/Stryker%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Portage, Michigan-based Stryker Corporation (SYK) operates as a medical technology company that develops, manufactures, and markets specialty surgical and medical products. Valued at $141.2 billion by market cap, the company's products include implants, surgical, neurologic, ear, nose and throat and interventional pain equipment, endoscopic, surgical navigation, digital imaging systems, as well as patient handling and emergency medical equipment. The Medtech giant is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Thursday, Oct. 30.

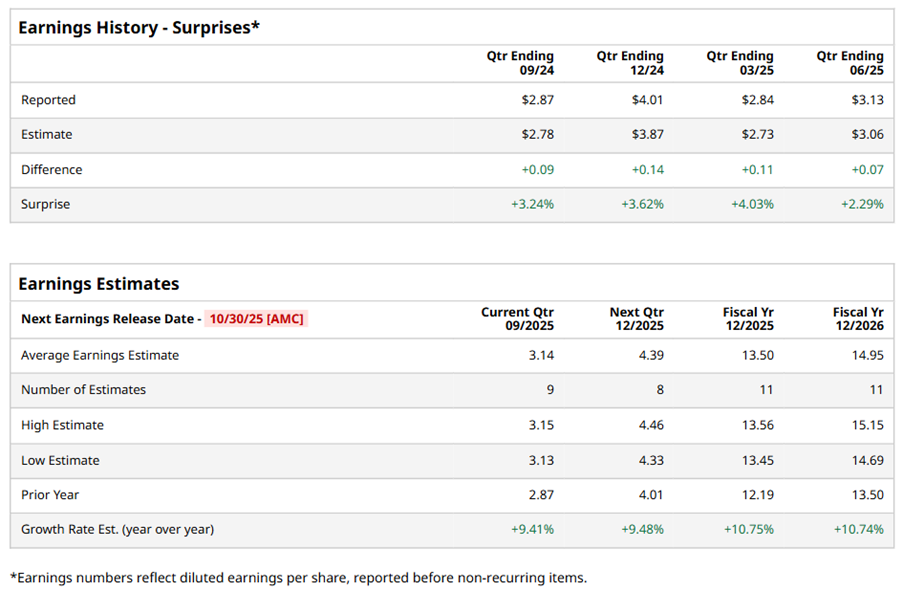

Ahead of the event, analysts expect SYK to report a profit of $3.14 per share on a diluted basis, up 9.4% from $2.87 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect SYK to report EPS of $13.50, up 10.8% from $12.19 in fiscal 2024. Its EPS is expected to rise 10.7% year over year to $14.95 in fiscal 2026.

SYK stock has underperformed the S&P 500 Index’s ($SPX) 13.5% gains over the past 52 weeks, with shares up 2.2% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 7.2% losses over the same time frame.

Stryker's underperformance is due to intensifying competition from Zimmer Biomet Holdings, Inc. (ZBH), Johnson & Johnson (JNJ), and Medtronic plc (MDT), particularly in robotic orthopedics, as well as macro pressures such as inflation, FX volatility, and wage pressures impacting margins. Regulatory hurdles and supply chain bottlenecks also pose challenges, affecting new product launches and profitability.

On Jul. 31, SYK shares closed down by 1.9% after reporting its Q2 results. Its net sales increased 11.1% year over year to $6 billion. The company’s adjusted EPS grew 11.4% from the year-ago quarter to $3.13.

Analysts’ consensus opinion on SYK stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 28 analysts covering the stock, 18 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and eight give a “Hold.” SYK’s average analyst price target is $434.48, indicating a potential upside of 17.7% from the current levels.