Valued at a market cap of $12.7 billion, Regency Centers Corporation (REG) is a leading real estate investment trust (REIT) specializing in grocery-anchored shopping centers across affluent U.S. suburban markets. Headquartered in Jacksonville, Florida, the company owns or manages nearly 480 properties, totaling around 57 million square feet. Its tenant base includes major grocers like Publix, Trader Joe’s, and Kroger, along with restaurants and service providers, ensuring high occupancy and stable income.

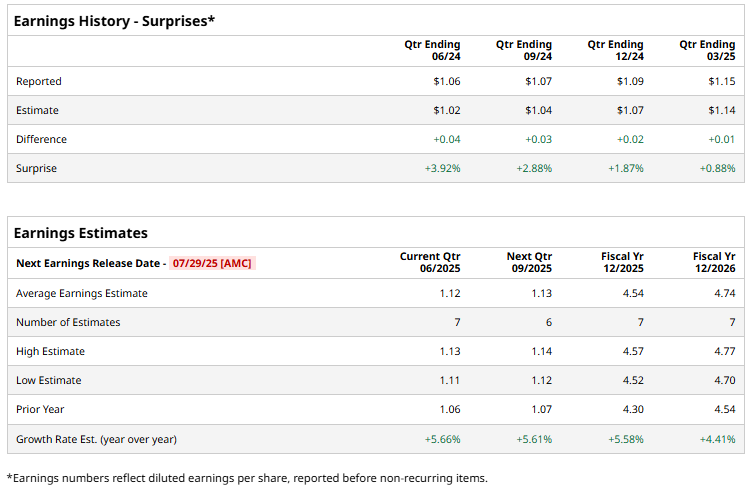

The REIT is all set to report its fiscal 2025 Q2 earnings after the market closes on Tuesday, July 29. Ahead of this event, analysts expect this retail REIT to report an FFO of $1.12 per share, up 5.7% from $1.06 per share in the year-ago quarter. The company has a solid trajectory of consistently beating Wall Street’s FFO estimates in each of the last four quarters.

For fiscal 2025, analysts expect REG to report an FFO of $4.54 per share, up 5.6% from $4.30 in fiscal 2024. Furthermore, its FFO is expected to grow 4.4% year over year to $4.74 in fiscal 2026.

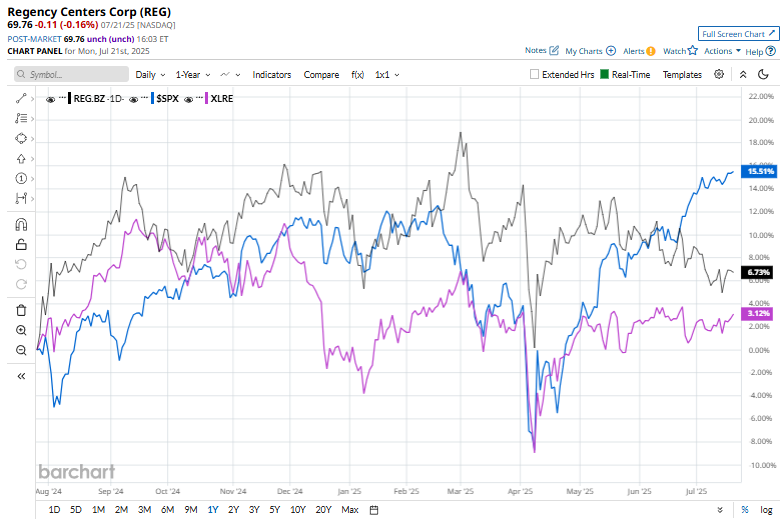

Shares of REG have rallied 5.5% over the past 52 weeks, trailing the S&P 500 Index's ($SPX) 14.5% gain but outpacing the Real Estate Select Sector SPDR Fund’s (XLRE) 3.7% rise over the same time frame.

On Apr. 29, REG shares rose marginally following the release of its Q1 results. The company reported a 3.3% year-over-year increase in core operating earnings to $199.4 million, or $1.09 per share, and a 5.4% rise in Nareit FFO to $210.7 million, or $1.15 per share. Regency also posted a 4.3% growth in same property NOI, driven by a 4% increase in base rents.

Additionally, portfolio occupancy improved to 96.5%, while the company executed 1.4 million square feet of leasing with an 8.1% blended cash rent spread. In a further vote of confidence, S&P upgraded Regency’s credit rating to A during the quarter, with a stable outlook, underscoring the REIT’s strong fundamentals and disciplined capital strategy.

Wall Street analysts are highly optimistic about REG’s stock, with a "Strong Buy" rating overall. Among 18 analysts covering the stock, 11 recommend "Strong Buy," two advise “Moderate Buy,” and five suggest “Hold.” The mean price target for REG is $78.65, indicating a 12.7% potential upside from current levels.