With a market cap of $14.5 billion, Kimco Realty Corporation (KIM) is a leading U.S. REIT specializing in high-quality, open-air, grocery-anchored shopping centers and mixed-use properties concentrated in major metropolitan and Sun Belt markets. As of June 30, 2025, it owned interests in 566 properties totaling 101 million square feet.

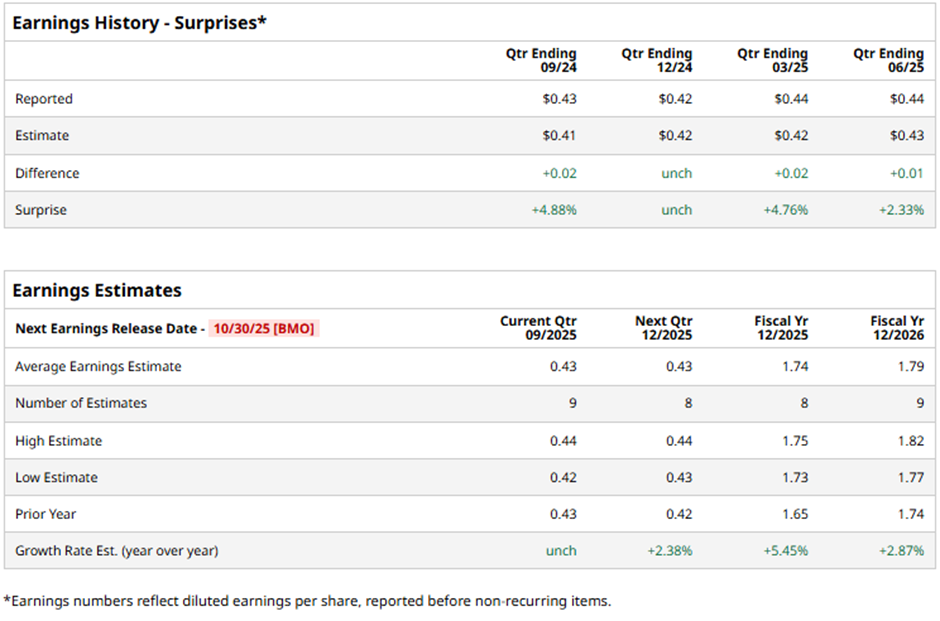

The Jericho, New York-based company is set to release its fiscal Q3 2025 results before the market opens on Thursday, Oct. 30. Ahead of this event, analysts project Kimco Realty to report an FFO of $0.43 per share, in line with the year-ago quarter. It has exceeded or met Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts forecast the REIT to report FFO of $1.74 per share, up 5.5% from 1.65 per share in fiscal 2024.

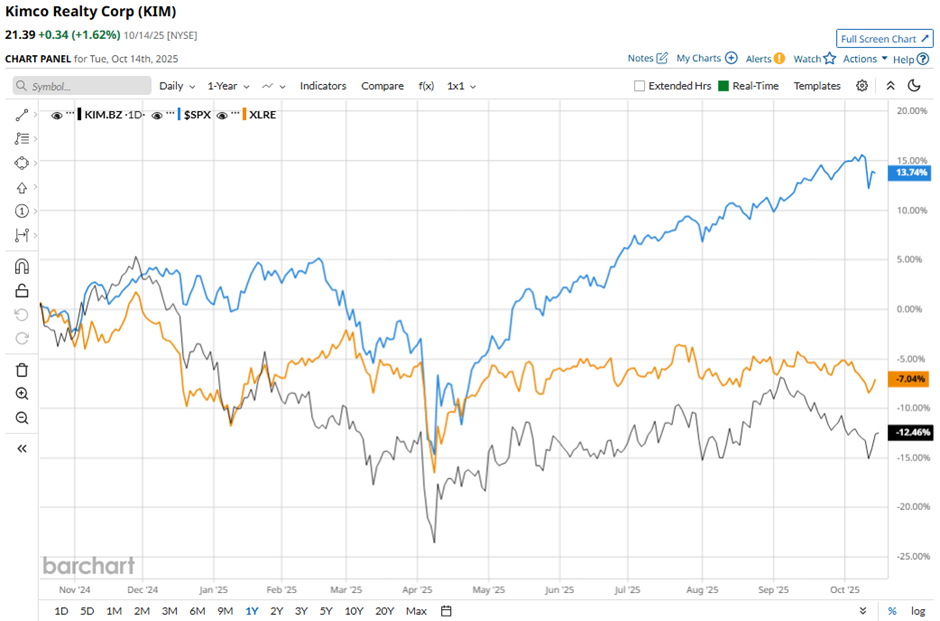

KIM stock has fallen 8.6% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 13.4% increase and the Real Estate Select Sector SPDR Fund's (XLRE) 5.6% decrease over the same time frame.

Despite reporting better-than-expected Q2 2025 FFO of $0.44 per share, Kimco Realty’s shares fell 3.1% on Jul. 31 as revenue of $525.2 million missed Street forecasts. Investors were also cautious about the modest occupancy dip linked to the bankruptcies of JOANN and Party City.

Analysts' consensus view on KIM stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 25 analysts covering the stock, nine suggest a "Strong Buy" and 16 recommend a "Hold." The average analyst price target for Kimco Realty is $24.60, indicating a potential upside of 15% from the current levels.