With a market cap of $26.8 billion, Eversource Energy (ES) is a public utility holding company engaged in the energy delivery business across Connecticut, Massachusetts, and New Hampshire. It operates through Electric Distribution; Electric Transmission; Natural Gas Distribution; and Water Distribution segments, providing electricity, natural gas, and water services to residential, commercial, and industrial customers.

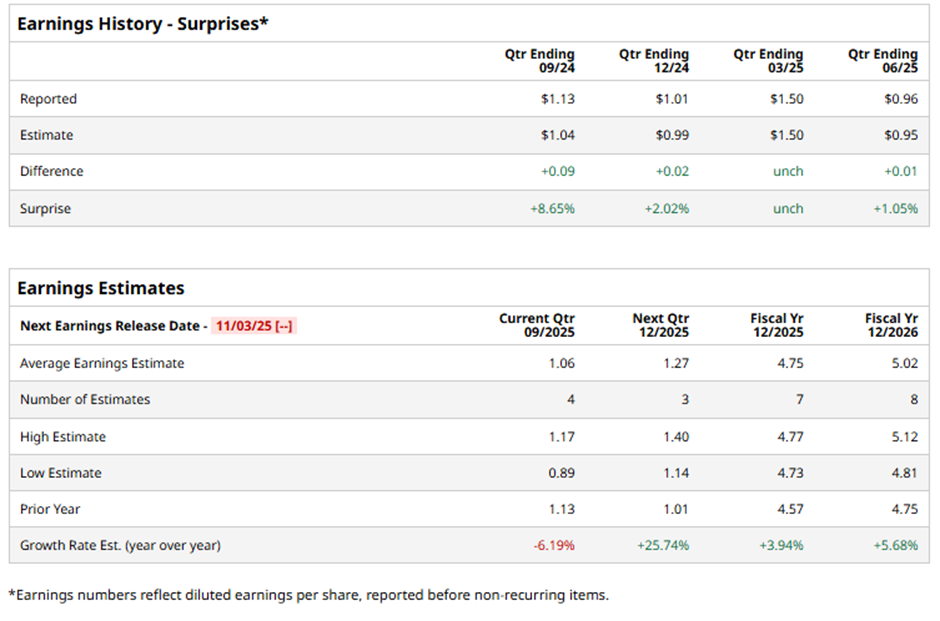

The Springfield, Massachusetts-based company is expected to unveil its fiscal Q3 2025 results next month. Before the event, analysts anticipate Eversource Energy to report an EPS of $1.06, down 6.2% from $1.13 in the year-ago quarter. However, it has surpassed or met Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts expect the power provider to report EPS of $4.75, up 3.9% from $4.57 in fiscal 2024. Moreover, EPS is projected to grow 5.7% year-over-year to $5.02 in fiscal 2026.

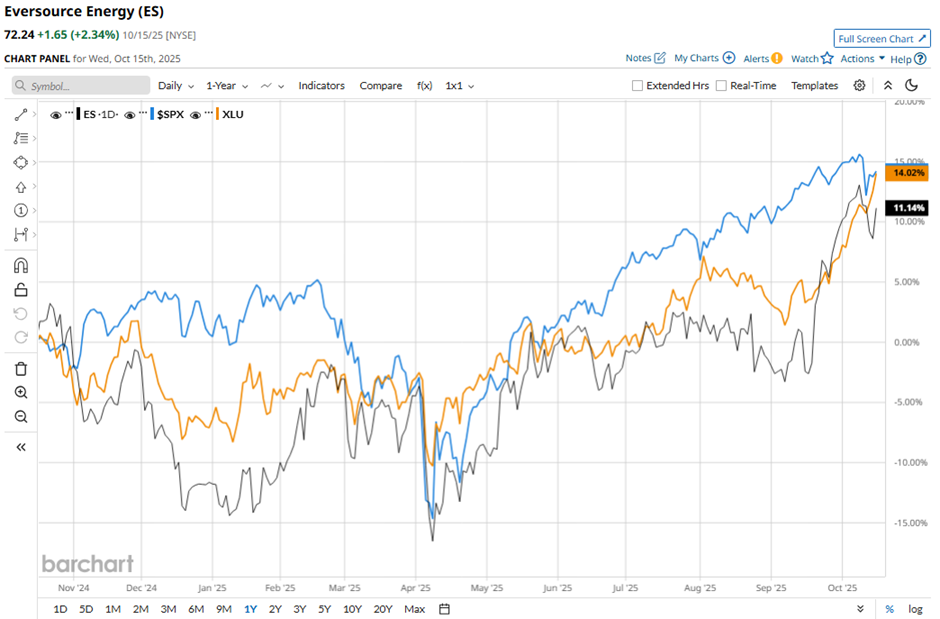

ES stock has risen 10.5% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 14.7% gain and the Utilities Select Sector SPDR Fund's (XLU) 15.3% increase over the same period.

Despite Eversource Energy’s better-than-expected Q2 2025 EPS of $0.96 on Jul. 31, shares fell marginally the next day. Losses at the parent and other companies widened to $66.5 million from $38.5 million a year earlier, mainly due to higher interest expenses following the sale of offshore wind projects.

Analysts' consensus rating on ES stock is cautiously optimistic, with an overall "Moderate Buy" rating. Out of 17 analysts covering the stock, opinions include six "Strong Buys," eight "Holds," one "Moderate Sell," and two "Strong Sells." As of writing, the stock is trading above the average analyst price target of $71.15.