/Raymond%20James%20Financial%2C%20Inc_%20location-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Based in Saint Petersburg, Florida, Raymond James Financial, Inc. (RJF) is a diversified financial services platform that delivers investment advice, wealth management, securities trading, investment banking, asset management, and banking solutions. Commanding a market capitalization of about $32.2 billion, the firm serves individuals, corporations, and municipalities.

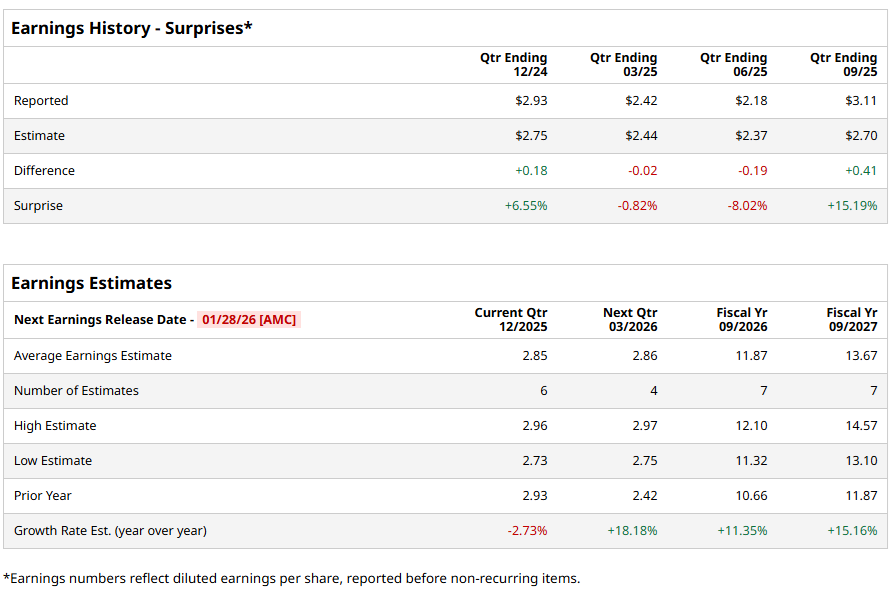

Attention now turns to earnings visibility. Raymond James is scheduled to report fiscal 2026 first-quarter results on Wednesday, Jan. 28, after market close. Analysts expect diluted EPS of $2.85, a 2.7% decline from $2.93 in the prior-year quarter. Notably, the company has exceeded EPS estimates in only two of the past four quarters while missing expectations in the other two.

Looking beyond the quarter, Wall Street projects full fiscal year 2026 diluted EPS of $11.87, implying an 11.4% year-over-year growth. More significantly, analysts forecast fiscal year 2027 EPS of $13.67, representing a 15.2% increase from the prior year.

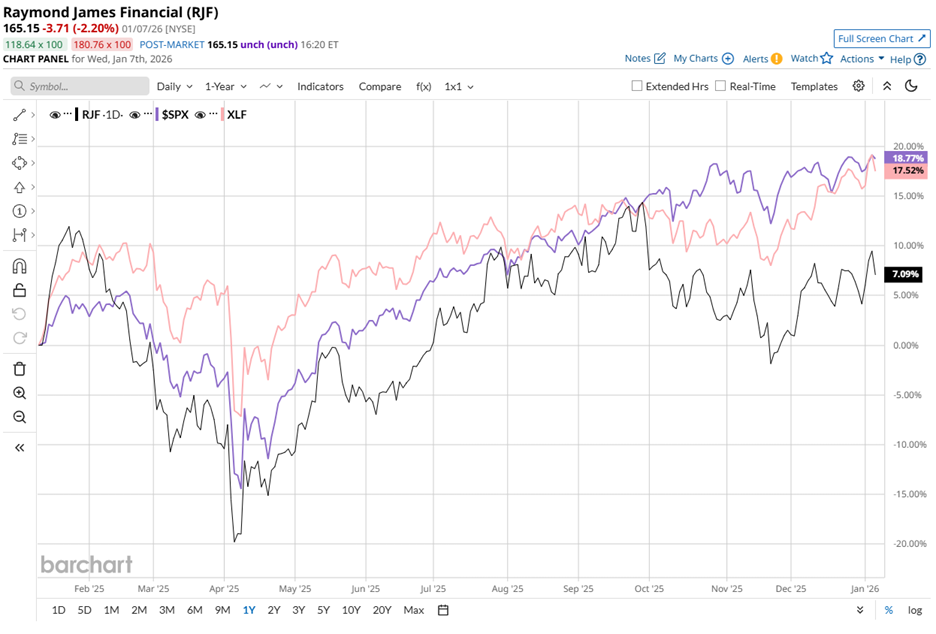

Share-price performance provides additional context heading into earnings. RJF stock has risen 3.9% over the past 52 weeks and gained 2.8% year-to-date (YTD). Over the same periods, the S&P 500 Index ($SPX) advanced 17.1% and 1.1%, respectively.

The gap persists at the sector level as well. The State Street Financial Select Sector SPDR ETF (XLF) climbed nearly 15.1% over the past 52 weeks and rose 1.5% YTD.

However, capital return actions have already drawn market approval. On Wednesday, Dec. 3, 2025, Raymond James’ management increased its quarterly cash dividend by 8% to $0.54 per share, payable Jan. 16, to shareholders of record on Jan. 2. Management also authorized a new $2 billion share repurchase program, replacing a $1.5 billion plan with $105 million remaining.

Shares responded immediately, rising nearly 2% on Dec. 3, 2025, and extending gains with another 2.4% jump on Dec. 4. The reaction signaled confidence in balance sheet strength, excess capital, and management’s willingness to reward shareholders even amid mixed near-term earnings momentum.

Heading into the release, Wall Street maintains a “Moderate Buy” consensus rating on RJF stock, unchanged over the past three months. Of 14 analysts covering the stock, four rate it “Strong Buy” and 10 recommend “Hold.”

RJF’s mean price target of $184.67 represents potential upside of 11.8%. Meanwhile, the Street-high target of $198 suggests a gain of 19.9% from current levels, if execution improves.