/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

With a market cap of $31.8 billion, Super Micro Computer, Inc. (SMCI) is a global leader in high-performance, energy-efficient server and storage solutions based on modular and open architecture. The company designs, develops, and sells a wide range of IT infrastructure products and services for enterprise data centers, cloud computing, AI, 5G, and edge computing markets.

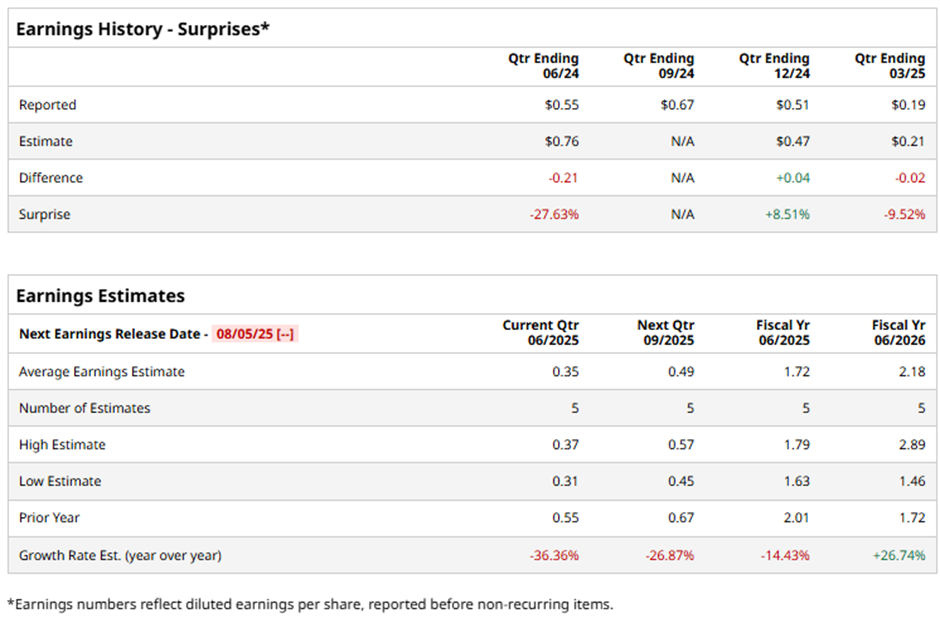

Headquartered in San Jose, California, the company is slated to announce its fiscal Q4 2025 earnings results on Tuesday, Aug. 5. Ahead of this event, analysts expect SMCI to report an EPS of $0.35, a decline of 36.4% from $0.55 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in one of the past quarters while missing on two other occasions.

For fiscal 2025, analysts expect the server technology company to report EPS of $1.72, marking a decrease of 14.4% from $2.01 in fiscal 2024. However, EPS is anticipated to grow 26.7% year-over-year to $2.18 in fiscal 2026.

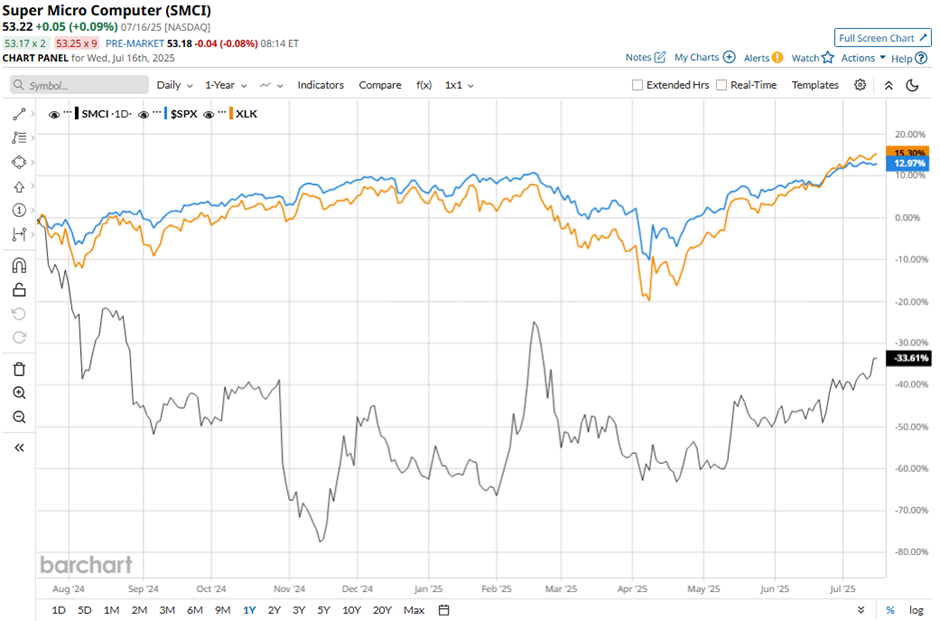

Shares of Super Micro Computer have dipped 39.3% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 10.5% return and the Technology Select Sector SPDR Fund's (XLK) 10.8% rise over the same period.

Super Micro Computer stock fell 1.4% following its Q3 2025 results on May 6 due to significantly disappointing financials, including adjusted EPS of $0.31 and revenue of $4.6 billion, both falling short of Wall Street expectations. Investor concern was further fueled by shrinking gross margins, which dropped to 9.6% year-over-year, and a steep decline in net income to $109 million.

Additionally, weak Q4 guidance and the company's decision not to provide full-year 2026 forecasts due to tariff-related uncertainty added to the market's negative reaction.

Analysts' consensus view on Super Micro Computer stock remains cautious, with an overall "Hold" rating. Out of 16 analysts covering the stock, four recommend a "Strong Buy," three "Moderate Buys," six "Holds," one has a "Moderate Sell," and two give a "Strong Sell" rating. As of writing, the stock is trading above the average analyst price target of $42.27.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.