With a market cap of $11.3 billion, Paramount Skydance Corporation (PSKY) is a leading global media and entertainment company formed through the merger of Paramount Global and Skydance Media. It produces and distributes film, television, sports, news, and streaming content through its brands, including Paramount Pictures, CBS, and Paramount+.

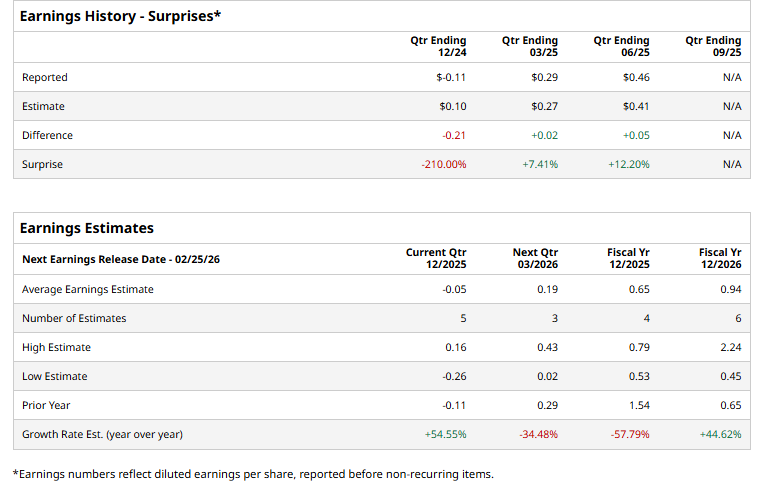

The company is expected to announce its fourth-quarter results soon. Ahead of the event, analysts expect PSKY to report a loss of $0.05 per share, a 54.6% improvement from the loss of $0.11 reported in the year-ago quarter. The company has surpassed the Street’s bottom-line expectations in two of the past three quarters, while missing on another occasion.

For FY2025, analysts expect Paramount’s earnings to drop 57.8% from $1.54 per share reported in 2024 to $0.65 per share. However, in fiscal 2026, its earnings are expected to grow 44.6% year over year to $0.94 per share.

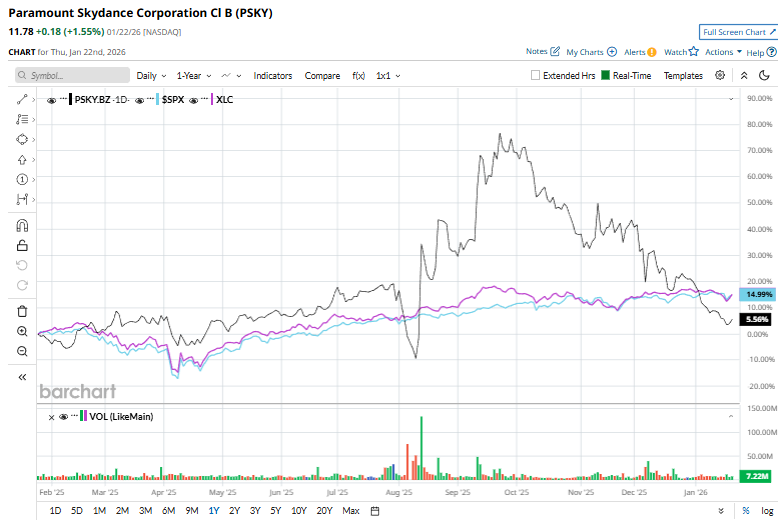

PSKY stock has climbed 12.1% over the past 52 weeks, trailing the S&P 500 Index’s ($SPX) 13.6% gains and the Communication Services Select Sector SPDR ETF Fund’s (XLC) 17.1% surge during the same time frame.

On Dec. 22, shares of Paramount rose 3.8% after the company strengthened its $30-per-share all-cash bid for Warner Bros. Discovery, Inc. (WBD) by securing a personal financing guarantee from Oracle co-founder Larry Ellison. Ellison agreed to provide an irrevocable $40.4 billion backstop for the equity portion of the deal, addressing concerns about the certainty of funding. The move significantly boosted the credibility of Paramount’s takeover attempt and reduced key financing risks, prompting a positive reaction from investors.

The stock holds a consensus “Hold” rating overall. Of the 18 analysts covering the PSKY stock, opinions include one “Strong Buy,” 12 “Holds,” and five “Strong Sells.” Its mean price target of $14.42 implies a premium of 22.4% from the current market prices.