Valued at a market cap of $27.6 billion, PPL Corporation (PPL) is a utility company that generates, transmits, and distributes electricity and natural gas. The Allentown, Pennsylvania-based company focuses on modernizing the electric grid, expanding renewable energy integration, and improving customer service through advanced technology. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Wednesday, Nov. 5.

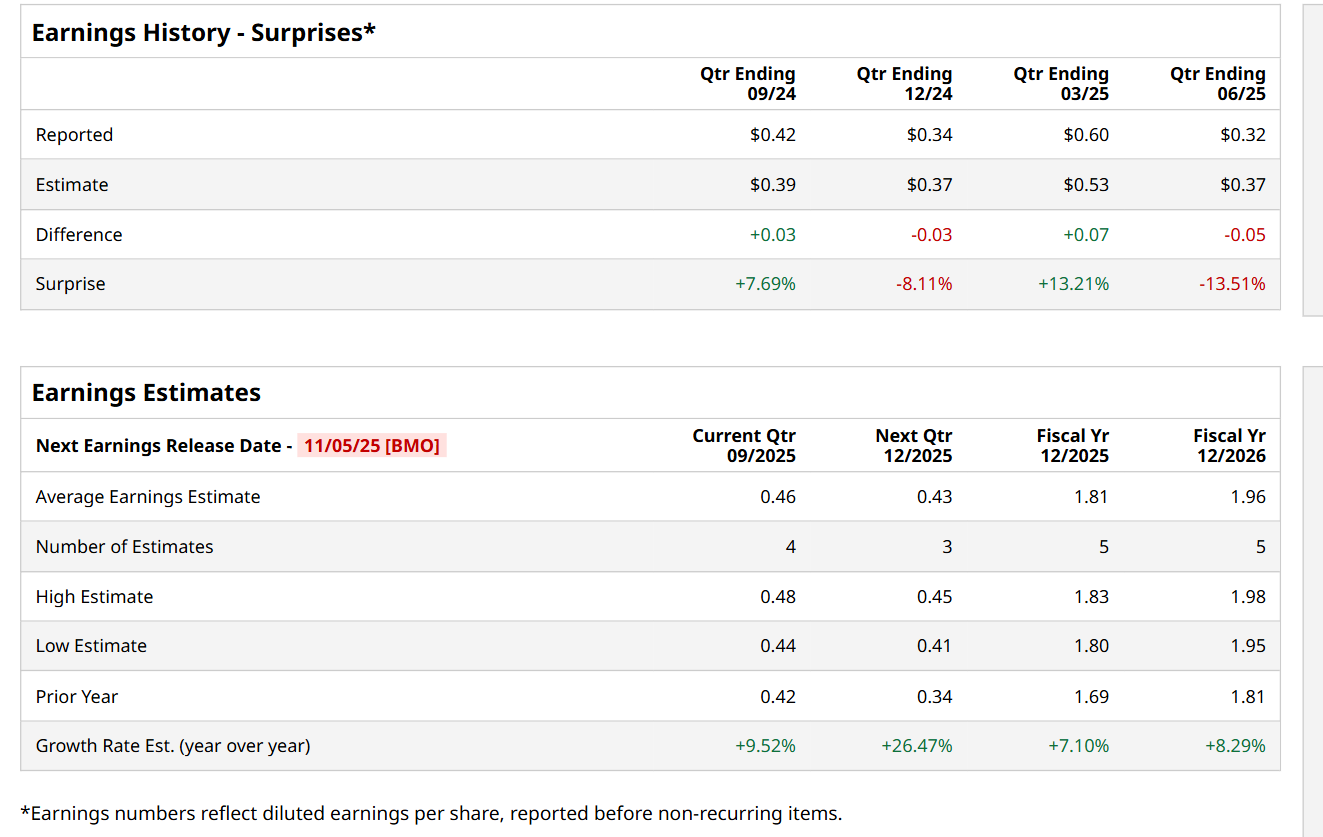

Ahead of this event, analysts expect this utility company to report a profit of $0.46 per share, up 9.5% from $0.42 per share in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in two of the last four quarters, while missing on two other occasions. In Q2, PPL’s EPS of $0.32 fell short of the consensus estimates by 13.5%.

For fiscal 2025, analysts expect PPL to report a profit of $1.81 per share, up 7.1% from $1.69 per share in fiscal 2024. Furthermore, its EPS is expected to grow 8.3% year-over-year to $1.96 in fiscal 2026.

PPL has underperformed the S&P 500 Index's ($SPX) 16.2% return over the past 52 weeks, with its shares up 14% over the same time frame. However, it has outpaced the Utilities Select Sector SPDR Fund’s (XLU) 11.4% uptick over the same time period.

Shares of PPL plunged nearly 1% on Jul. 31, after reporting mixed Q2 results. The company’s operating revenue improved 7.7% year-over-year to $2 billion, surpassing consensus estimates by 2.5%. However, its adjusted EPS of $0.32 decreased 15.8% from the year-ago quarter, falling 13.5% short of expectations. The earnings decline can be attributed to several factors, including the timing of certain operating costs and regulatory true-ups, the impact of favorable weather conditions in the second quarter of 2024, and higher interest expenses.

Wall Street analysts are moderately optimistic about PPL’s stock, with an overall "Moderate Buy" rating. Among 15 analysts covering the stock, nine recommend "Strong Buy," one indicates a "Moderate Buy,” and five suggest "Hold.” The mean price target for PPL is $40.86, indicating a 9.4% potential upside from the current levels.