/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

Redmond, Washington-based Microsoft Corporation (MSFT) is the largest software company in the world. It dominates the PC software market with more than 80% of the market share for operating systems and also provides various market-leading business and productivity software. With a market cap of $3.9 trillion, Microsoft operates in 190+ countries across the globe.

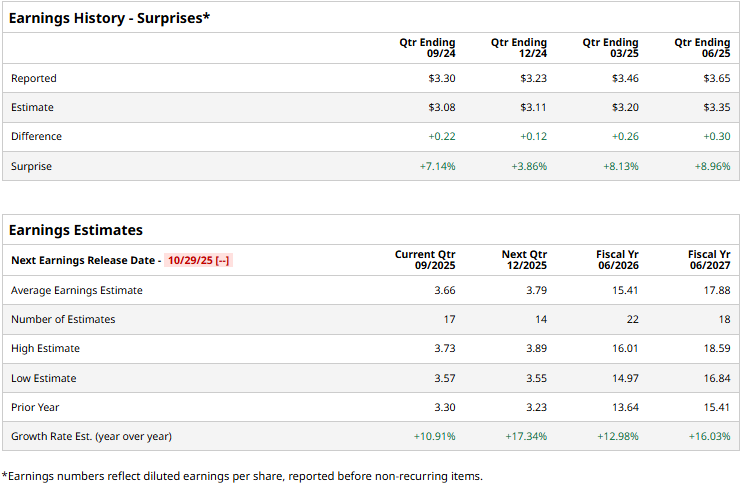

The software giant is set to announce its first-quarter results after the markets close on Wednesday, Oct. 29. Ahead of the event, analysts expect MSFT to report a profit of $3.66 per share, up 10.9% from $3.30 per share reported in the year-ago quarter. Furthermore, the company has surpassed Wall Street’s bottom-line estimates in each of the past four quarters.

For fiscal 2026, analysts expect Microsoft to deliver an EPS of $15.41, up 13% from $13.64 reported in fiscal 2025. While in fiscal 2027, its earnings are expected to surge 16% year-over-year to $17.88 per share.

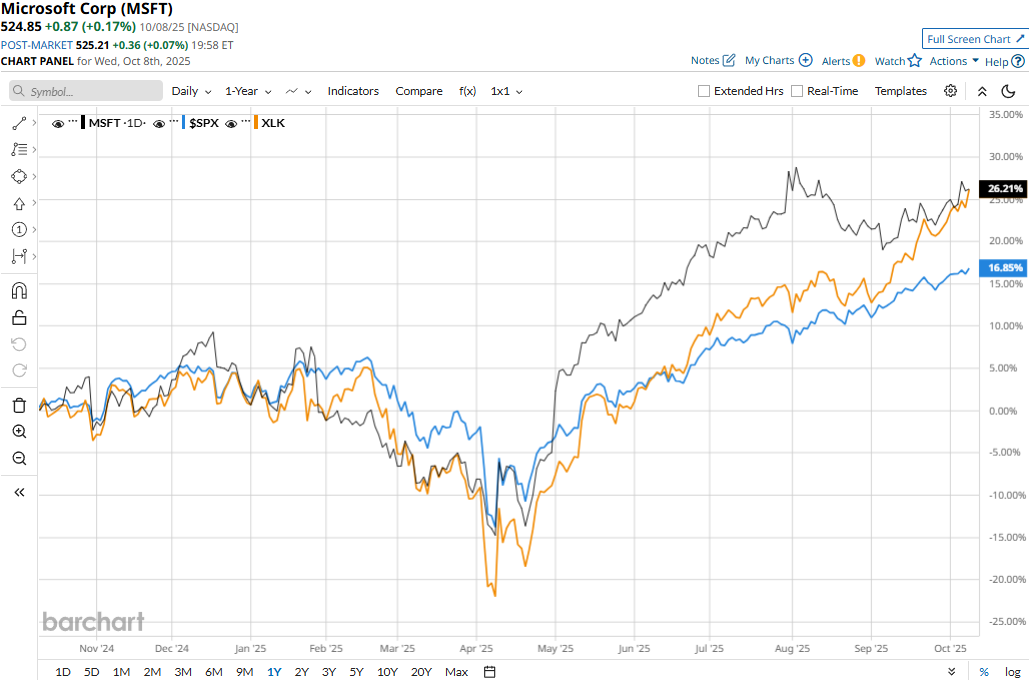

MSFT stock prices have soared 26.6% over the past 52 weeks, marginally lagging behind the Technology Select Sector SPDR Fund’s (XLK) 27.5% surge and notably outperforming the S&P 500 Index’s ($SPX) 17.4% gains during the same time frame.

Microsoft’s stock prices gained nearly 4% in the trading session following the release of its impressive Q4 results on Jul. 30. Driven by solid contributions from Cloud, Microsoft 365 Commercial products, and other businesses, the company’s overall topline for the quarter soared 18.1% year-over-year to $76.4 billion, beating the consensus estimates by 3.7%.

Although Microsoft observed a slight drop in gross margins, its operating expenses as a percentage of revenues observed a notable decline. This led to a massive 23.6% surge in net income to $27.2 billion, and the company’s EPS of $3.65 surpassed the Street’s expectations by 9%.

The consensus view on MSFT remains highly optimistic, with a “Strong Buy” rating overall. Of the 48 analysts covering the stock, opinions include 40 “Strong Buys,” five “Moderate Buys,” and three “Holds.” Its mean price target of $627.15 suggests a 19.5% upside potential from current price levels.