With a market cap of around $53 billion, Phillips 66 (PSX) is a diversified energy manufacturing and logistics company with operations in the United States, the United Kingdom, Germany, and internationally. It operates through five segments: Midstream; Chemicals; Refining; Marketing and Specialties; and Renewable Fuels, providing integrated services across the processing, transportation, storage, and marketing of fuels, petrochemicals, and renewable products.

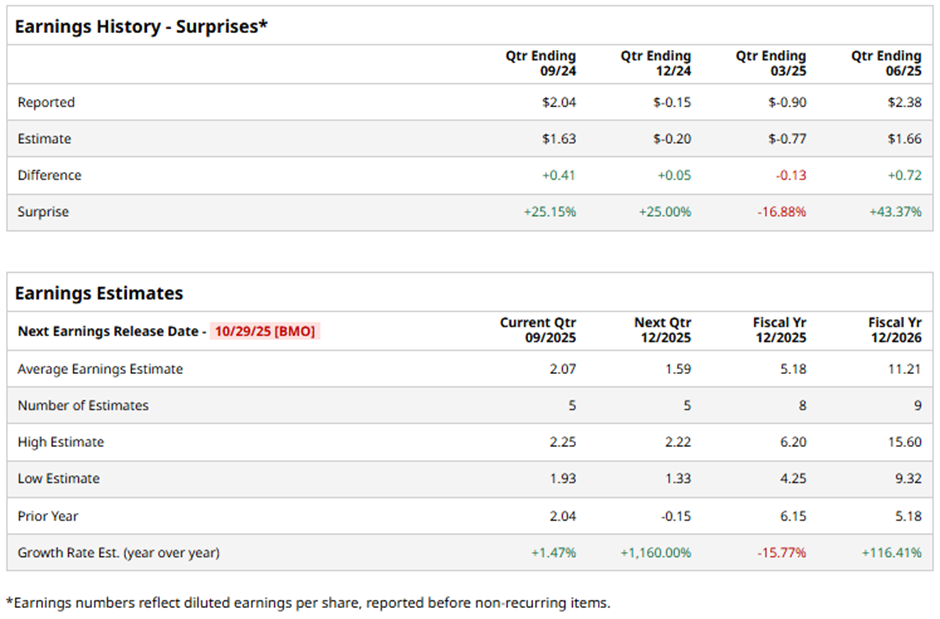

The Houston, Texas-based company is expected to announce its fiscal Q3 2025 earnings results before the market opens on Wednesday, Oct. 29. Ahead of this event, analysts predict PSX to report an adjusted EPS of $2.07, up 1.5% from $2.04 in the previous year's quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the oil refiner to report adjusted EPS of $5.18, down 15.8% from $6.15 in fiscal 2024. However, adjusted EPS is anticipated to grow significantly, 116.4% year-over-year, to $11.21 in fiscal 2026.

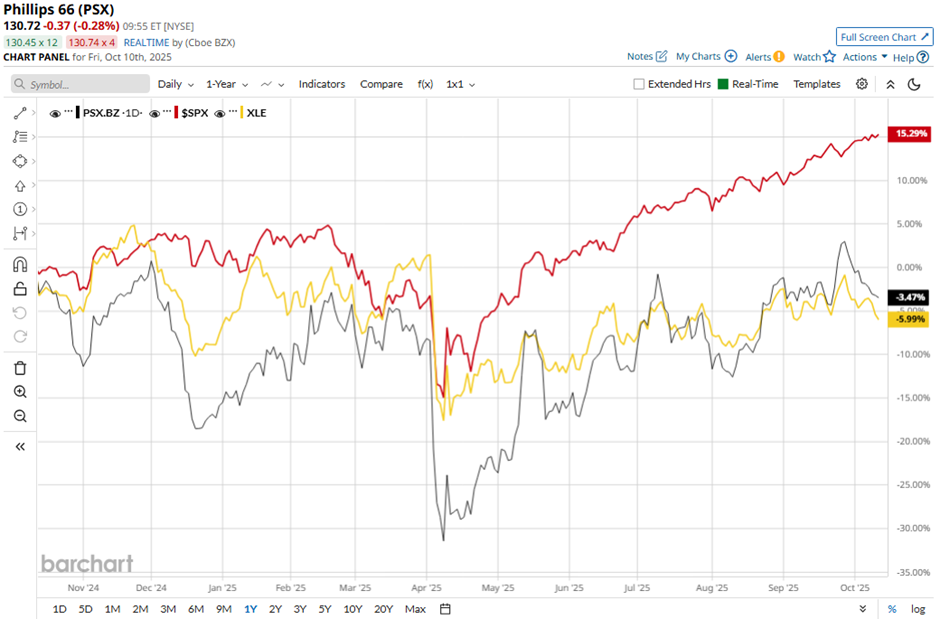

Shares of Phillips 66 have decreased 4.5% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.7% gain. Nevertheless, the stock has shown a slightly less pronounced decline than the Energy Select Sector SPDR Fund's (XLE) 5.4% drop over the same period.

Shares of Phillips 66 rose marginally on Jul. 25 after the company posted Q2 2025 results, with adjusted EPS of $2.38 per share, beating the consensus estimate. The beat was driven by higher refining volumes and stronger realized refining margins, which climbed to $11.25 per barrel, with notable strength in the Central Corridor and West Coast.

Additionally, Marketing & Specialties earnings surged to $660 million from $415 million, supported by U.S. marketing fuel margins rising to $2.83 per barrel from $1.70, offsetting weakness in Chemicals and Renewable Fuels.

Analysts' consensus rating on PSX stock is cautiously optimistic, with an overall "Moderate Buy" rating. Out of 20 analysts covering the stock, opinions include eight "Strong Buys," one "Moderate Buy," and 11 "Holds." This reflects a slightly less bullish view compared to three months ago, when nine analysts rated it a “Strong Buy.” The average analyst price target for Phillips 66 is $141.26, indicating a potential upside of 8.1% from the current levels.