Charlotte, North Carolina-based Nucor Corporation (NUE) is a leading producer of structural steel, steel bars, steel joists, steel deck, and cold finished bars. With a market cap of $31.1 billion, Nucor operates through steel mills, steel products, and raw materials segments. The steel manufacturer is gearing up to announce its Q3 earnings after the market closes on Monday, Oct. 27.

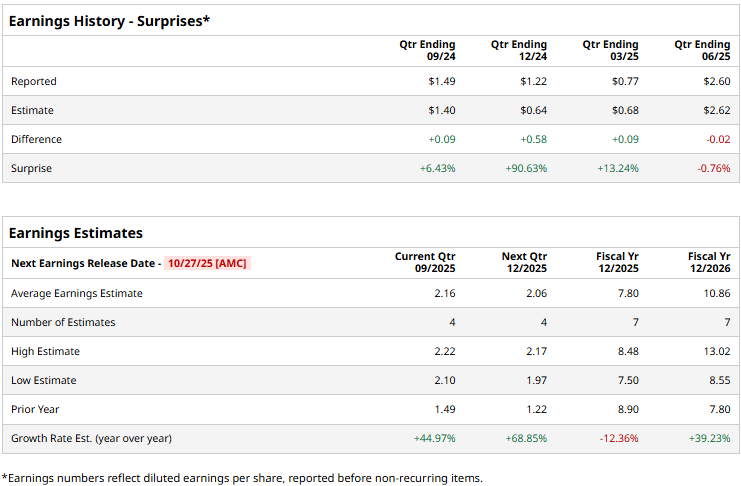

Ahead of the event, analysts expect Nucor to report a profit of $2.16 per share, up 45% from $1.49 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. While it missed the Street’s bottom-line estimates once over the past four quarters, it surpassed the projections on three other occasions.

For the full fiscal 2025, Nucor is expected to report an EPS of $7.80, down 12.4% from $8.90 reported in 2024. While in fiscal 2026, its earnings are expected to surge 39.2% year-over-year to $10.86 per share.

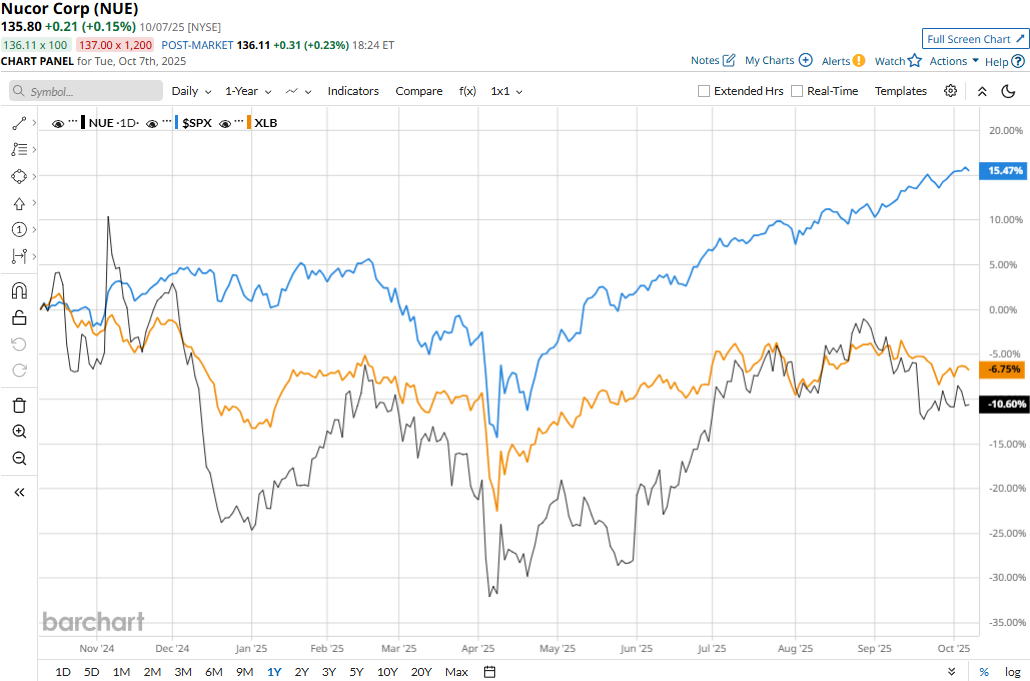

NUE stock prices have declined 11.1% over the past 52 weeks, notably underperforming the Materials Select Sector SPDR Fund’s (XLB) 5.8% drop and the S&P 500 Index’s ($SPX) 17.9% surge during the same time frame.

Nucor’s stock prices declined 2.7% in the trading session following the release of its disappointing Q2 results on Jul. 28. Despite the favorable tax and trade policies of the current federal administration, including the high tariffs on steel and aluminum imports, the company’s results remain underwhelming due to its inefficiencies.

Nucor’s topline for the quarter grew 4.7% year-over-year to $8.5 billion, which came mostly in line with the Street’s expectations. However, due to an increase in cost of goods sold and high marketing, admin, and other expenses, the company’s bottom-line dropped 6.5% year-over-year to $603 million, missing the consensus estimates.

The consensus opinion on the NUE stock remains optimistic, with an overall “Strong Buy” rating. Out of the 14 analysts covering the stock, 10 recommend “Strong Buy,” one advises “Moderate Buy,” and three suggest a “Hold” rating. Its mean price target of $158.67 suggests a 16.8% upside potential from current price levels.