With a market cap of $41.1 billion, Diamondback Energy, Inc. (FANG) is an independent oil and natural gas exploration and production company, primarily focused on the Permian Basin. The company drives growth through acquisitions and active drilling in this prolific, low-cost shale region spanning West Texas and southeastern New Mexico.

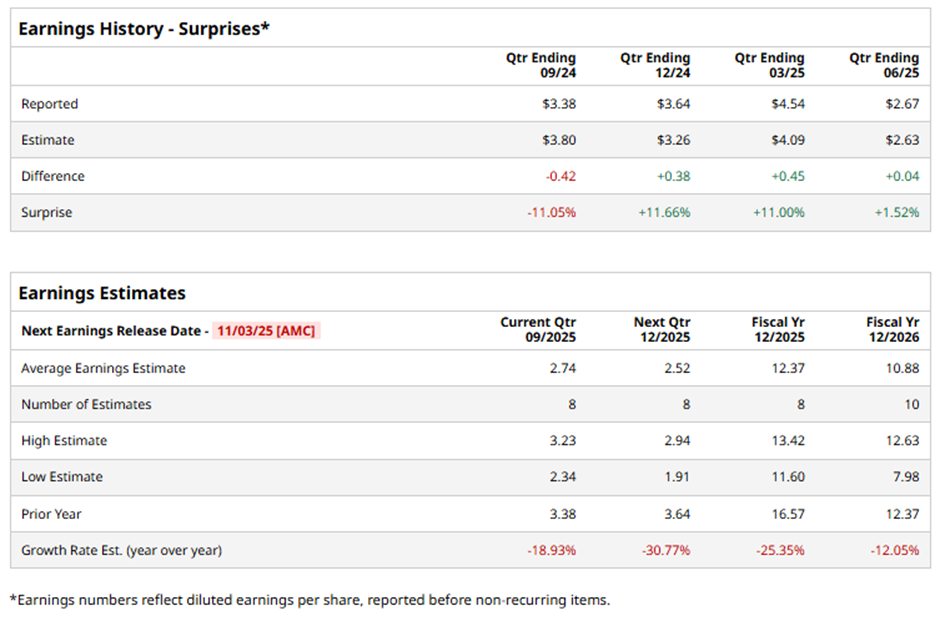

The Midland, Texas-based company is expected to announce its fiscal Q3 2025 results after the market closes on Monday, Nov. 3. Ahead of this event, analysts expect Diamondback Energy to report an adjusted EPS of $2.74, down 18.9% from $3.38 in the previous year's quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the energy exploration and production company to report adjusted EPS of $12.37, a 25.4% decrease from $16.57 in fiscal 2024.

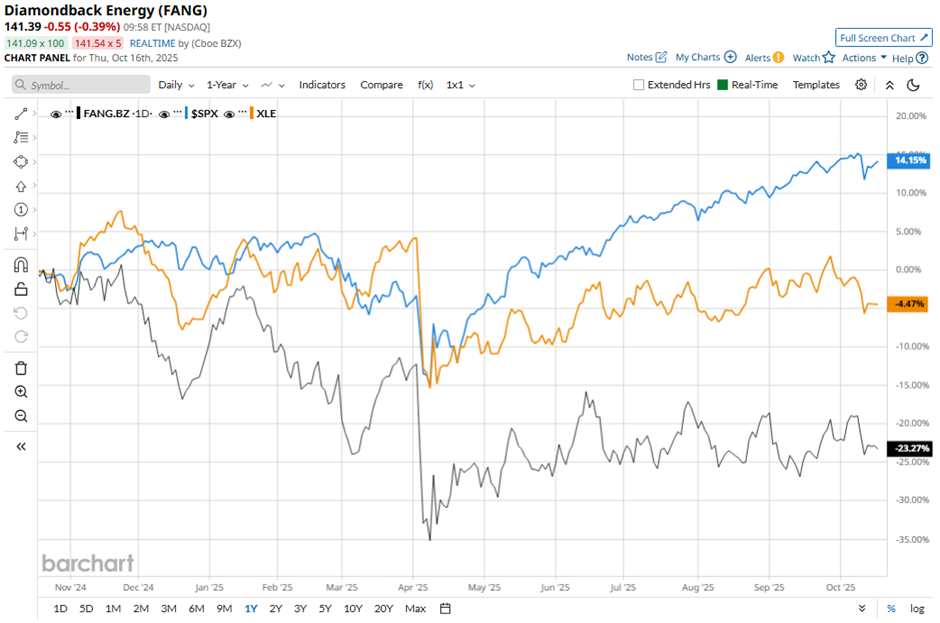

FANG stock has fallen 21.8% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 14.6% gain and the Energy Select Sector SPDR Fund's (XLE) 4.3% decline over the same period.

Despite reporting stronger-than-expected Q2 2025 adjusted EPS of $2.67 and revenue of $3.68 billion on Aug. 4, Diamondback Energy’s shares fell 1.4% the next day. The decline reflected pressure from a roughly 20% drop in Brent crude prices and a decrease in its realized crude price to $63.23 per barrel. Additionally, Diamondback cut its full-year capital spending forecast by $200 million to a range of $3.4 billion to $3.6 billion and reduced rig activity.

Analysts' consensus rating on FANG stock is bullish, with an overall "Strong Buy" rating. Out of 31 analysts covering the stock, opinions include 25 "Strong Buys," three "Moderate Buys," and three "Holds." The average analyst price target for Diamondback Energy is $182.31, indicating a potential upside of 28.9% from the current levels.