/Paycom%20Software%20Inc%20logo%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $11.6 billion, Paycom Software, Inc. (PAYC) provides cloud-based human capital management (HCM) software delivered as a software-as-a-service solution for businesses in the United States. Its comprehensive HCM platform streamlines the entire employee lifecycle from recruitment to retirement, through integrated applications for talent acquisition, payroll, time and labor management, HR administration, and data-driven analytics.

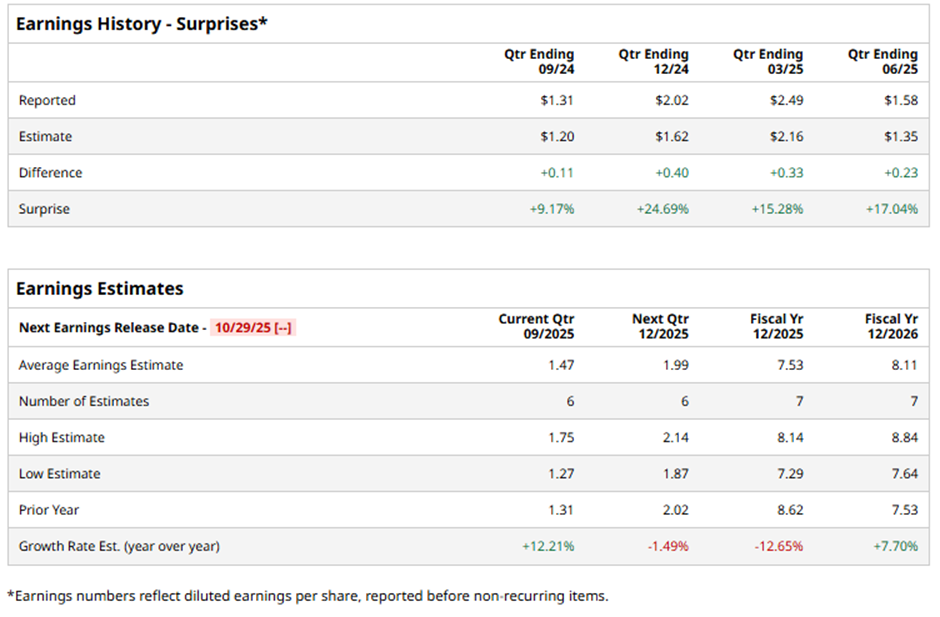

The Oklahoma City, Oklahoma-based company is expected to release its fiscal Q3 2025 results soon. Ahead of this event, analysts project Paycom Software to report an EPS of $1.47, a 12.2% growth from $1.31 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in the last four quarters.

For fiscal 2025, analysts forecast the human-resources and payroll software maker to report EPS of $7.53, down 12.7% from $8.62 in fiscal 2024. However, EPS is projected to grow 7.7% year-over-year to $8.11 in fiscal 2026.

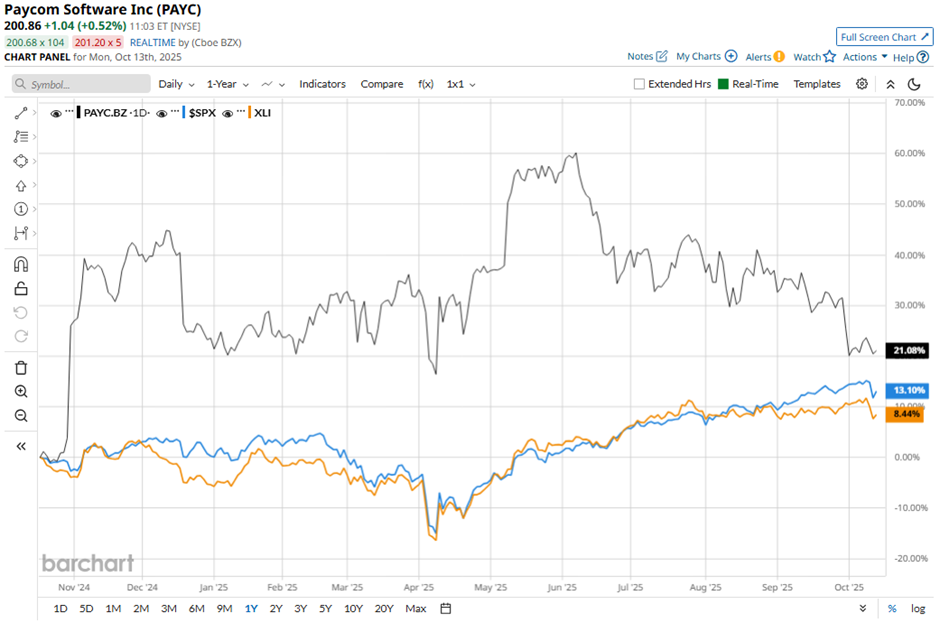

PAYC stock has soared 23.3% over the past 52 weeks, outperforming the broader S&P 500 Index's ($SPX) 14.1% return and the Industrial Select Sector SPDR Fund's (XLI) 9.2% gain over the same period.

Shares of Paycom soared 4.5% following its Q2 2025 results on Aug. 6, with adjusted EPS of $2.06 and revenue of $483.6 million, surpassing the forecasts. The company raised its full-year revenue outlook to $2.05 billion - $2.06 billion and boosted its core profit forecast to $872 million - $882 million. Investor optimism was further fueled by strong demand driven by Paycom’s new AI-powered features, which automate HR tasks and enhance employee management capabilities.

Analysts' consensus view on PAYC stock is moderately optimistic, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, five suggest a "Strong Buy" and 15 provide a "Hold" rating. The average analyst price target for Paycom Software is $252, indicating a potential upside of 25.5% from the current levels.