/Intuitive%20Surgical%20Inc%20location%20sign-by%20Sundry%20Photography%20via%20iStock.jpg)

With a market cap of $158.1 billion, Intuitive Surgical, Inc. (ISRG) develops, manufactures, and markets innovative robotic-assisted surgical systems and related products that enable minimally invasive care. Its flagship offerings include the da Vinci Surgical System and the Ion endoluminal system, supported by a comprehensive portfolio of instruments, accessories, services, and digital solutions.

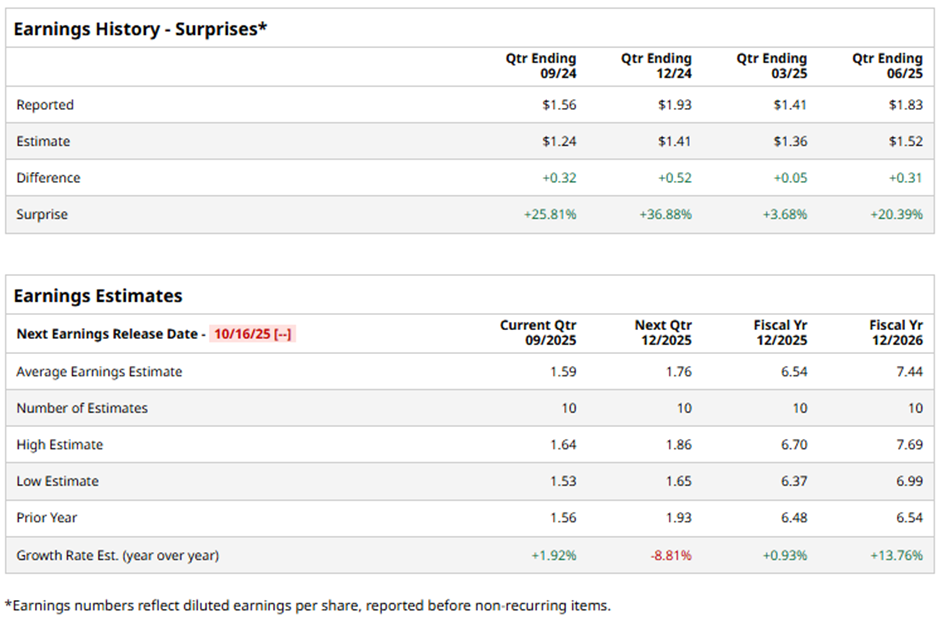

The Sunnyvale, California-based company is expected to announce its fiscal Q3 2025 results on Thursday, Oct. 16. Ahead of this event, analysts expect Intuitive Surgical to report an EPS of $1.59, up 1.9% from $1.56 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts predict the company to report an EPS of $6.54, a marginal rise from $6.48 in fiscal 2024. Moreover, EPS is anticipated to grow 13.8% year-over-year to $7.44 in fiscal 2026.

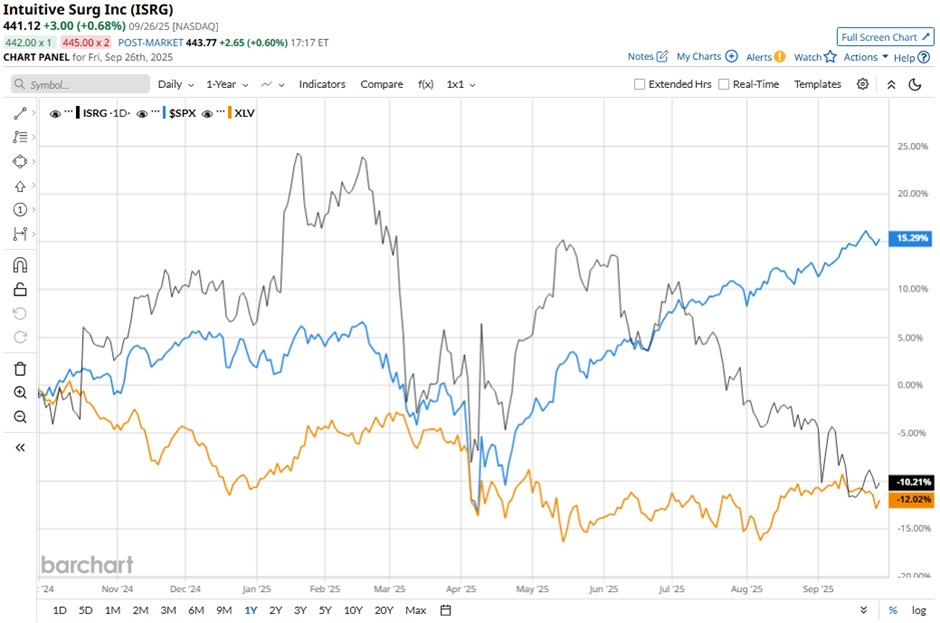

Shares of Intuitive Surgical have decreased 9.3% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 15.6% gain. However, it has shown less pronounced decline than the Health Care Select Sector SPDR Fund’s (XLV) 11.5% dip over the same period.

Shares of ISRG fell 1.8% following its Q2 2025 results on Jul. 22 despite beating expectations, as investor concerns focused on slowing international system placements, which declined to 179 due to budgetary pressures in Japan, China, and Europe. While Q2 sales rose 21% to $2.4 billion and adjusted EPS jumped 23% to $2.19, the cautious tone on global growth overshadowed these positives.

Analysts' consensus view on ISRG stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 29 analysts covering the stock, 18 suggest a "Strong Buy," two give a "Moderate Buy," eight recommend a "Hold," and one has a "Strong Sell." The average analyst price target for Intuitive Surgical is $597.12, indicating a potential upside of 35.4% from the current levels.