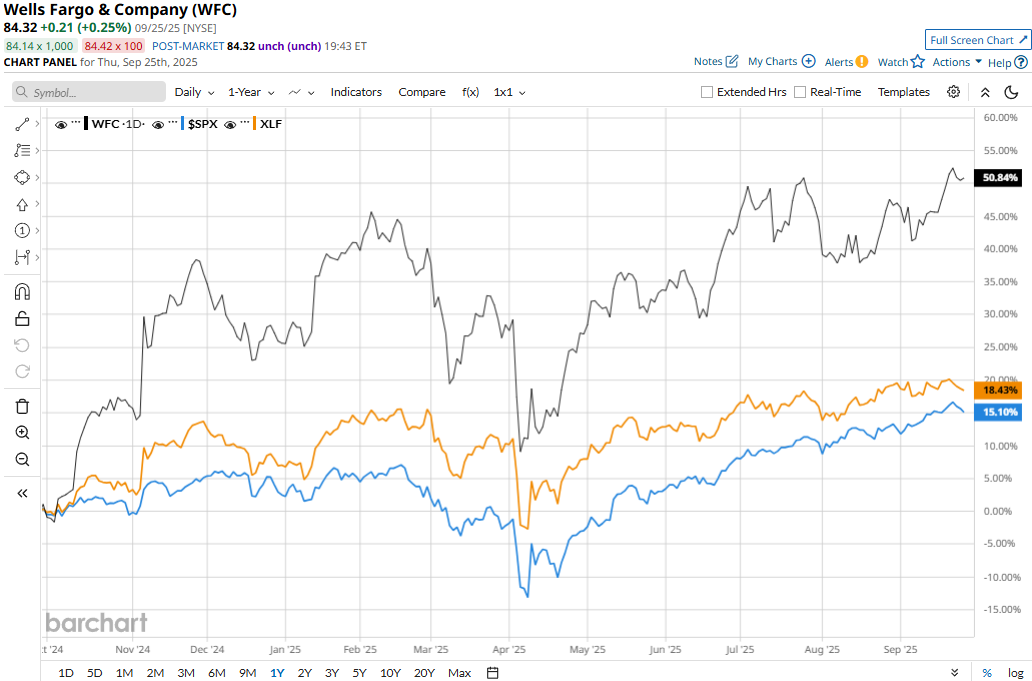

WFC’s stock prices have surged 57.3% over the past 52 weeks, substantially outpacing the S&P 500 Index’s ($SPX) 15.4% gains and the Financial Select Sector SPDR Fund’s (XLF) 19.4% returns during the same time frame.

Despite delivering better-than-expected results, Wells Fargo’s stock prices dropped 5.5% in the trading session following the release of its Q2 results on Jul. 15. Driven by the impact of lower rates on floating rate assets and deposit mix changes, the company’s net interest income (NII) dropped 1.8% year-over-year to $11.7 billion. Meanwhile, driven by growth in IB fees and solid performance in the investment management segment, WFC’s non-interest income grew by 4% to $9.1 billion. Overall, the company’s topline came in at $20.8 billion, up a modest 64 bps year-over-year, slightly above the Street’s expectations. Nonetheless, its net income for the quarter surged 11.9% year-over-year to $5.5 billion, beating the consensus estimates by a large margin.

Observing the market conditions, Wells Fargo reduced its NII guidance for the full year. The company expects its NII to remain flat in 2025, compared to the previous guidance of 1% to 3% growth. This unsettled investor sentiment and triggered a major sell-off.

Analysts remain optimistic about WFC’s prospects; the stock has a consensus “Moderate Buy” rating overall. Out of the 26 analysts covering WFC, 14 recommend “Strong Buy,” three advocate “Moderate Buy,” and nine recommend “Hold” ratings. Its mean price target of $87.69 suggests a modest 4% upside potential from current price levels.