Linde plc (LIN) is a leading global industrial gases and engineering company headquartered in United Kingdom. The company produces and supplies atmospheric gases (like oxygen, nitrogen, and argon) and process gases (including hydrogen and helium) to a wide range of industries such as healthcare, manufacturing, energy, and electronics. Linde’s market cap is around $206.2 billion.

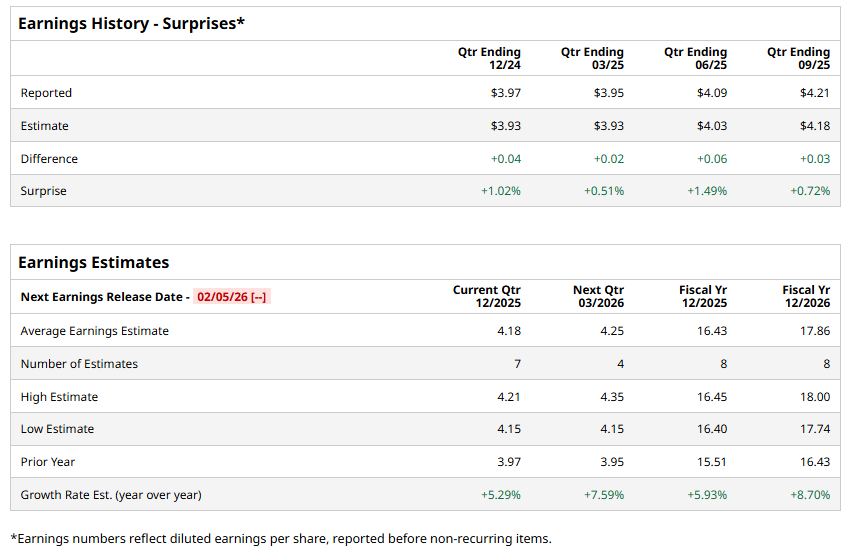

Linde is slated to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect the company to report an EPS of $4.18, a 5.3% rise from $3.97 in the year-ago quarter. It has exceeded Wall Street’s earnings expectations in each of the last four quarters, which is impressive.

For fiscal 2025, analysts forecast Linde to report EPS of $16.43, a 5.9% growth from $15.51 in fiscal 2024. Moreover, EPS is anticipated to increase 8.7% year-over-year to $17.86 in fiscal 2026.

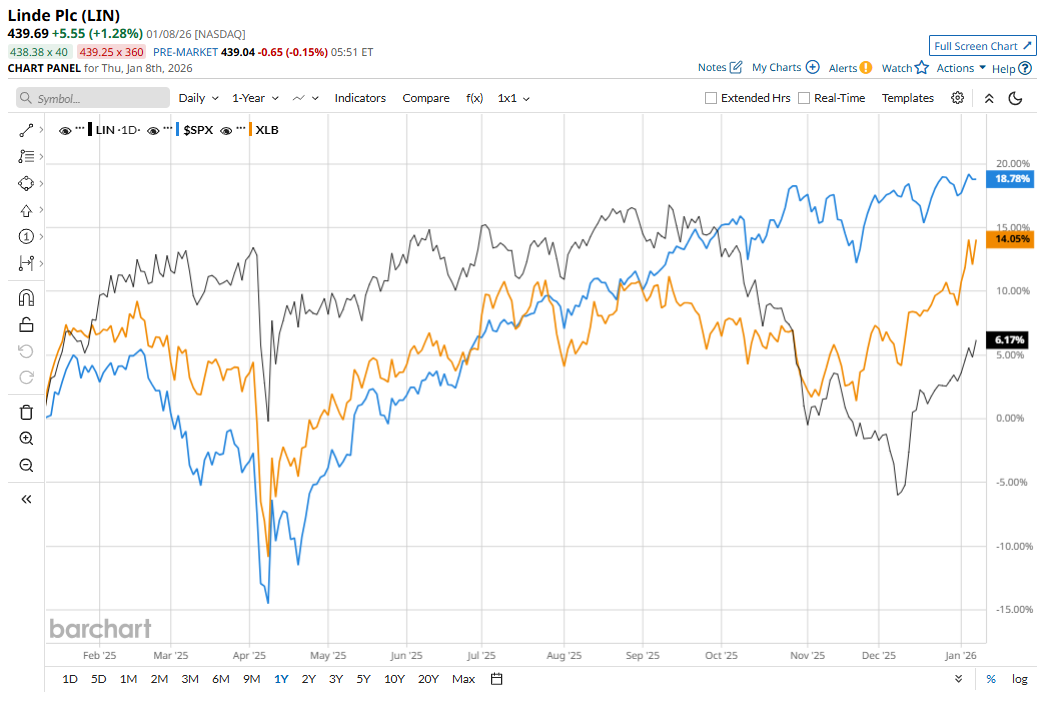

Shares have gained 4.7% over the past 52 weeks, underperforming the broader S&P 500 Index’s ($SPX) 17% return and the Materials Select Sector SPDR Fund’s (XLB) 12.9% increase over the same time frame.

In 2025, Linde’s stock rose modestly as the company continued to deliver resilient earnings growth, topping Wall Street estimates, and strengthened its positioning in key industrial and clean-energy markets. However, it still underperformed the broader market because its gains were muted by sluggish global industrial activity, particularly in manufacturing and chemical sectors, macro headwinds, and modest revenue growth, which tempered investor enthusiasm relative to the stronger performance of major market indices.

Analysts’ consensus view on LIN is bullish, with an overall “Strong Buy” rating. Among 25 analysts covering the stock, 19 suggest a “Strong Buy,” two give a “Moderate Buy,” and four recommend a “Hold.” The average analyst price target for LIN is $507.04, indicating a potential upside of 15.3% from the current levels.