Houston, Texas-based Schlumberger Limited (SLB) engages in the provision of technology for the energy sector. Valued at $53.1 billion by market cap, Schlumberger operates as a leading oilfield services company, serving oil and gas explorers and producers across the world.

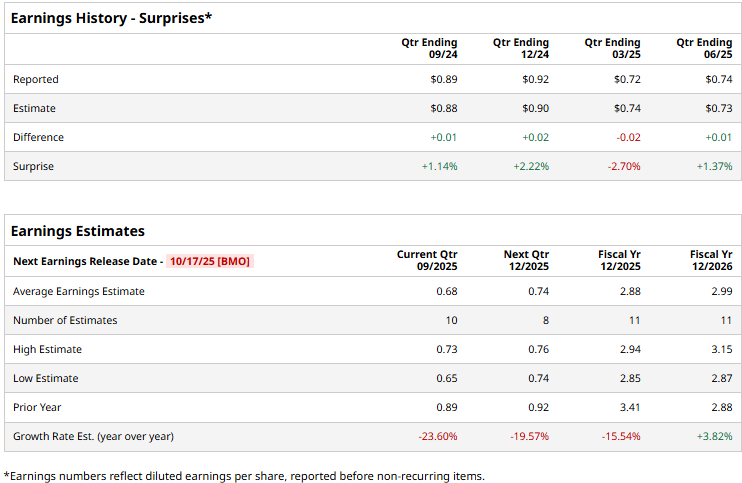

The oilfield service provider is gearing up to unveil its third-quarter results before the market opens on Friday, Oct. 17. Ahead of the event, analysts expect SLB to deliver an adjusted profit of $0.68 per share, down 23.6% from $0.89 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates thrice over the past four quarters, it missed the projections on one other occasion.

For the full fiscal 2025, analysts expect SLB to deliver an adjusted EPS of $2.88, down 15.5% from $3.41 reported in 2024. While in fiscal 2026, its earnings are expected to grow 3.8% year-over-year to $2.99 per share.

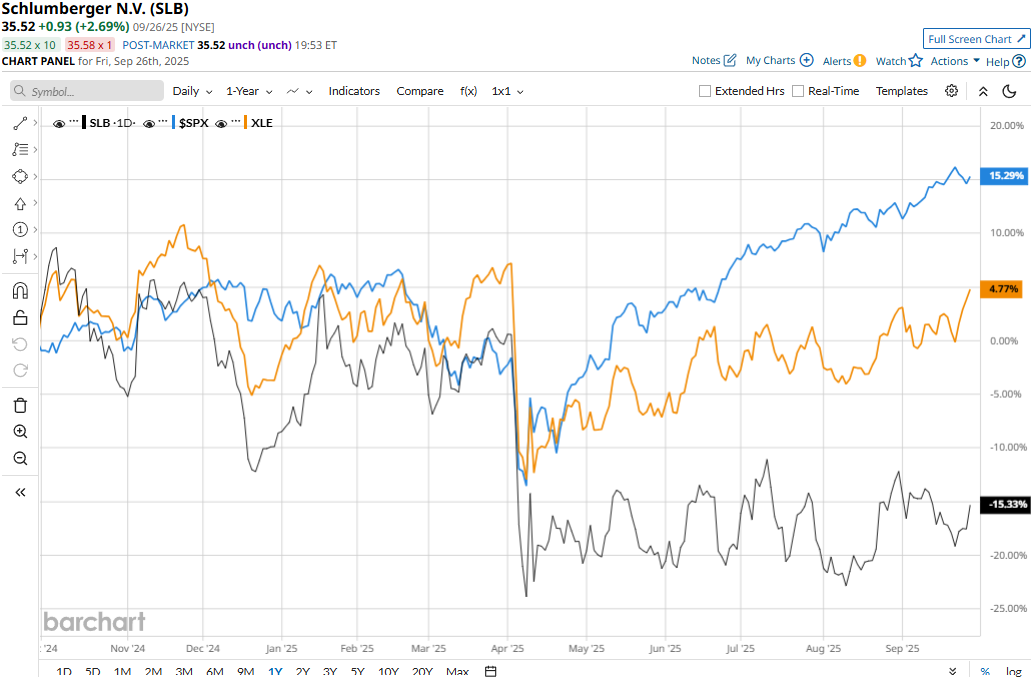

SLB stock prices have plunged 13.7% over the past 52 weeks, significantly underperforming the Energy Select Sector SPDR Fund’s (XLE) 7.7% gains and the S&P 500 Index’s ($SPX) 15.6% surge during the same time frame.

Schlumberger’s stock prices dropped 3.9% following the release of its mixed Q2 results on Jul. 18. While the company’s financials observed a slight improvement from Q1, they remained underwhelming on a year-on-year basis. Its topline for the quarter dropped 6.5% year-over-year to $8.5 billion. Meanwhile, its adjusted EPS dropped 12.9% year-over-year to $0.74 and exceeded the consensus estimates by 1.4%.

Nevertheless, its aggregated operating cash flows of Q1 and Q2 have inched up 2.2% year-over-year to $1.8 billion. Following the initial dip, SLB maintained a positive momentum for the next six trading sessions.

Analysts remain optimistic about the stock’s prospects. SLB maintains a consensus “Strong Buy” rating overall. Of the 24 analysts covering the stock, opinions include 15 “Strong Buys,” four “Moderate Buys,” and five “Holds.” Its mean price target of $47.25 suggests a notable 33% upside potential from current price levels.