Bentonville, Arkansas-based Walmart Inc. (WMT) runs supermarkets, warehouse clubs, cash and carry stores, and discount stores. With a market cap of $846.5 billion, Walmart operates through Walmart U.S., Walmart International, and Sam's Club segments. The discount retail giant is expected to announce its third-quarter results before the markets open on Thursday, Nov. 20.

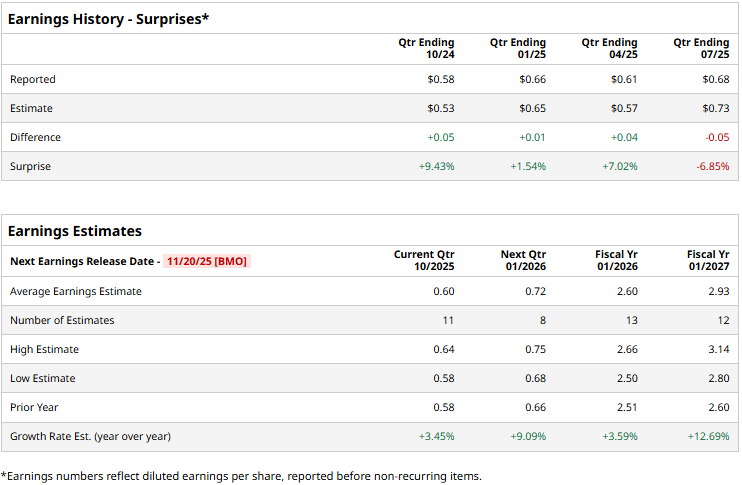

Ahead of the event, analysts expect Walmart to report a profit of $0.60 per share, up a modest 3.5% from $0.58 per share reported in the year-ago quarter. While the company has surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

For the full fiscal 2026, Walmart’s EPS is expected to come in at $2.60, up 3.6% from $2.51 reported in fiscal 2025. While in fiscal 2026, its earnings are expected to surge 12.7% year-over-year to $2.93 per share.

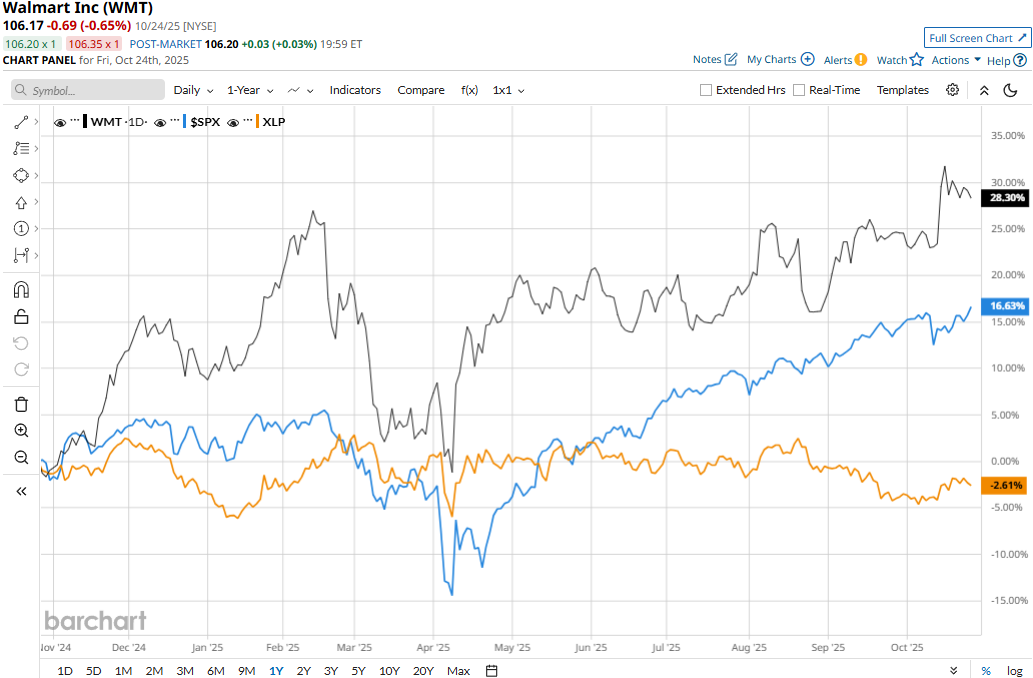

WMT stock prices have soared 27.9% over the past 52 weeks, significantly outperforming the S&P 500 Index’s ($SPX) 16.9% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.2% decline during the same time frame.

Walmart’s stock prices declined 4.5% in the trading session following the release of its mixed Q2 results on Aug. 21. The company observed a solid sales momentum during the quarter, its global eCommerce revenues surged by a high double-digit figure, while US comparable sales increased 4.6% driven by strong grocery and health & wellness sales. Overall, the company’s net sales increased by an impressive 4.8% year-over-year to $175.8 billion, beating the consensus estimates by 1.1%. However, its adjusted EPS plummeted 47.3% year-over-year to $0.68, missing the Street’s expectations by 6.9%.

Nonetheless, analysts remain extremely bullish on the stock’s long-term prospects. WMT has a consensus “Strong Buy” rating overall. Of the 38 analysts covering the stock, opinions include 31 “Strong Buys,” six “Moderate Buys,” and one “Hold.” Its mean price target of $114.24 suggests a 7.6% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.