/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

Valued at a market cap of $1.4 trillion, Tesla, Inc. (TSLA) is a global leader in electric vehicles and clean energy solutions, operating across automotive and energy generation and storage segments. With its dominant U.S. EV market share and innovative direct-to-consumer model, Tesla has grown from a niche automaker into a trillion-dollar company revolutionizing sustainable transportation and energy.

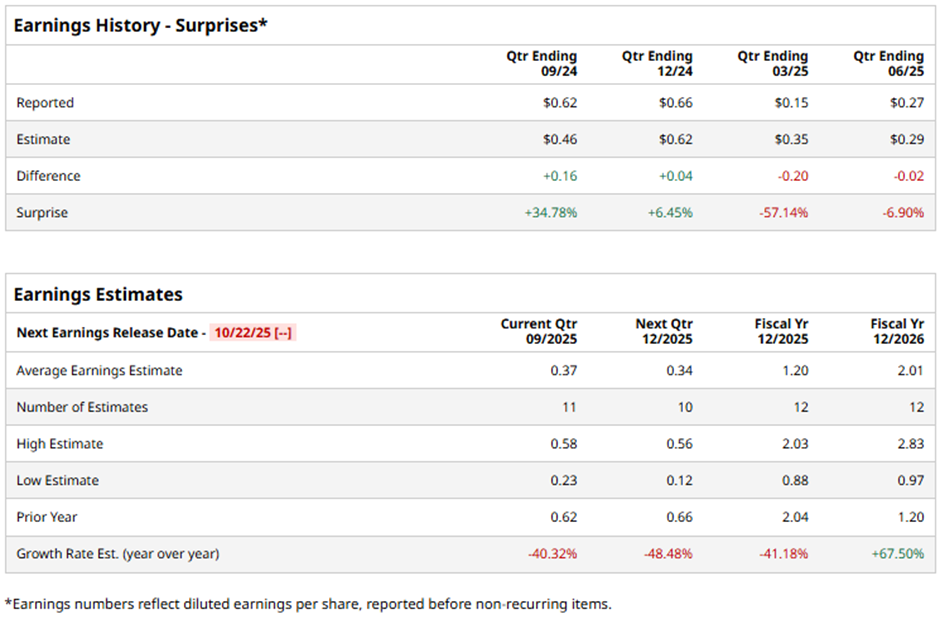

Analysts expect the Austin, Texas-based company to report an EPS of $0.37 in Q3 2025, a 40.3% decrease from $0.62 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts forecast the electric vehicle giant to report an EPS of $1.20, down 41.2% from $2.04 in fiscal 2024. However, EPS is projected to surge 67.5% year-over-year to $2.01 in fiscal 2026.

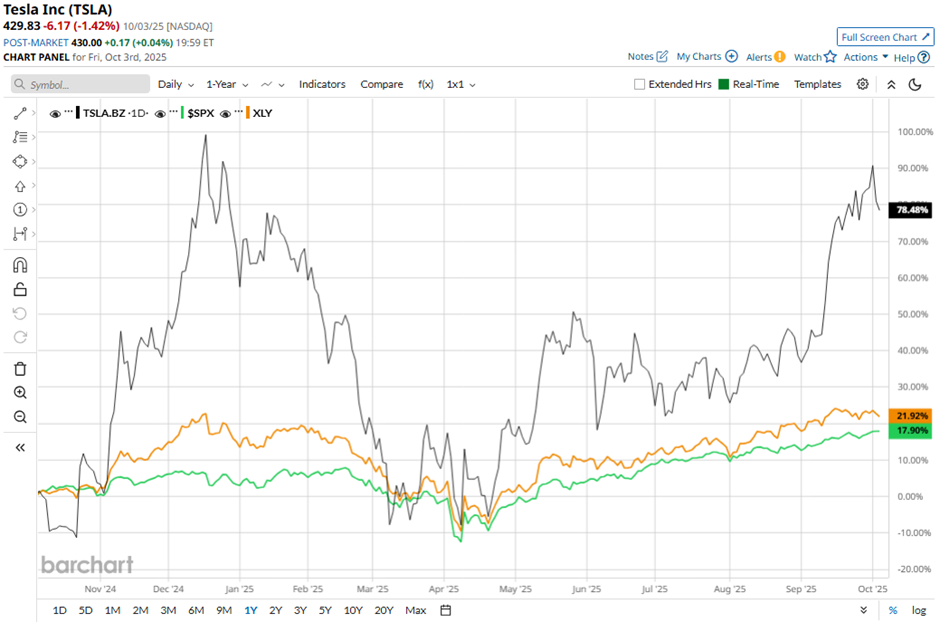

Shares of Tesla have jumped 78.6% over the past 52 weeks, significantly outperforming both the S&P 500 Index's ($SPX) 17.8% return and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 21.6% increase over the period.

Tesla shares tumbled 8.2% following its Q2 2025 results on Jul. 23 as investors focused on narrowing margins and weak forward signals despite revenue of $22.5 billion slightly beating forecasts and EPS of $0.40 meeting expectations. Automotive gross margin excluding regulatory credits dropped to 14.6%, below expectations, reflecting steep price cuts, restructuring charges, and rising AI-driven expenses.

Analysts' consensus view on TSLA stock is cautious, with an overall "Hold" rating. Among 41 analysts covering the stock, 13 indicate "Strong Buy," two suggest "Moderate Buy," 17 have a “Hold,” and nine advise "Strong Sell." This configuration is slightly less bullish than three months ago, with 14 analysts suggesting a "Strong Buy."

As of writing, it is trading above the average analyst price target of $332.03.