/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

Pennsylvania-based Universal Health Services, Inc. (UHS) owns and operates acute care hospitals, behavioral health centers, surgical hospitals, ambulatory surgery centers, and radiation oncology centers. With a market cap of $13.2 billion, Universal Health operates through Acute Care Hospital Services and Behavioral Health Care Services segments.

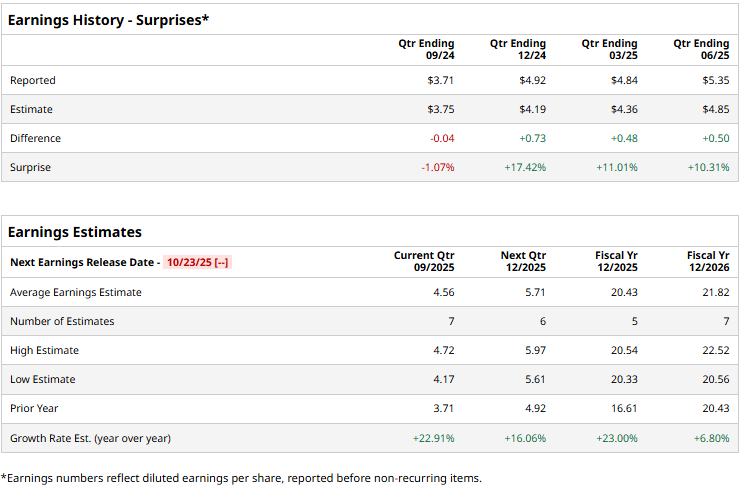

The healthcare giant is set to announce its third-quarter results after the market closes on Thursday, Oct. 23. Ahead of the event, analysts expect UHS to deliver an adjusted profit of $4.56 per share, up 22.9% from $3.71 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

For the full fiscal 2025, UHS is expected to deliver an adjusted EPS of $20.43, up 23% year-over-year from $16.61 in 2024. In fiscal 2026, its earnings are expected to grow 6.8% year-over-year to $21.82 per share.

UHS stock prices have dropped 3.7% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 17.8% surge, but outpacing the Health Care Select Sector SPDR Fund’s (XLV) 4.4% decline during the same time frame.

Universal Health Services’ stock prices surged 5.1% in the trading session following the release of its impressive Q2 results on Jul. 28. The company reported a robust 7.9% year-over-year growth in comparable facility sales in the acute care segment and a solid 8.9% growth in comparable facility sales in its behavioral health care segment. Overall, the company’s net revenues came in at $4.3 billion, up 9.6% year-over-year and 1.5% above the Street’s expectations. Further, its adjusted EPS soared 24.1% year-over-year to $5.35, beating the consensus estimates by 10.3%.

Moreover, observing the solid business momentum, Universal raised its full-year adjusted EBITDA and EPS guidance for the full fiscal 2025, boosting investor confidence.

Analysts remain optimistic about the stock’s prospects. UHS maintains a consensus “Moderate Buy” rating overall. Among the 20 analysts covering the UHS stock, opinions include eight “Strong Buys,” 11 “Holds,” and one “Moderate Sell.” Its mean price target of $217.75 suggests a modest 5.1% upside potential.