/Hasbro%2C%20Inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $10.5 billion, Hasbro, Inc. (HAS) is a leading toy, game, and entertainment company based in Pawtucket, Rhode Island. Its portfolio includes iconic brands like MONOPOLY, Nerf, Transformers, My Little Pony, Play-Doh, Dungeons & Dragons, Peppa Pig, among others. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Thursday, Oct. 23.

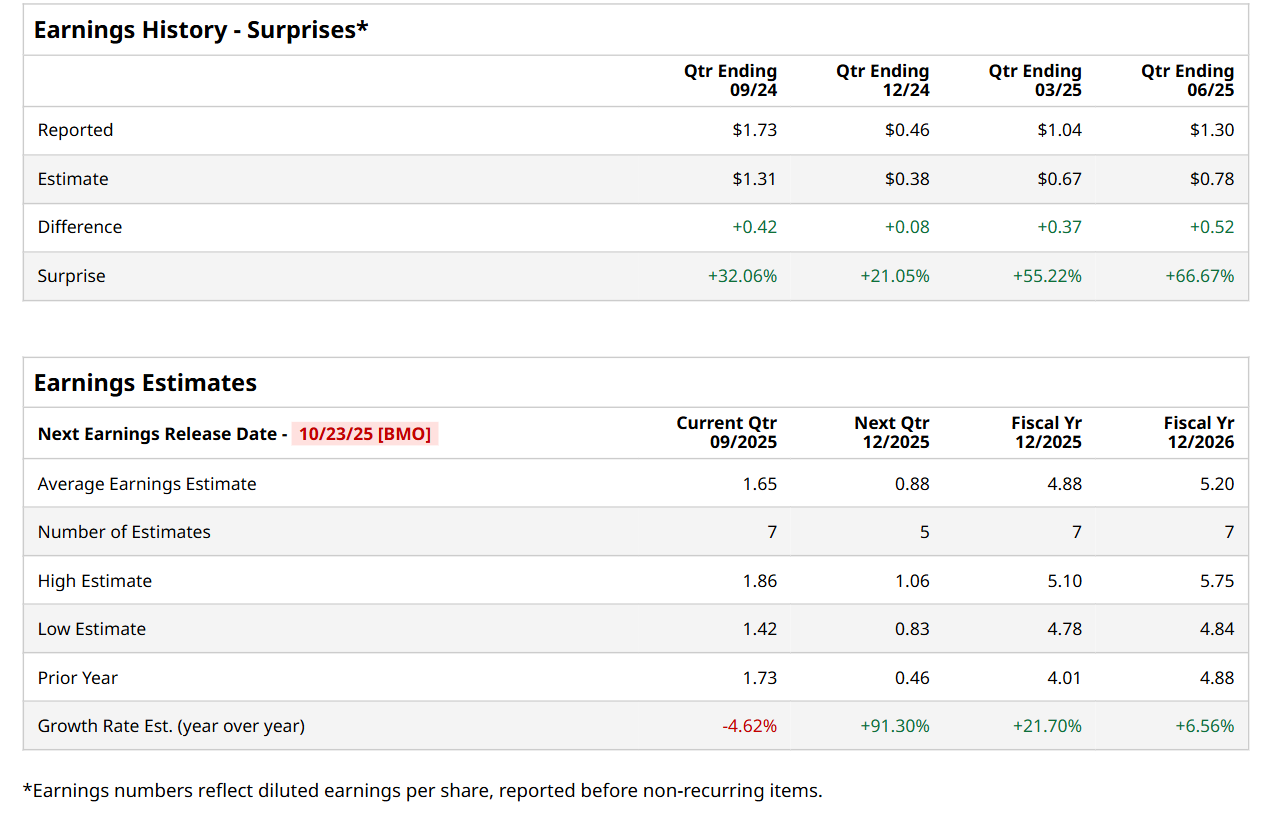

Ahead of this event, analysts expect this game and entertainment company to report a profit of $1.65 per share, down 4.6% from $1.73 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s earnings estimates in each of the last four quarters. In Q2, Hasbro’s EPS of $1.30 exceeded the forecasted figure by a notable margin of 66.7%.

For fiscal 2025, analysts expect HAS to report a profit of $4.88 per share, representing a 21.7% increase from $4.01 per share in fiscal 2024. Furthermore, its EPS is expected to grow 6.6% year-over-year to $5.20 in fiscal 2026.

Shares of HAS have gained 3.4% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 17.2% uptick and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 21.1% return over the same time frame.

On Jul. 23, Hasbro reported its Q2 results, posting better-than-expected adjusted EPS of $1.30 and revenue of $980.8 million. Moreover, its adjusted EPS rose 6.6% from the same period last year. However, its shares slipped 2.3% in the following trading session as investors focused on a 1.5% decline in its overall revenue, driven by weakness in the consumer products segment. Revenue from this segment fell 15.7%, mainly due to anticipated softness in toys driven by retailer order timing and geographic volatility, making investors jittery.

Wall Street analysts are highly optimistic about HAS’ stock, with a "Strong Buy" rating overall. Among 12 analysts covering the stock, 10 recommend "Strong Buy," one indicates a "Moderate Buy," and one suggests a "Hold.” The mean price target for HAS is $89.82, indicating a 20.1% potential upside from the current levels.