Sempra (SRE) is a San Diego–based energy infrastructure company serving over 40 million consumers across the U.S. and Mexico. With a market cap of $60.5 billion, it operates through three main segments: Sempra California; Sempra Texas Utilities; and Sempra Infrastructure, focusing on modernizing utility systems, expanding renewable natural gas and hydrogen initiatives, and developing LNG export facilities to support cleaner, more reliable energy.

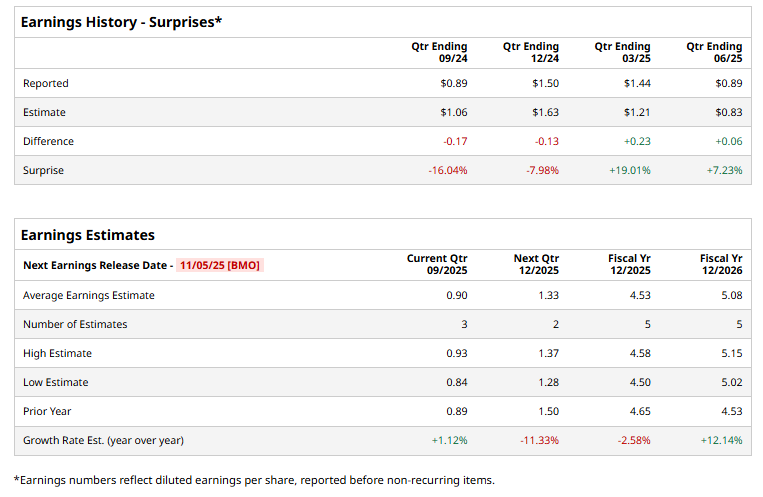

The company is slated to announce its fiscal Q3 2025 earnings results on Wednesday, Nov. 5. Ahead of this event, analysts expect Sempra to report an adjusted EPS of $0.90, up 1.1% from $0.89 in the year‑ago quarter. It has exceeded Wall Street's earnings expectations in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the natural gas and electricity provider to report adjusted EPS of $4.53, down 2.6% from $4.65 in fiscal 2024. However, adjusted EPS is expected to grow 12.1% year over year to $5.08 in fiscal 2026.

Shares of Sempra have gained 8.7% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 15.1% return and the Utilities Select Sector SPDR Fund's (XLU) 11% gain over the same period.

On Aug. 7, SRE shares rose 1.8% after reporting its Q2 results. It posted adjusted earnings of $0.89 per share, surpassing Wall Street’s estimate of $0.83. Revenue came in at $3 billion, marking a slight year-over-year decline. The company emphasized steady progress in its transition toward a more utility-focused business model, supported by regulatory advancements in Texas and ongoing major infrastructure projects. Looking ahead, Sempra expects full-year adjusted EPS between $4.30 and $4.70.

Analysts' consensus view on Sempra stock remains cautiously optimistic, with an overall "Moderate Buy" rating. Out of 17 analysts covering the stock, seven recommend a "Strong Buy," one "Moderate Buy," and nine "Holds." As of writing, the stock is trading above the average analyst price target of $91.50.