The Sherwin-Williams Company (SHW), with its headquarters in Cleveland, Ohio, is recognized for its extensive presence in paints and coatings worldwide, spanning over 120 countries. The business operates a vast distribution network, comprising thousands of outlets, to manufacture and supply paints, coatings, floor coverings, and similar products worldwide. The company has a market capitalization of $84.03 billion.

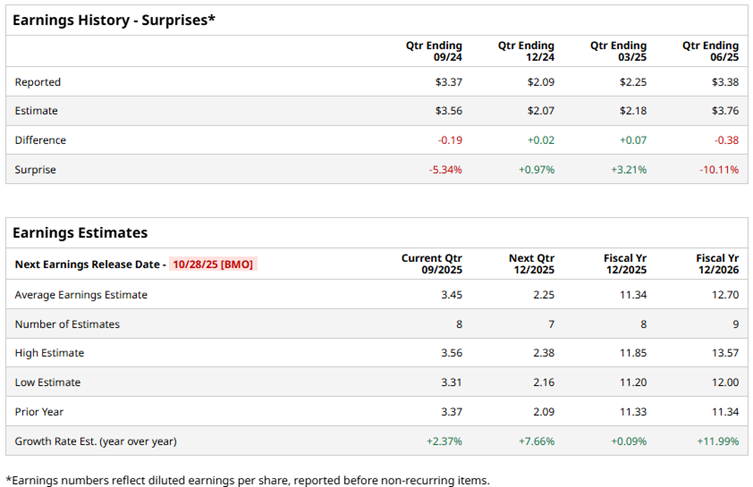

Sherwin-Williams is set to report its third-quarter results on Tuesday, Oct. 28, 2025, before the market opens. Ahead of the results, Wall Street analysts expect modest growth in its bottom line. For the third quarter, analysts expect the company’s profit to grow by 2.4% year-over-year (YOY) to $3.45 per diluted share. It has a mixed history of surpassing consensus estimates, topping them on two of the last four occasions and missing them on two instances.

For the fiscal year 2025, Sherwin-Williams’ profit is expected to grow marginally annually to $11.34 per diluted share.

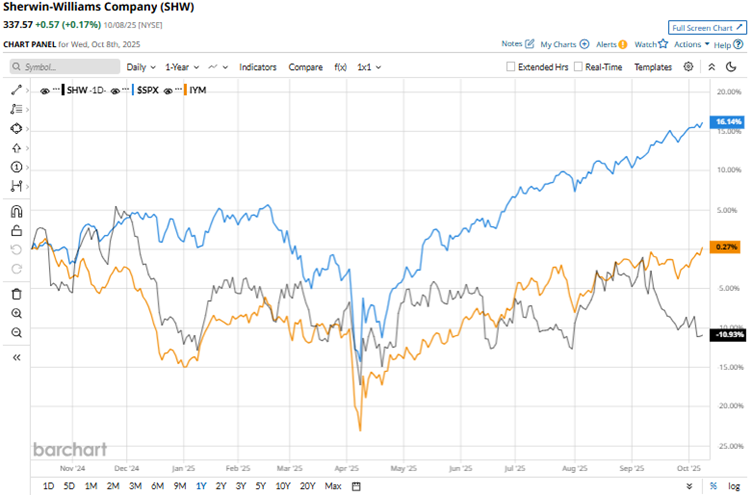

Sherwin-Williams’ stock has been underperforming the broader market over the past year. Over the past 52 weeks, the stock has lost 9.6%, while it is down marginally year-to-date (YTD). On the other hand, the broader S&P 500 Index ($SPX) has gained 17.4% and 14.8% over the same periods, respectively.

Comparing with the basic materials sector, as shown by the iShares U.S. Basic Materials ETF (IYM), we see that the ETF has gained 2.5% over the past 52 weeks and 16.7% YTD. Therefore, the stock has been underperforming its sector.

In the second quarter, Sherwin-Williams recorded mixed results. The company’s net sales grew marginally YOY to $6.31 billion, while its adjusted EPS dropped from $3.70 to $3.38. While the topline figure surpassed the Wall Street analysts’ consensus estimate, the bottom-line figure was lower than what was expected.

Sherwin-Williams recently acquired BASF's Brazilian architectural paints business, also known as Suvinil. The business is expected to complement the company’s presence in Latin America.

Wall Street analysts have been soundly bullish about Sherwin-Williams’ prospects. Among the 27 analysts covering the stock, it has a consensus rating of “Moderate Buy” overall. That includes 14 “Strong Buy” ratings, two “Moderate Buy” ratings, and 11 “Holds.” The mean price target of $385.76 indicates a 14.3% upside from current levels, while the Street-high price target of $420 implies a 24.4% upside.