/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $130.8 billion, Palo Alto Networks, Inc. (PANW) is a global cybersecurity company providing advanced security solutions across the Americas, Europe, the Middle East, Africa, Asia Pacific, and Japan. It delivers comprehensive cloud, network, and AI-driven security platforms through products such as Prisma, Strata, and Cortex to protect organizations across multiple industries.

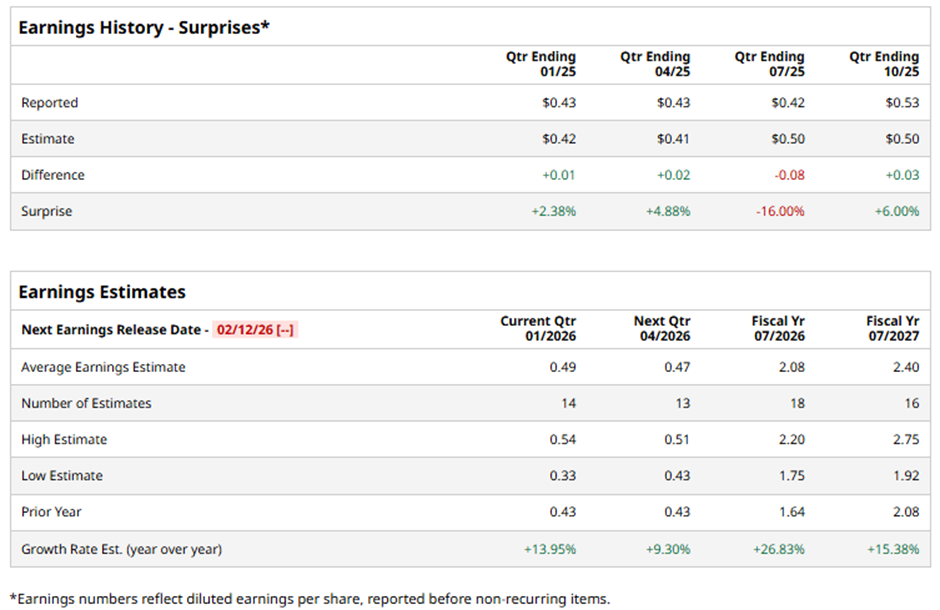

The Santa Clara, California-based company is slated to announce its fiscal Q2 2026 results soon. Ahead of this event, analysts forecast PANW to report an EPS of $0.49, an increase of nearly 14% from $0.43 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2026, analysts expect the security software maker to report EPS of $2.08, a growth of 26.8% from $1.64 in fiscal 2025.

Shares of Palo Alto Networks have risen nearly 5% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) nearly 17% return and the State Street Technology Select Sector SPDR ETF's (XLK) 26.5% surge over the same period.

Despite reporting stronger-than-expected Q1 2026 adjusted EPS of $0.93 and revenue of $2.47 billion on Nov. 19, shares of PANW tumbled 7.4% the next day because investors reacted negatively to the company’s plan to acquire Chronosphere, viewed as a costly and high-risk move. The worry was that the pricey acquisition could pressure profitability even though total revenue grew 16% year-over-year to $2.5 billion and Next-Generation Security ARR rose 29% to $5.9 billion.

Analysts' consensus view on PANW stock remains bullish, with an overall "Strong Buy" rating. Out of 49 analysts covering the stock, 34 recommend a "Strong Buy," three "Moderate Buys," and 12 "Holds." The average analyst price target for Palo Alto Networks is $228.06, suggesting a potential upside of 21.5% from current levels.