/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $242.6 billion, Salesforce, Inc. (CRM) is a cloud-based customer relationship management (CRM) software company headquartered in San Francisco, California. The company helps businesses manage sales, marketing, customer service, analytics, and app development through its integrated platform, Customer 360.

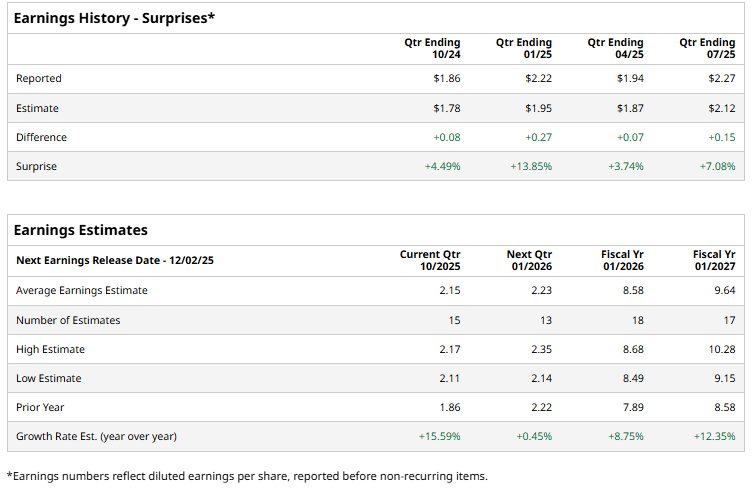

The company is set to announce its fiscal Q3 2026 earnings results shortly. Ahead of this event, analysts expect Salesforce to report an EPS of $2.15, a 15.6% growth from $1.86 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2026, analysts expect CRM to report EPS of $8.58, marking an increase of 8.8% from $7.89 in fiscal 2025. Moreover, EPS is expected to grow 12.4% year over year to $9.64 in fiscal 2027.

Shares of Salesforce have dropped 12.1% over the past 52 weeks, struggling to keep up with the broader S&P 500 Index's ($SPX) 18.4% gain and the Technology Select Sector SPDR Fund's (XLK) 29.8% return over the same period.

On Oct. 21, shares of Salesforce jumped 4.7% as easing trade tensions, upbeat corporate earnings, and optimism over potential interest rate cuts fueled a broad market rally.

Analysts' consensus view on Salesforce stock remains fairly bullish, with a "Moderate Buy" rating overall. Out of 50 analysts covering the stock, 35 recommend a "Strong Buy," two "Moderate Buys," 12 "Holds," and one "Strong Sell." Its mean price target of $330.65 represents a potential upswing of 29.4% from the current market price.