/First%20Solar%20Inc%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $25.5 billion, First Solar, Inc. (FSLR) is a leading global solar technology company, specializing in the design, manufacture, and sale of photovoltaic (PV) solar modules using proprietary thin-film cadmium telluride semiconductor technology. The company provides lower-carbon solar energy solutions and related services to utilities, developers, and commercial customers worldwide.

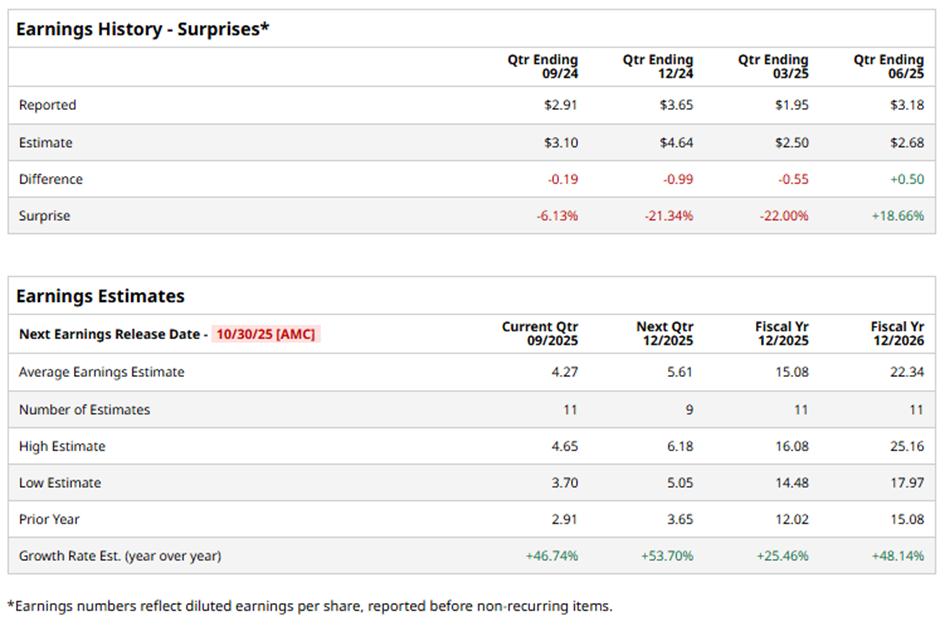

The Tempe, Arizona-based company is slated to announce its fiscal Q3 2025 results after the market closes on Tuesday, Oct. 30. Ahead of this event, analysts expect First Solar to report a profit of $4.27 per share, a 46.7% surge from $2.91 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts expect the largest U.S. solar company to report EPS of $15.08, a 25.5% rise from $12.02 in fiscal 2024. In addition, EPS is expected to grow 48.1% year-over-year to $22.34 in fiscal 2026.

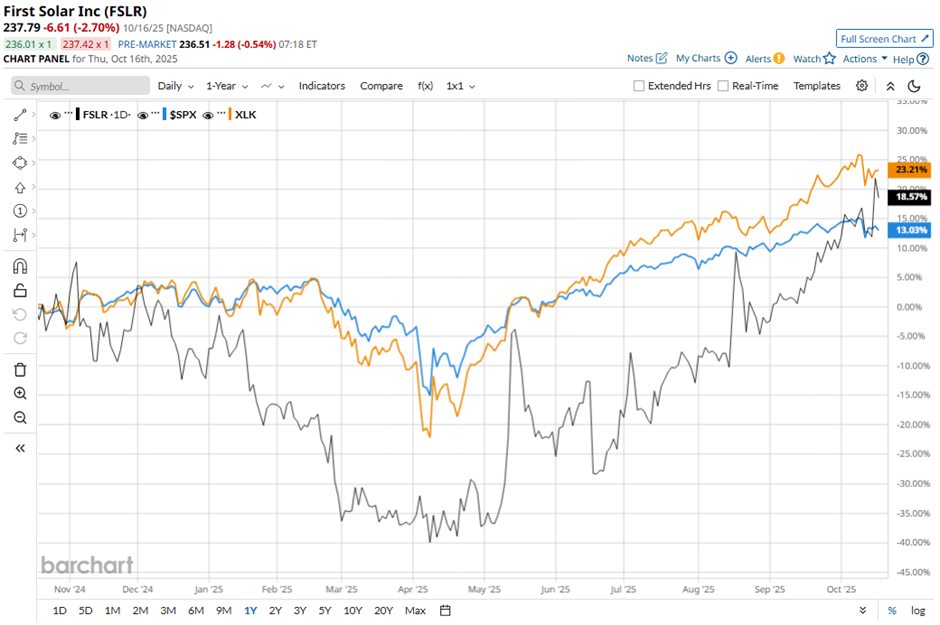

Shares of First Solar have risen 15.7% over the past 52 weeks, outperforming the broader S&P 500 Index's ($SPX) 13.5% gain. However, the stock has lagged behind the Technology Select Sector SPDR Fund's (XLK) over 24% return over the same period.

Shares of First Solar climbed 5.3% following its Q2 2025 results on Jul. 31. The company reported net income of $3.18 per share and revenue of $1.1 billion, topping forecasts. The company also raised its full-year net sales guidance to $4.9 billion - $5.7 billion, above the analyst average, citing expectations for higher product prices following new U.S. tariffs on foreign-made panels.

Analysts' consensus view on FSLR stock remains bullish, with an overall "Strong Buy" rating. Out of 31 analysts covering the stock, 23 recommend a "Strong Buy," two "Moderate Buys," five give a "Hold" rating, and one has a "Strong Sell." As of writing, the stock is trading above the average analyst price target of $234.73.